At the end of the first quarter of 2020, analysts at Lodging Econometrics (LE) report that the total U.S. construction pipeline continued to expand year-over-year (YOY) to 5,731 projects/706,128 rooms, up 1% by projects and 3% by rooms. However, quarter-over-quarter, the pipeline has contracted slightly less than 1% by both project and room counts, down from 5,748 projects/708,898 rooms at the close of 2019.

Projects currently under construction stand at an all-time high of 1,819 projects/243,100 rooms. Projects scheduled to start construction in the next 12 months total 2,284 projects/264,286 rooms, while projects in the early planning stage stand at 1,628 projects/198,742 rooms. Projects in the early planning stage are up 8% by projects and 11% by rooms, YOY. Developers with projects under construction have generally extended their opening dates by two to four months. For projects scheduled to start construction in the next 12 months, on average, developers have adjusted their construction start and opening dates outwards by four to six months. Additionally, brands have been empathetic with developers by relaxing timelines as everyone adjusts to the COVID-19 interruptions. As a result, LE anticipates a stronger count of openings in the second half of 2020, compared to the first half.

In the first quarter of 2020, the U.S. opened 144 new hotels with 16,305 rooms. While the COVID-19 pandemic has slowed development, it has not completely stalled it. There were still 312 new projects with 36,464 rooms announced into the pipeline in the first quarter.

Many open or temporarily closed hotels have already begun or are in the planning stages of renovating and repositioning their assets while occupancy is low or non-existent. At the close of the first quarter, LE recorded 769 active renovation projects/163,030 rooms and 616 active conversion projects/69,258 rooms throughout the United States.

To date, the largest fiscal relief and stimulus efforts include the unprecedented $2 trillion CARES Act, the Paycheck Protection Program (PPP), and the Paycheck Protection Program Liquidity Facility (PPPLF), with a third phase of relief having been signed by the president last week. This third phase includes nearly $500 billion to further support the small-business loan program, as well as provide additional critical funding needed for hospitals and comprehensive testing. A phase four “CARES Act 2” package is already being discussed.

In order to support the economy and build liquidity, the Federal Reserve cut interest rates to almost zero; reduced bank reserve requirements to zero; rapidly purchased hundreds of billions of dollars in treasury bonds and mortgage-backed securities; bought corporate and municipal debt; and extended emergency credit to non-banks. The Federal Reserve has signaled that it will provide more support to the economy if warranted.

Although there are discussions about opening parts of the country that are beginning to stabilize; it will be measured with phased openings designed to effectively balance a highly desired economic ramp up while following prudent health and safety precautions.

*COVID-19 (coronavirus) did not have a full impact on first quarter 2020 U.S. results reported by LE. Only the last 30 days of the quarter were affected. LE’s market intelligence department has and will continue to gather the necessary global intelligence on the supply side of the lodging industry and make that information available to our subscribers. It is still early to predict the full impact of the outbreak on the lodging industry. We will have more information to report in the coming months.

Related Stories

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

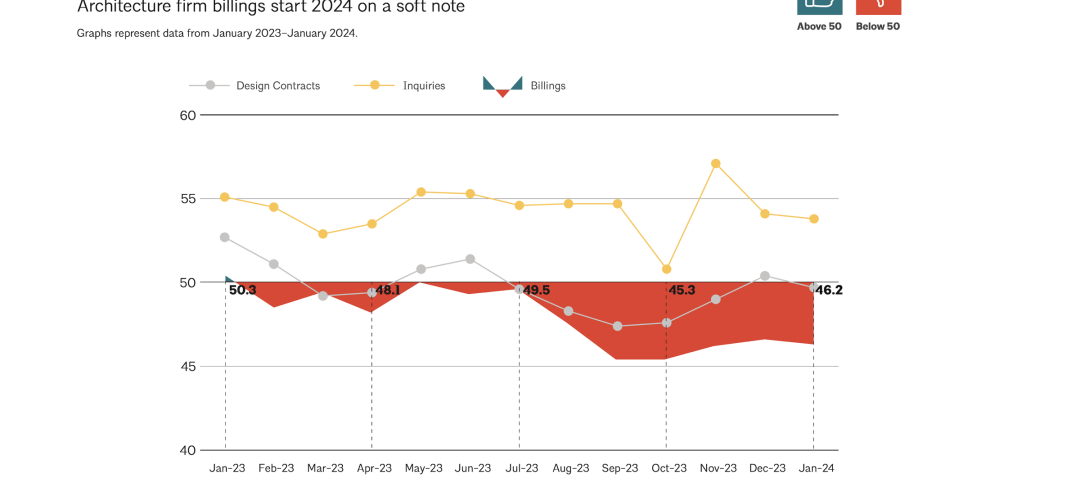

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.