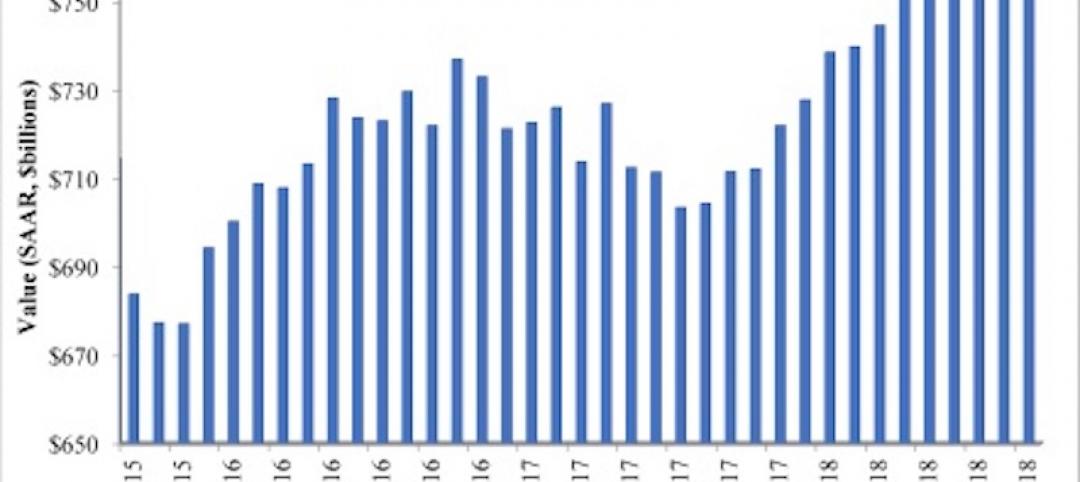

At the end of the first quarter of 2019, analysts at Lodging Econometrics (LE) reported that the total U.S. construction pipeline continued to expand with 5,647 projects/687,941 rooms, up a strong 7% by projects and 8% by rooms year-over-year (YOY). Pipeline totals are a mere 236 projects, or 4%, shy of the all-time high of 5,883 projects/785,547 rooms reached in the second quarter of 2008. The record should be pierced later in the year. Conversions and renovations are already at record levels.

Projects currently under construction stand at 1,709 projects/227,924 rooms with projects scheduled to start construction in the next 12 months at 2,429 projects/281,395 rooms. Projects in the early planning stage stand at 1,509 projects/178,622 rooms.

The upscale, upper-midscale, and midscale chain scales, all reached record-highs for both projects and rooms. Sixty-six percent of projects in the total pipeline are concentrated in two chain scales: upscale and upper midscale.

Annualized construction starts are at the highest level since 2008. In 2019, LE forecasts a 2.2% supply growth rate with 1,038 new hotels/118,385 rooms expected to open. For 2020, LE anticipates 1,174 new hotel openings and 128,598 rooms.

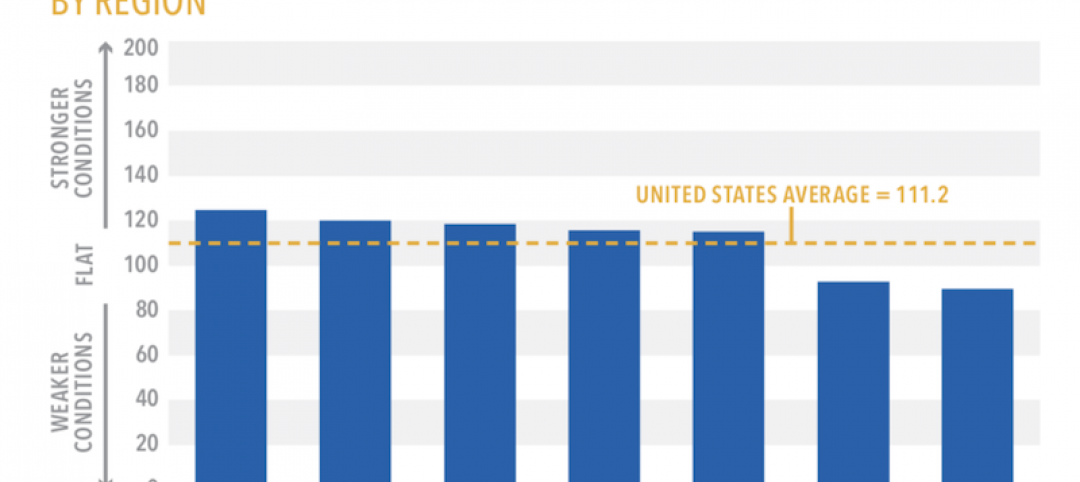

Hotel operations had a good quarter but mostly from expense improvements. Only 7 of the top 25 markets showed occupancy increases, quarter-over-quarter (QOQ). Only 11 markets had rev-par increases. Overall, U.S. demand growth was up 2.4% while supply was up 2%.

Leading Markets in the U.S. Hotel Construction Pipeline

In the first quarter of 2019, analysts at Lodging Econometrics (LE) report that the top five markets with the largest hotel construction pipelines are New York City with 170 projects/29,247 rooms. Next are Dallas and Los Angeles, both at record highs, with 163 projects/19,689 rooms and 158 projects/25,578 rooms, respectively. Houston follows with 151 projects/15,643 rooms, and Nashville with 116 projects/15,599 rooms.

Markets with the greatest number of projects already under construction are New York with 119 projects/20,068 rooms, Dallas with 48 projects/6,265 rooms, and Los Angeles with 42 projects/6,288 rooms. Houston has 36 projects/4,162 rooms while Nashville, Austin, and San Jose all have 34 projects presently under construction.

Reflective of the increasing pipeline, LE’s forecast for new hotel openings will continue to rise through 2020. In 2019, New York City tops the list with 63 new hotels expected to open with 9,605 rooms, followed by Dallas with 30 projects/3,604 rooms, Houston with 28 projects/3,342 rooms, Austin with 25 projects/2,512 rooms, and Nashville with 23 projects/3,030 rooms. In the 2020 forecast, New York continues to lead with the highest number of new hotels anticipated to open with 44 projects/6,225 rooms followed by Los Angeles with 35 projects/5,140 rooms and Dallas with 33 projects/4,163 rooms.

The number of markets where supply growth is now exceeding demand growth continues to increase. At the first quarter, 18 of the top 25 markets experienced the shift, up from 12 of the top 25 markets at the end of the fourth quarter of 2018.

Markets of concern where new supply is already outpacing demand and future new openings are forecasted to be high are Houston, New York, Dallas, and Los Angeles.

Related Stories

Market Data | Dec 19, 2018

Brokers look forward to a commercial real estate market that mirrors 2018’s solid results

Respondents to a recent Transwestern poll expect flat to modest growth for rents and investment in offices, MOBs, and industrial buildings.

Market Data | Dec 19, 2018

When it comes to economic clout, New York will far outpace other U.S. metros for decades to come

But San Jose, Calif., is expected to have the best annual growth rate through 2035, according to Oxford Economics’ latest Global Cities report.

Market Data | Dec 19, 2018

Run of positive billings continues at architecture firms

November marked the fourteenth consecutive month of increasing demand for architectural firm services.

Market Data | Dec 5, 2018

ABC predicts construction sector will remain strong in 2019

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry.

Market Data | Dec 4, 2018

Nonresidential spending rises modestly in October

Thirteen out of 16 subsectors are associated with year-over-year increases.

Market Data | Nov 20, 2018

Construction employment rises from October 2017 to October 2018 in 44 states and D.C.

Texas has biggest annual job increase while New Jersey continues losses; Iowa, Florida and California have largest one-month gains as Mississippi and Louisiana trail.

Market Data | Nov 15, 2018

Architecture firm billings continue to slow, but remain positive in October

Southern region reports decline in billings for the first time since June 2012.

Market Data | Nov 14, 2018

A new Joint Center report finds aging Americans less prepared to afford housing

The study foresees a significant segment of seniors struggling to buy or rent on their own or with other people.

Market Data | Nov 12, 2018

Leading hotel markets in the U.S. construction pipeline

Projects already under construction and those scheduled to start construction in the next 12 months, combined, have a total of 3,782 projects/213,798 rooms and are at cyclical highs.

Market Data | Nov 6, 2018

Unflagging national office market enjoys economic tailwinds

Stable vacancy helped push asking rents 4% higher in third quarter.