At the end of the second quarter, analysts at Lodging Econometrics (LE) report that the total U.S. construction pipeline stands at 5,312 projects/634,501 rooms, up 7% from 2017’s 4,973 projects/598,371 rooms. The pipeline has been growing moderately and incrementally each quarter and should continue its upward growth trend as long as the economy remains strong. Pipeline totals are still significantly below the all-time high of 5,883 projects/785,547 rooms reached in 2008.

Projects scheduled to start construction in the next 12 months have seen minimal change year-over-year (YOY) with 2,291 projects/266,878 rooms. Projects currently under construction are at 1,594 projects/208,509 rooms, the highest recorded since 2007. This also marks the fourth consecutive quarter that the number of rooms under construction has been over 200,000 units.

Early planning with 1,427 projects/159,114 rooms, saw a 25% increase in projects and 18% increase in rooms YOY. This increase in early planning is typical late cycle activity where developers are anxious to move from the drawing board into the permitting phase prior to any economic slowdown. Many are larger projects that wait for peak operating performance in their markets before seeking financing.

Both the increase in projects under construction and those in the early planning stage are reflective of the urgency developers currently have before the economy softens and/or interest rates further accelerate.

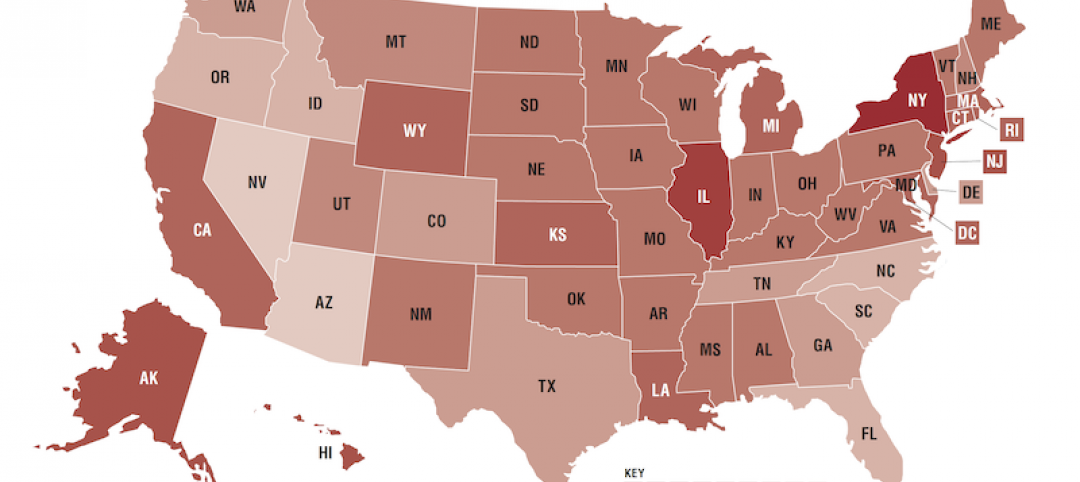

The top five markets with the largest hotel construction pipelines are: New York City with 169 projects/29,365 rooms; Dallas with 156 projects/18, 908 rooms; Houston with 150 projects/16,321 rooms; Nashville with 123 projects/16,392 rooms; and Los Angeles with 121 projects/18,037 rooms.

The five top markets with the most projects currently under construction are New York City with 101 projects/17,108 rooms, Dallas with 47 projects/6,350 rooms, Nashville with 43 projects/7,005 rooms, Houston with 40 projects/4,738 rooms, and Atlanta with 28 projects/3,387 rooms.

In the second quarter, Nashville has the largest number of new projects announced into the pipeline with 13 projects/1,351 rooms, followed by Los Angeles with 12 projects/1,845 rooms, New York City with 11 projects/1,075 rooms, Houston with 11 projects/909 rooms, and Dallas with 10 projects/1,229 rooms. If all of the projects in their pipelines come to fruition, these leading markets will increase their current room supply by: Nashville 38.2%, Austin 29.3%, Fort Worth 28.5%, San Jose 25.3%, and New York City 25.2%.

Hotels forecast to open in 2018 are led by New York City with 45 projects/7,762 rooms, followed by Dallas with 33 projects/ 3,813 rooms, and then Houston with 27 projects/3,114 rooms. In 2019, New York is forecast to again top the list of new hotel openings with 52 projects/7,356 rooms while, at this time, Dallas is anticipated to take the lead in 2020 with 40 projects/4,943 rooms expected to open.

Related Stories

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.