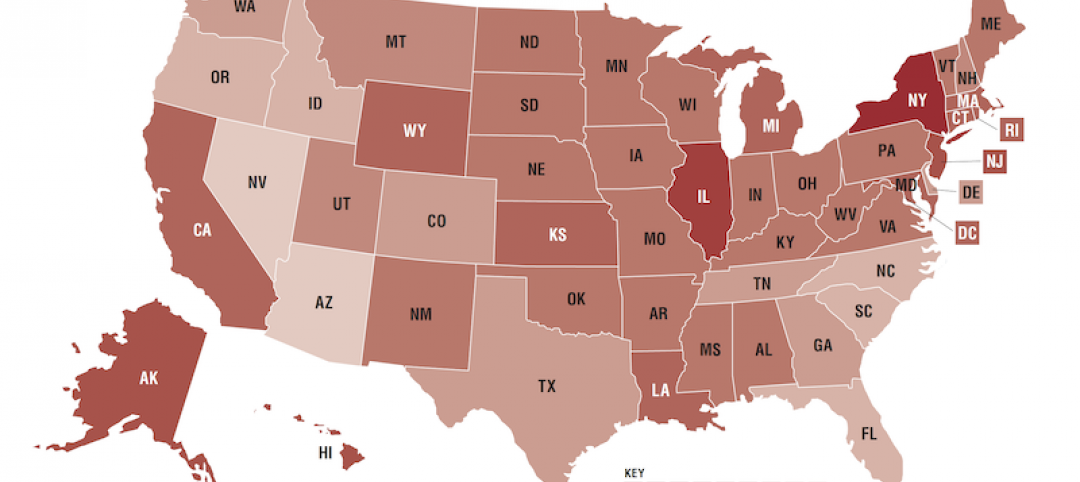

Bolstered by a positive economic environment, U.S. multifamily rents increased 3% year-over-year in January 2020.

Sixteen of the country’s top 30 markets posted year-over-year rent growth above the national average and none experienced a decline, a new report from Yardi® Matrix shows. The $1,463 rent was $1 below the average for December, but “stagnant or decelerating rents are common during the winter months and could continue” through the first quarter, the report says. The national economy’s resilience continues to sustain “strong and steady” multifamily fundamentals.

Phoenix and Las Vegas maintained their year-over-year rent growth leadership for the 16th consecutive month in January. Sacramento, Calif., California’s Inland Empire and Nashville, Tenn., rounded out the top five metros. Nashville and Charlotte, N.C., the No. 6 entry, have benefited from corporate relocations from higher-cost cities. Boston was the lone Northeastern market in the top 10.

Potential impediments to rent growth this year include new statewide rent control measures and increased local regulation of security deposits and resident acceptance criteria.

National supply deliveries figure to decline this year as “multifamily construction originations are at a five-year low and the increased cost of labor and materials continues to be an issue,” according to the report.

Get the latest in-depth data on employment, supply, occupancy and market rent growth trends in the Yardi Matrix multifamily national report for January 2020.

Related Stories

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.

Market Data | Oct 4, 2019

Global construction output growth will decline to 2.7% in 2019

It will be the slowest pace of growth in a decade, according to GlobalData.