The coronavirus pandemic is accelerating momentum nationwide for life sciences real estate demand, according to a recent report from JLL's Healthcare and Life Sciences team.

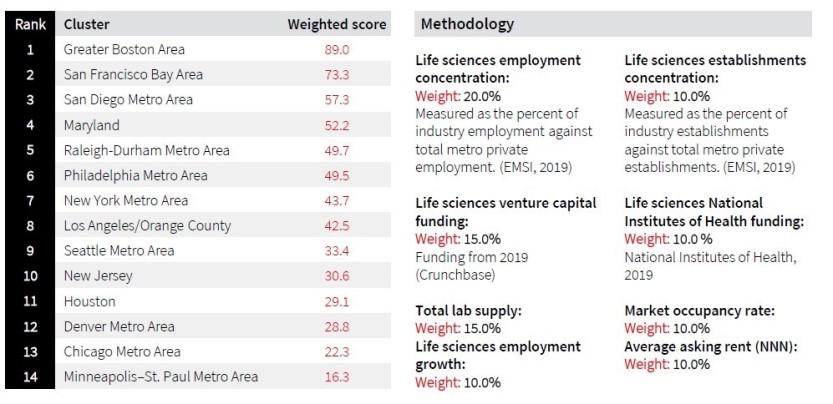

The report, 2020 Life Sciences Real Estate Outlook, outlines the nation's top life sciences cluster hubs (Boston and San Francisco top the list) and pinpoints emerging markets for life sciences real estate.

Audrey Symes, Research Director, JLL Healthcare and Life Sciences, joined BD+C's David Barista on the August 6 episode of The Weekly to discuss the primary drivers of growth across the nation's life sciences cluster hubs. Watch the highlights here:

Here are highlights from JLL's 2020 Life Sciences Real Estate Outlook (text from JLL):

Rankings of the top U.S. life sciences cluster hubs were released today in the JLL 2020 U.S. Life Sciences Outlook, which also tracks the progress of up-and-coming life science markets that are fast becoming options of choice for life science companies and investors alike. Emerging hubs are looking to real estate to boost productivity as they anticipate growth of the worldwide prescription drug market, expected to surpass $1 trillion by 2022.

Boston, San Francisco, and San Diego retained their rankings as leaders among U.S. life sciences ecosystems and top contenders for venture capital investment, capturing 70% of all venture capital (VC) investment in 2019. Boston and San Francisco also lead the other clusters significantly with respect to development, with 2.7 million square feet (MSF) and 4.0 MSF respectively under construction.

Massive infusion of venture capital is also quick to promote life sciences employment growth. In 2019, 11 of 14 cluster markets set or approached record VC funding levels, a significant positive for the reinforcement of cluster market strength, resilience and security.

New York, Los Angeles, and Philadelphia increased their cluster scores since 2019, reaching new peaks in venture capital funding and life sciences employment. As speed to market accelerates for many pharmaceuticals, proximity to incubators at major research institutions has also supported developing clusters such as Raleigh-Durham, Houston, and Maryland, which have attracted recent interest from developers such as ARE, Longfellow and Hines.

Additionally, the race for development of COVID-19-related vaccines is already beginning to energize demand in pharma-heavy New Jersey, a trend that should spread to more markets as 2020 progresses.

“Each cluster has a different specialty and occupies its own point along the maturity spectrum, providing a diverse range of options for investors and occupiers alike,” said Roger Humphrey, Executive Managing Director, JLL Life Sciences. “But they do a share a major commonality. Each cluster features a highly-educated workforce and ties to the research community, which in turn attracts a steady stream of multi-sourced investment that creates a need for institutional real estate.”

Beyond COVID-19’s recent acceleration of innovation in the life sciences industry, life-enhancing pharmaceuticals and medical devices have been increasingly sought out by Millennials reaching the peak of their earning potential and seeking personalized experiences.

And, the upcoming expiration of a suite of patents creates an opportunity for mid-tier life sciences companies to pursue new long-term profit sources. Many new products on the market and in development are curative rather than therapeutic, increasing marketing potential and overall category growth.

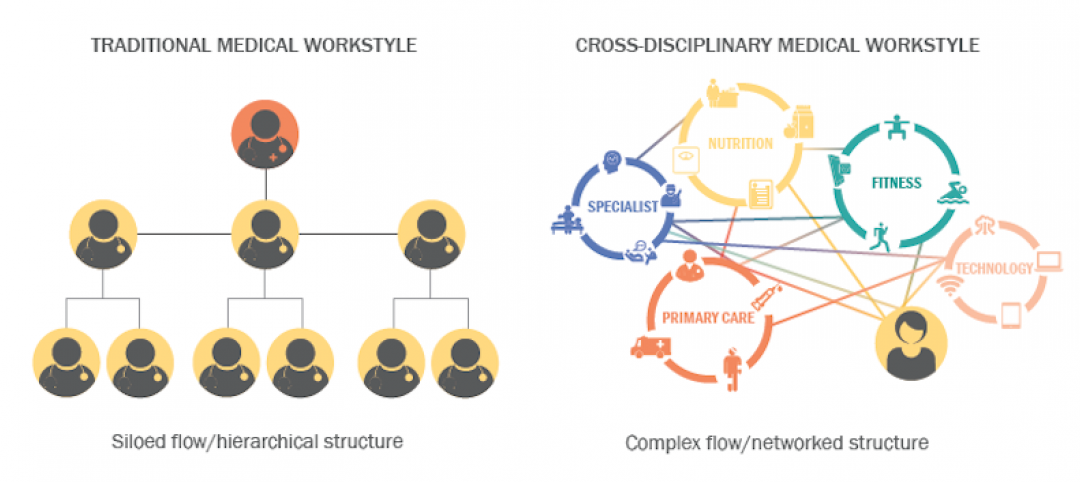

“Conditions are ideal for maximum profitability arising from innovative new pharmaceuticals and medical devices,” said Audrey Symes, Research Director, JLL Healthcare and Life Sciences. “Meaningful advances within the life sciences industry, such as machine learning, are creating new sources of workflow and thus real estate demand. This combination of simulative factors sets up the life sciences industry to expand at an unprecedented pace, both in terms of manufacturing and patient demand.”

Related Stories

Laboratories | Jun 18, 2018

A Massachusetts research building is the first to meet WELL’s Gold standard

Design changes in lighting and HVAC systems were required to meet compliance criteria.

Laboratories | May 21, 2018

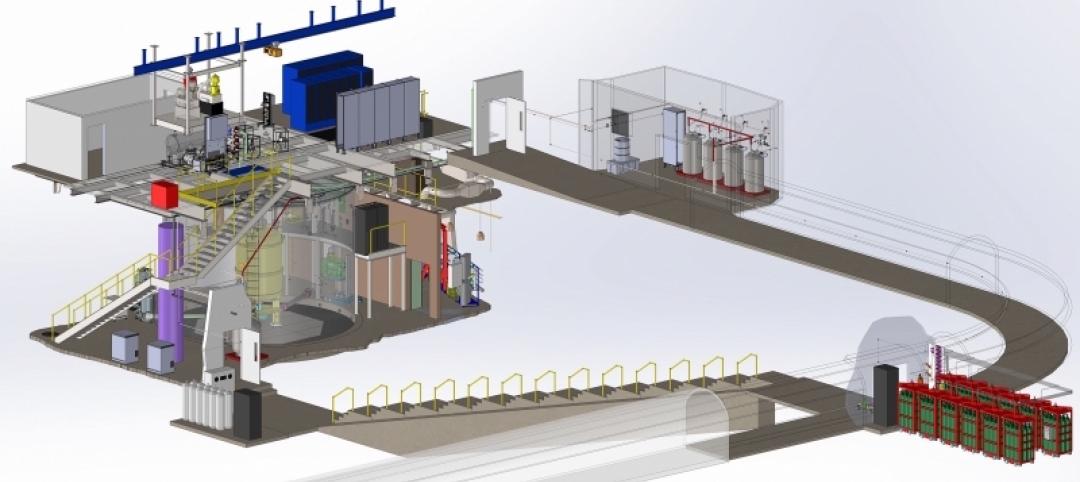

Virtual Design and Construction Technology helped design MIT’s new accelerator facility

SGA designed the incubator space.

Laboratories | Feb 26, 2018

Three trends shaping labs of the future

It’s all about flexibility and talent for the future of life sciences.

University Buildings | Feb 16, 2018

The University of Washington receives a new Nanoengineering and Sciences Building

The building marks the second phase of a 168,000-sf complex.

Laboratories | Feb 15, 2018

Mass science: Superlab design best practices

What are superlabs? And what makes for a superbly designed superlab?

Reconstruction & Renovation | Feb 7, 2018

Renovations begin on an underground facility that is investigating the nature of dark matter

This LEO A DALY-designed project makes way to produce the world’s most sensitive detector to this point.

Healthcare Facilities | Jan 6, 2018

A new precision dental center embodies Columbia University’s latest direction for oral medicine education

The facility, which nests at “the core” of the university’s Medical Center, relies heavily on technology and big data.

Giants 400 | Dec 13, 2017

Top 45 science + technology architecture firms

HDR, HOK, and Interior Architects top BD+C’s ranking of the nation’s largest science + technology sector architecture and AE firms, as reported in the 2017 Giants 300 Report.

Healthcare Facilities | Nov 6, 2017

Design isn’t enough to foster collaboration in healthcare and research spaces

A new Perkins Eastman white paper finds limited employee interaction at NYU Winthrop Hospital, a year after it opened.

Laboratories | Sep 22, 2017

Designing for how we learn: Maker spaces and instructional laboratories

Here is how the See + Hear + Do = Remember mantra can be applied to maker spaces and instructional labs.