Though news reports and predictions painted a gloomy picture, the U.S. economy actually ended 2013 with a record setting year on Wall Street. The Dow Jones Industrial Average finished up 26.5%, its best return since 1995, and the S&P up nearly 30%, shattering previous records.

(See past articles from CBRE Healthcare)

Momentum continues to build in the housing market with positive trends in pricing, new housing starts, and inventory volume across the country. The U.S. economy added 74,000 jobs in December, as the unemployment rate fell to 6.7%, according to the Bureau of Labor Statistics.

With an improving economy and an unprecedented stimulus from the Federal Reserve continuing through 2014, the macro-economic outlook is good.

Healthcare Reform

Meanwhile, the healthcare industry has been rapidly evolving under the Affordable Care Act (ACA). Healthcare reform has compelled health systems, hospitals and physician groups to rein in sky-high costs while improving the quality of care, often coping with more regulatory requirements and less money.

Changes to reimbursement methods and reductions in healthcare provider compensation combined with an increased demand for healthcare services over the next five years, from an estimated 79 million aging baby boomers and 30 million newly insured patients, is forcing health systems to rethink their approach to balance sheet assets and liabilities, including health care real estate.

As health systems and physician groups change their delivery network, both healthcare service operators and owners of healthcare real estate are repositioning their portfolio requirements based on their growth needs. This has led to the highest medical office sales volume in the healthcare capital markets since 2007.

Healthcare reform incentives are driving consolidation of services in the industry, which has produced a robust mergers and acquisitions environment. As hospitals and healthcare organizations face mounting competitive, regulatory and financial challenges, leadership is seeking ways to capitalize on the increase of privately insured patients and Medicaid expansion while effectively serving the interests of their communities.

Healthcare operators need to diversify and expand their patient base while also becoming more efficient and leaner. This is most effectively achieved through greater economies of scale by merging with other health systems, hospitals, and physician groups, leading to a consolidation in the industry.

Consolidation is taking on two forms that are impacting real estate. First, is a unification of real estate assets as a result of health system mergers and physician employment, which has caused a consolidation of physician practices into fewer facilities that are strategically dispersed throughout the community. The other is consolidation among the hospitals and health systems seeking to concentrate operations in a single Metropolitan Statistical Area (MSA), region or state.

Off-Campus Healthcare

Healthcare investors are monitoring the consolidation trends and strategically aligning themselves through real estate transactions with market dominant hospitals and health systems, specifically those with investment grade credit ratings. Historically, investment in medical office properties revealed an institutional and REIT investor preference for core on-campus properties only.

However, over the past 12-18 months, we have witnessed little difference between core on-campus and core off-campus medical office buildings with meaningful hospital tenancy. This is a direct result of the health system shift to high quality healthcare delivered in outpatient facilities further away from traditional acute-care hospital campuses.

The care delivery network is moving from the busy, compact hospital campuses to off-campus outpatient settings with convenient access where patients live, work and shop. In response to healthcare providers commitment to off-campus destinations located near traditional retail properties and close to residential neighborhoods, investors have modified their investment criteria with a focus on off-campus properties.

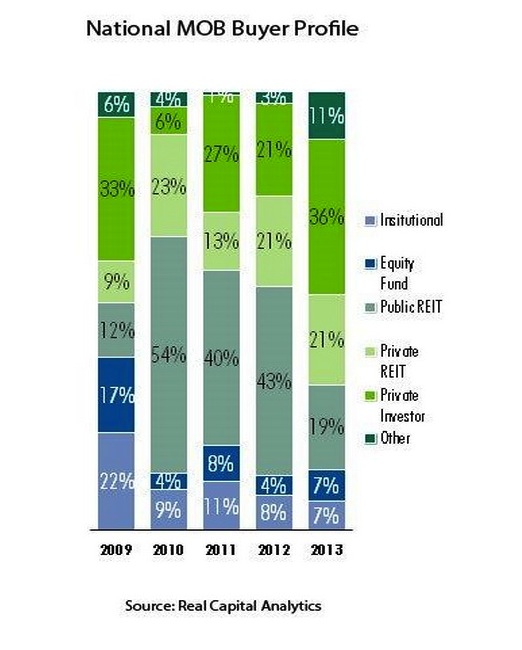

The buyer pool for healthcare real estate has steadily increased over the last couple of years as investors continue to realize the inherent stability and higher returns for medical properties when compared to the more competitive multi-family, office, retail, and industrial real estate markets.

Public healthcare REITs have historically dominated the medical office investment market share, but in 2013 the private healthcare REITs and private capital investors took over the top slots. Listed and non-listed U.S. equity REITs (including both Public and Private) raised a total of $76.96 billion of equity and debt in 2013, an amount that surpassed 2012’s prior record of $73.33 billion, according to the National Association of Real Estate Investment Trusts (NAREIT). Nearly $9.3 billion, or roughly 12% was attributed to the Healthcare sector.

Conclusion

We anticipate another active year in healthcare capital markets for 2014. All investors will have stable access to capital and interest rates will likely remain at historic lows.

The favorable macro-economic outlook and consolidation among healthcare providers and continuous modification of the healthcare delivery model will continue to fuel the investment engine for what could be another record year in medical office sales.

About the authors

Lee Asher (Lee.Asher@cbre.com) and Chris Bodnar (Chris.Bodnar@cbre.com) are both Senior Vice Presidents with CBRE Healthcare Capital Markets Group. For more on CBRE Healthcare, visit www.cbre.com/healthcare.

Related Stories

Adaptive Reuse | Sep 12, 2024

White paper on office-to-residential conversions released by IAPMO

IAPMO has published a new white paper titled “Adaptive Reuse: Converting Offices to Multi-Residential Family,” a comprehensive analysis of addressing housing shortages through the conversion of office spaces into residential units.

Mixed-Use | Sep 10, 2024

Centennial Yards, a $5 billion mixed-use development in downtown Atlanta, tops out its first residential tower

Centennial Yards Company has topped out The Mitchell, the first residential tower of Centennial Yards, a $5 billion mixed-use development in downtown Atlanta. Construction of the apartment building is expected to be complete by the middle of next year, with first move-ins slated for summer 2025.

Healthcare Facilities | Sep 9, 2024

Exploring the cutting edge of neuroscience facility design

BWBR Communications Specialist Amanda Fisher shares the unique considerations and challenges of designing neuroscience facilities.

Office Buildings | Sep 6, 2024

Fact sheet outlines benefits, challenges of thermal energy storage for commercial buildings

A U.S. Dept. of Energy document discusses the benefits and challenges of thermal energy storage for commercial buildings. The document explains how the various types of thermal energy storage technologies work, where their installation is most beneficial, and some practical considerations around installations.

Office Buildings | Sep 5, 2024

Office space downsizing trend appears to be past peak

The office downsizing trend may be past its peak, according to a CBRE survey of 225 companies with offices in the U.S., Canada, and Latin America. Just 37% of companies plan to shrink their office space this year compared to 57% last year, the survey found.

University Buildings | Sep 4, 2024

UC San Diego’s new Multidisciplinary Life Sciences Building will support research and teaching in both health and biological sciences

The University of California San Diego has approved plans for a new Multidisciplinary Life Sciences Building, with construction starting this fall. The 200,000-sf, six-level facility will be the first building on the UC San Diego campus to bridge health science research with biological science research and teaching.

Codes and Standards | Sep 3, 2024

Atlanta aims to crack down on blighted properties with new tax

A new Atlanta law is intended to crack down on absentee landlords including commercial property owners and clean up neglected properties. The “Blight Tax” allows city officials to put levies on blighted property owners up to 25 times higher than current millage rates.

Resiliency | Sep 3, 2024

Phius introduces retrofit standard for more resilient buildings

Phius recently released, REVIVE 2024, a retrofit standard for more resilient buildings. The standard focuses on resilience against grid outages by ensuring structures remain habitable for at least a week during extreme weather events.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Adaptive Reuse | Aug 29, 2024

More than 1.2 billion sf of office space have strong potential for residential conversion

More than 1.2 billion sf of U.S. office space—14.8% of the nation’s total—have strong potential for conversion to residential use, according to real estate software and services firm Yardi. Yardi’s new Conversion Feasibility Index scores office buildings on their suitability for multifamily conversion.