Video may have killed the radio star, but has e-commerce done the same to your local retail establishment? Will the rise of everything from Amazon to Zappos take down the bookstore up the street, your local shoe store? Don’t bet on it.

While the much-touted demise of good old fashioned, bricks-and-mortar stores makes for good headlines, it’s not actually based in fact.

According to JLL’s Cross Sector Outlook released this spring, despite e-commerce’s leaps and bounds over the last few years, it still represents a relatively small percentage of total retail sales—6.0% to be exact. Your shoe store is safe for now, and probably well into the future.

“Remember catalogs? Flipping through the pages, dialing up a call center and placing an order? Web sales are really just replacing that,” said Kris Cooper, Managing Director, JLL Capital Markets. “People still need to see and touch things; the instant gratification of an in-store purchase can’t be discounted. Retailers who want to thrive will need to incorporate it all—hands-on goods, e-commerce and mobile-commerce.”

Despite these emerging structural challenges and newly-announced store closings, such as those of Radio Shack, Office Depot, and Coldwater Creek, the U.S. retail sector has continued on its solid recovery and is exhibiting tightening market conditions.

Cap rates compressed by approximately 20 basis points in 2013 as rent growth is expected to increase to 2.7% in 2014. Vacancy rates are also expected to compress another 20 basis points by the end of this year.

Right now, power centers, in particular, are punching above their weight class, experiencing the tightest overall market conditions with a total vacancy rate of just 5.1%.

A FEEDING FRENZY

What does this mean for the health of the retail investment sales and financing market? Investors have wasted no time hopping back on the retail bandwagon, particularly in core markets where new product often produces a “feeding frenzy.”

In February, Savanna purchased 10 Madison Square West in New York for more than $2,900 per square foot ($60 million). Price appreciation for retail product was outstanding in 2013; the Moody’s/RCA CPPI for retail is expected to post a 23% increase for the year—and reach similar numbers by the end of 2014.

“Right now, it’s all about high-quality, grocery-anchored centers and trophy malls," said Margaret Caldwell, Managing Director, JLL’s Capital Markets. "Demand for those asset types is incredible right now—if only we could convince all the owners to bring those to market. Investment in the gateway cities is strong, as always—but watch for a few dark horses to emerge in the coming months. Markets like Phoenix and Indianapolis could make some real headway by the end of the year.”

In the financing arena, debt is plentiful as balance sheet lenders such as life insurance companies are increasing their allocations in 2014 and remain competitive, while domestic banks continue to report stronger demand for commercial property loans. CMBS money is also plentiful, with retail collateralizing 20 percent of all CMBS deals in the first quarter of 2014.

“Watch for equity to make some significant strides in the retail space in the coming year, as well,” said Mark Brandenburg, Executive Vice President, JLL’s Capital Markets. “For a long time, equity sponsors were holding back, waiting to see if retail would survive the e-commerce invasion. Now that things have settled down a bit, many of those JV equity players are under allocated in the retail space and they’ll need to make some big plays to balance things out.”

Brandenburg also advises investors to keep their eyes on secondary markets as the borrowing rates for primary versus secondary markets don’t vary much.

“Leveraged yields into secondary and tertiary markets will be higher for the same quality real estate due to positive leverage between borrowing rates and cap rates,” he concluded.

About JLL's Retail Group

JLL’s Retail Group serves as the industry’s leader in retail real estate services. The firm’s more than 850 dedicated retail experts in the Americas partner with investors and occupiers around the globe to support and shape investment and site selection strategies.

Its retail specialists provide independent and expert advice to clients, backed by industry-leading research that delivers maximum value throughout the entire lifecycle of an asset or lease. The firm has more than 80 retail brokerage experts spanning 20 major markets, representing more than 100 retail clients. As the largest third party retail property manager in the United States, JLL’s retail portfolio has 305 centers, totaling 65.7 million square feet under management in regional malls, lifestyle centers, grocery-anchored centers, power centers, central business districts, transportation facilities and mixed-use projects.

For more, visit www.jllretail.com.

Related Stories

| Oct 12, 2010

Building 13 Naval Station, Great Lakes, Ill.

27th Annual Reconstruction Awards—Gold Award. Designed by Chicago architect Jarvis Hunt and constructed in 1903, Building 13 is one of 39 structures within the Great Lakes Historic District at Naval Station Great Lakes, Ill.

| Oct 12, 2010

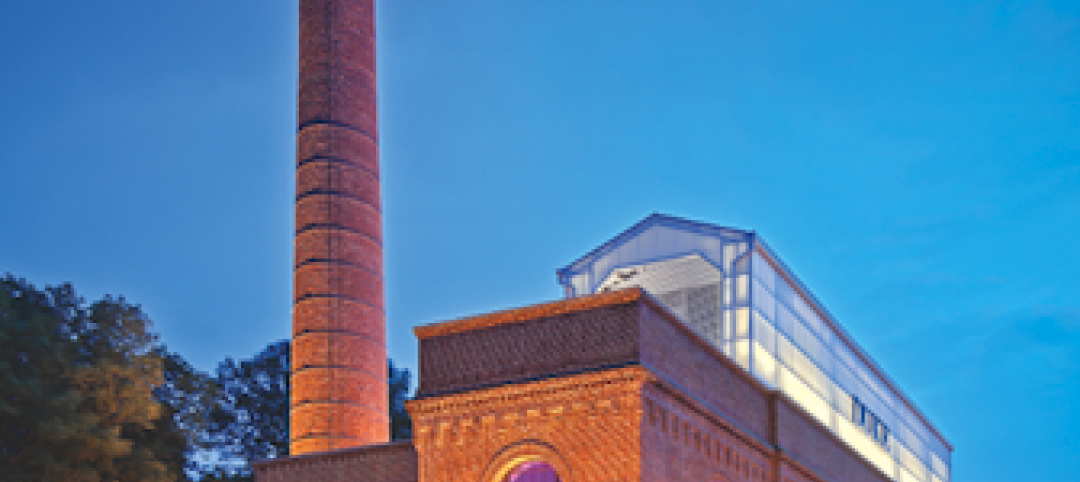

Full Steam Ahead for Sustainable Power Plant

An innovative restoration turns a historic but inoperable coal-burning steam plant into a modern, energy-efficient marvel at Duke University.

| Oct 12, 2010

From ‘Plain Box’ to Community Asset

The Mid-Ohio Foodbank helps provide 55,000 meals a day to the hungry. Who would guess that it was once a nondescript mattress factory?

| Oct 11, 2010

HGA wins 25-Year Award from AIA Minnesota

HGA Architects and Engineers won a 25-Year Award from AIA Minnesota for the Willow Lake Laboratory.

| Oct 11, 2010

MBMA Releases Fire Resistance Design Guide for metal building systems

The Metal Building Manufacturers Association (MBMA) announces the release of the 2010 Fire Resistance Design Guide for Metal Building Systems. The guide provides building owners, architects, engineers, specifiers, fire marshals, building code officials, contractors, product vendors, builders and metal building manufacturers information on how to effectively meet fire resistance requirements of a project with metal building systems.

| Oct 11, 2010

Rhode Island is the first state to adopt IGCC

Rhode Island is the first state to adopt the International Green Construction Code (IGCC). The Rhode Island Green Buildings Act identifies the IGCC as an equivalent standard in compliance with requirements that all public agency major facility projects be designed and constructed as green buildings. The Rules and Regulations to implement the Act take effect in October 2010.

| Oct 8, 2010

Union Bank’S San Diego HQ awarded LEED Gold

Union Bank’s San Diego headquarters building located at 530 B Street has been awarded LEED Gold certification from the Green Building Certification Institute under the standards established by the U.S. Green Building Council. Gold status was awarded to six buildings across the United States in the most recent certification and Union Bank’s San Diego headquarters building is one of only two in California.

| Oct 6, 2010

Windows Keep Green Goals in View

The DOE's National Renewable Energy Laboratory has almost 600 window openings, and yet it's targeting LEED Platinum, net-zero energy use, and 50% improvement over ASHRAE 90.1. How the window ‘problem’ is part of the solution.

| Oct 6, 2010

From grocery store to culinary school

A former West Philadelphia supermarket is moving up the food chain, transitioning from grocery store to the Center for Culinary Enterprise, a business culinary training school.

| Sep 30, 2010

Luxury hotels lead industry in green accommodations

Results from the American Hotel & Lodging Association’s 2010 Lodging Survey showed that luxury and upper-upscale hotels are most likely to feature green amenities and earn green certifications. Results were tallied from 8,800 respondents, for a very respectable 18% response rate. Questions focused on 14 green-related categories, including allergy-free rooms, water-saving programs, energy management systems, recycling programs, green certification, and green renovation.