Prices of numerous construction materials soared again in November, outpacing the rate at which contractors raised their bid prices, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said the current steps being taken to address supply chain problems and rising prices have been insufficient and urged public officials to redouble their efforts.

“Prices for nearly every type of construction material are rising at runaway rates,” said Ken Simonson, the association’s chief economist. “These costs are compounding the difficulties contractors are experiencing from long lead times for production, gridlocked supply chains, and record numbers of job openings.”

The producer price index for inputs to new nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms--jumped 0.9% in November and 22.1% over 12 months. Those increases dwarfed the rise in the index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings, Simonson noted. That index climbed by 0.3% for the month and 12.4% from a year earlier.

A wide range of products used in construction, as well as trucking services, posted double-digit price increases over the past 12 months, Simonson observed. The price index for steel mill products more than doubled, soaring 141.6% since November 2020. The index for aluminum mill shapes jumped 41.1% over 12 months, while the index for copper and brass mill shapes rose 37.8%. The index for plastic construction products climbed by 32.5%. The index for gypsum products such as wallboard rose 20.9% and insulation costs increased 17.4%.

Trucking costs climbed 16.3%, as did the index for asphalt felts and coatings. The index for architectural coatings increased 12.4% and the index for lumber and plywood rose 12.2%. The index for diesel fuel, which contractors buy directly for their own vehicles and off-road equipment and also indirectly through surcharges on deliveries of materials and equipment, soared 81% over 12 months despite a 2.9% decline from October.

Association officials said the steep rise in materials prices shows that more needs to be done to tackle supply chain issues and price inflation that are making it difficult for contractors to be successful. They urged public officials to look at ways to temporarily increase capacity at backed up ports like Los Angeles/Long Beach, abandon plans to double tariffs on Canadian wood, and address rising levels of inflation.

“Rising materials prices are squeezing already slim profit margins for many contractors,” said Stephen E. Sandherr, the association’s chief executive officer. “Having strong demand for construction is important, being able to make a small amount of money on that work is vital.”

View producer price index data. View chart of gap between input costs and bid prices.

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

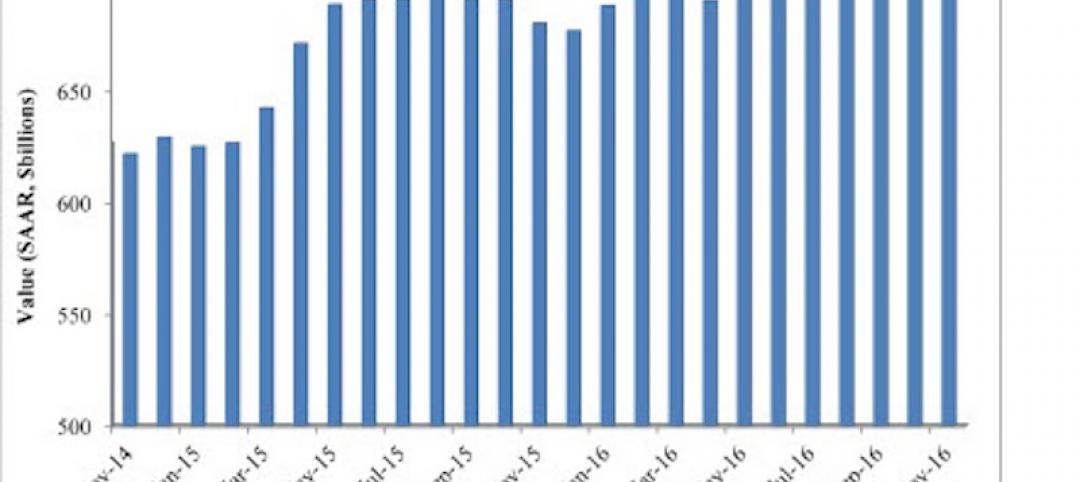

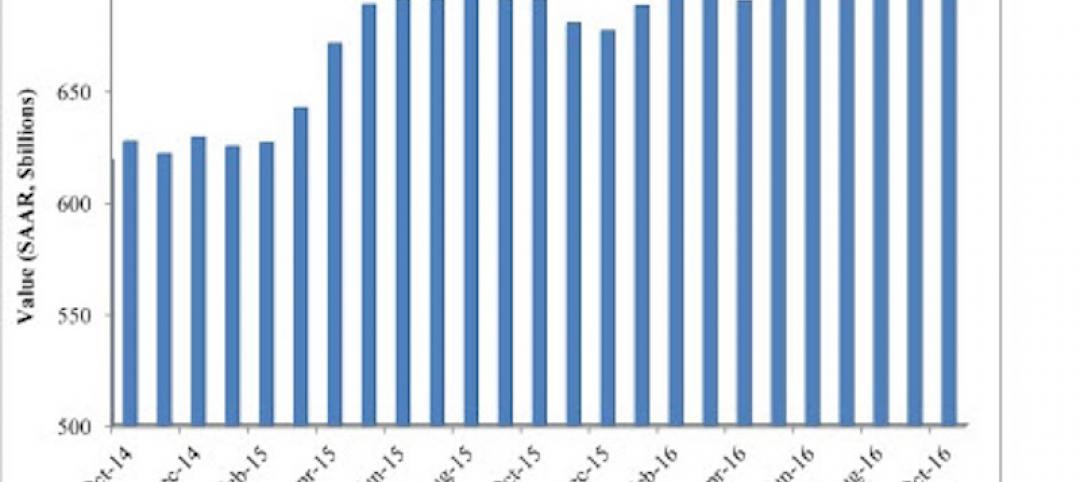

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

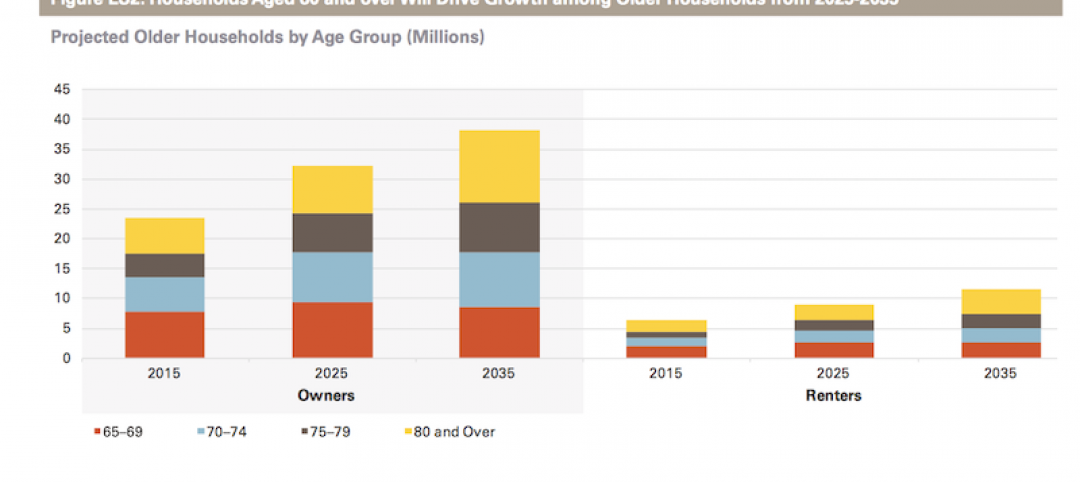

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.