Rents in most American cities continue to rise slightly each month, but are not duplicating the rapid escalation rates exhibited in 2021. But given ongoing gains, Yardi® Matrix has revised its end-of-year projections upwards for most markets in a new special report.

Average month-over-month asking rents increased by 1.1 percent in May compared to the one percent month-over-month increase in April. However, year-over-year asking rents decelerated, from 16 percent in April to 14 percent in May.

“While we are seeing the usual seasonal increase leading into the summer months, 2022 does not look like a repeat of 2021 even though rent growth remains elevated,” state Matrix analysts.

Asking rents fell in only six markets: the gateway markets of Queens and Brooklyn; small Southern markets Macon, Ga., and Jackson, Miss.; and tropical Honolulu and the Southwest Florida Coast.

Conversely, 84 markets experienced greater than one percent month-over-month increase, and seven markets saw month-over-month growth that topped two percent: Charleston, Knoxville, the Bay Area-South Bay, Miami, the Urban Twin Cities, Wilmington, N.C., and Portland, Maine.

Most markets received an increase to their end-of-year projections in the newly released Matrix report. The biggest increases were concentrated in markets that continue to outperform expectations, with Scranton-Wilkes-Barre, Wilmington, South Bend and Spokane all seeing a more than five percent increase for year-end 2022.

Learn more about the expectations for rents for the remainder of 2022.

Yardi Matrix offers the industry’s most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, student housing, industrial, office and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

Related Stories

Market Data | May 18, 2021

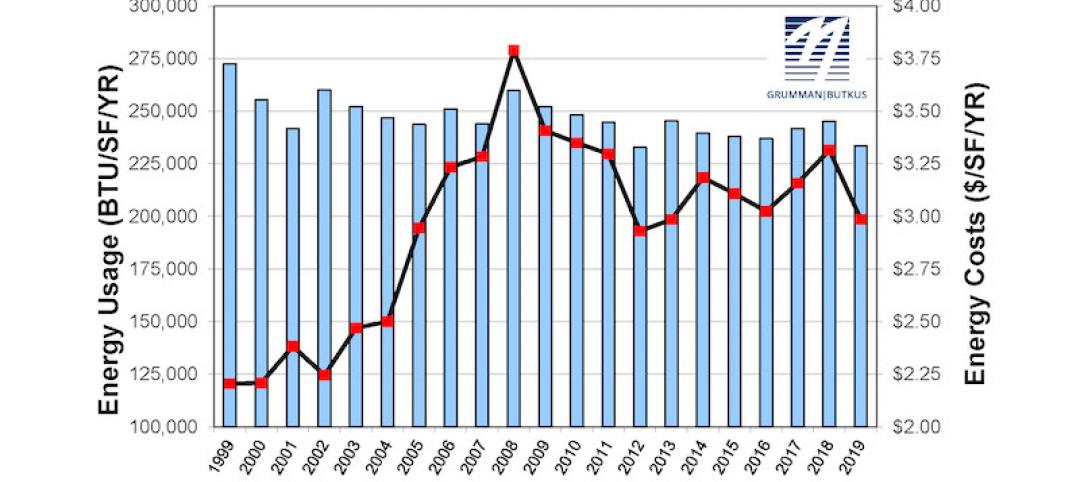

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

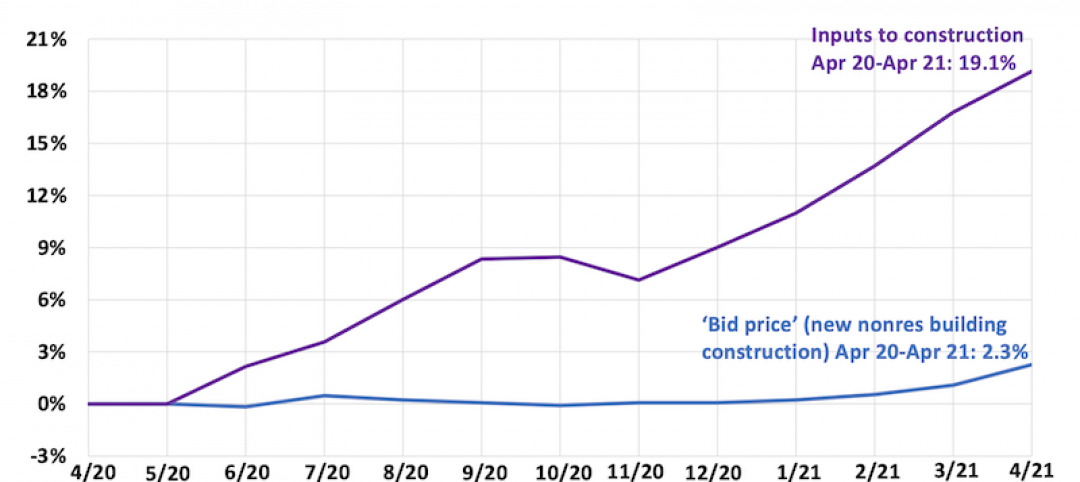

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

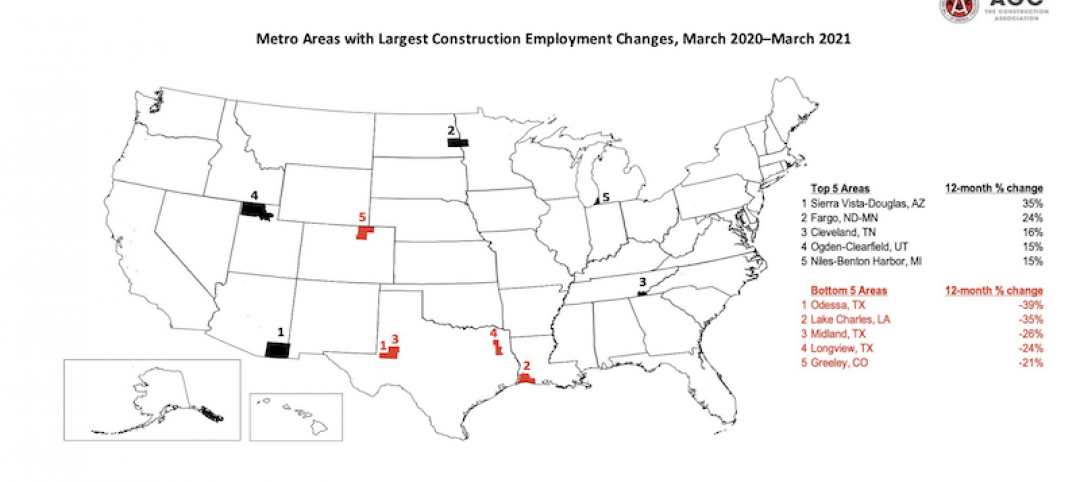

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.