Rents in most American cities continue to rise slightly each month, but are not duplicating the rapid escalation rates exhibited in 2021. But given ongoing gains, Yardi® Matrix has revised its end-of-year projections upwards for most markets in a new special report.

Average month-over-month asking rents increased by 1.1 percent in May compared to the one percent month-over-month increase in April. However, year-over-year asking rents decelerated, from 16 percent in April to 14 percent in May.

“While we are seeing the usual seasonal increase leading into the summer months, 2022 does not look like a repeat of 2021 even though rent growth remains elevated,” state Matrix analysts.

Asking rents fell in only six markets: the gateway markets of Queens and Brooklyn; small Southern markets Macon, Ga., and Jackson, Miss.; and tropical Honolulu and the Southwest Florida Coast.

Conversely, 84 markets experienced greater than one percent month-over-month increase, and seven markets saw month-over-month growth that topped two percent: Charleston, Knoxville, the Bay Area-South Bay, Miami, the Urban Twin Cities, Wilmington, N.C., and Portland, Maine.

Most markets received an increase to their end-of-year projections in the newly released Matrix report. The biggest increases were concentrated in markets that continue to outperform expectations, with Scranton-Wilkes-Barre, Wilmington, South Bend and Spokane all seeing a more than five percent increase for year-end 2022.

Learn more about the expectations for rents for the remainder of 2022.

Yardi Matrix offers the industry’s most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, student housing, industrial, office and self storage property types. Email matrix@yardi.com, call 480-663-1149 or visit yardimatrix.com to learn more.

Related Stories

Market Data | Jan 4, 2021

Nonresidential construction spending shrinks further in November

Many commercial projects languish, even while homebuilding soars.

Market Data | Dec 29, 2020

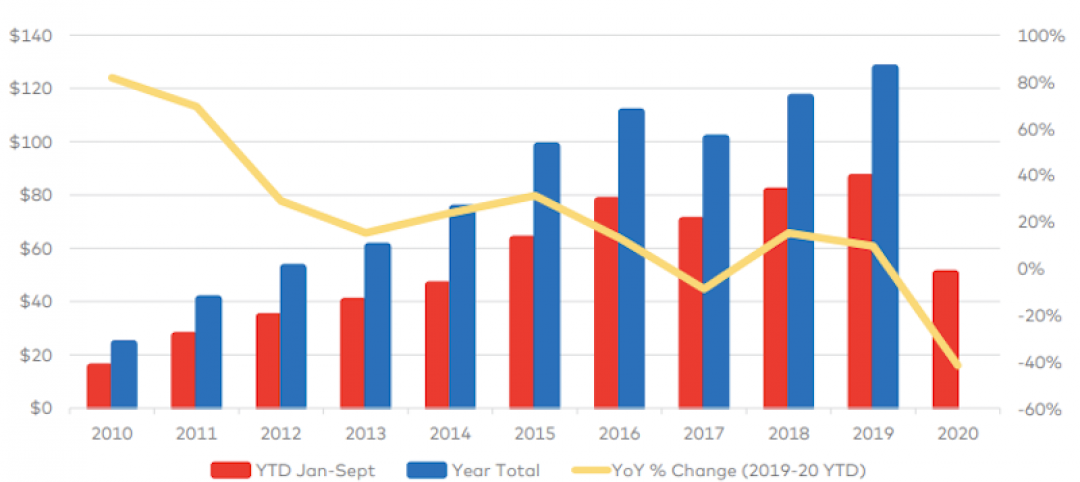

Multifamily transactions drop sharply in 2020, according to special report from Yardi Matrix

Sales completions at end of Q3 were down over 41 percent from the same period a year ago.

Market Data | Dec 28, 2020

New coronavirus recovery measure will provide some needed relief for contractors coping with project cancellations, falling demand

Measure’s modest amount of funding for infrastructure projects and clarification that PPP loans may not be taxed will help offset some of the challenges facing the construction industry.

Market Data | Dec 28, 2020

Construction employment trails pre-pandemic levels in 35 states despite gains in industry jobs from October to November in 31 states

New York and Vermont record worst February-November losses, Virginia has largest pickup.

Market Data | Dec 16, 2020

Architecture billings lose ground in November

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.3 from 47.5.

AEC Tech | Dec 8, 2020

COVID-19 affects the industry’s adoption of ConTech in different ways

A new JLL report assesses which tech options got a pandemic “boost.”

Market Data | Dec 7, 2020

Construction sector adds 27,000 jobs in November

Project cancellations, looming PPP tax bill will undercut future job gains.

Market Data | Dec 3, 2020

Only 30% of metro areas add construction jobs in latest 12 months

Widespread project postponements and cancellations force layoffs.

Market Data | Dec 2, 2020

New Passive House standards offers prescriptive path that reduces costs

Eliminates requirement for a Passive House consultant and attendant modeling.

Market Data | Dec 2, 2020

Nonresidential construction spending remains flat in October

Residential construction expands as many commercial projects languish.