A new market analysis compiled by Yardi® Matrix reports that the industrial sector of the U.S. economy is performing solidly. Warehouse and distribution assets posted double-digit total returns, record low vacancy rates and all-time high rents in 2017 and are on track for an even stronger year in 2018, according to the report.

The report, titled "Hitting Its Stride," details how rising e-commerce sales and online retailers' focus on moving closer to customers have made warehouse space popular with both investors and tenants.

See Also: Yardi Matrix report shows U.S. rent surge in April

Biopharmaceutical companies, whose growth potential and long-term returns have drawn increasing investment attention, are seeking new locations away from such traditional centers as Boston, San Francisco and Seattle. Meanwhile, rising imports, expanded Panama Canal capacity and larger cargo ships have driven up demand for industrial space at U.S. seaports. These and other factors "prompted a number of architects to design [warehouses] upward instead of outward," the report says, and inspired new designs to accommodate direct consumer delivery, refrigeration, vertical development and sustainability.

The report, which can be downloaded here, also includes a Q&A with Jim Connor, chairman and CEO of industrial asset owner and operator Duke Realty Corp.

Related Stories

Market Data | Nov 2, 2020

More contractors report canceled projects than starts, survey finds

Construction employment declined in most metros in latest 12 months.

Multifamily Housing | Oct 30, 2020

The Weekly show: Multifamily security tips, the state of construction industry research, and AGC's market update

BD+C editors speak with experts from AGC, Charles Pankow Foundation, and Silva Consultants on the October 29 episode of "The Weekly." The episode is available for viewing on demand.

Hotel Facilities | Oct 27, 2020

Hotel construction pipeline dips 7% in Q3 2020

Hospitality developers continue to closely monitor the impact the coronavirus will have on travel demand, according to Lodging Econometrics.

Market Data | Oct 22, 2020

Multifamily’s long-term outlook rebounds to pre-covid levels in Q3

Slump was a short one for multifamily market as 3rd quarter proposal activity soars.

Market Data | Oct 21, 2020

Architectural billings slowdown moderated in September

AIA’s ABI score for September was 47.0 compared to 40.0 in August.

Market Data | Oct 21, 2020

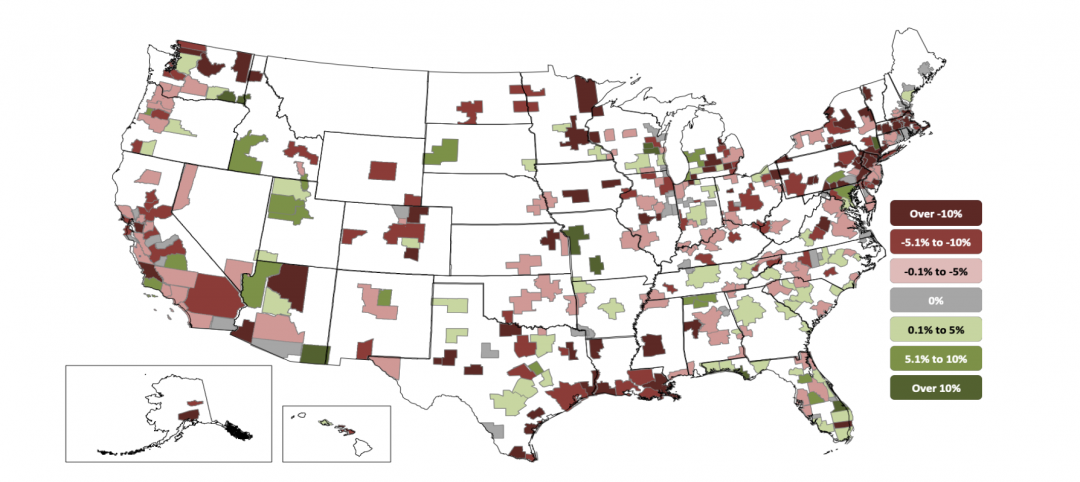

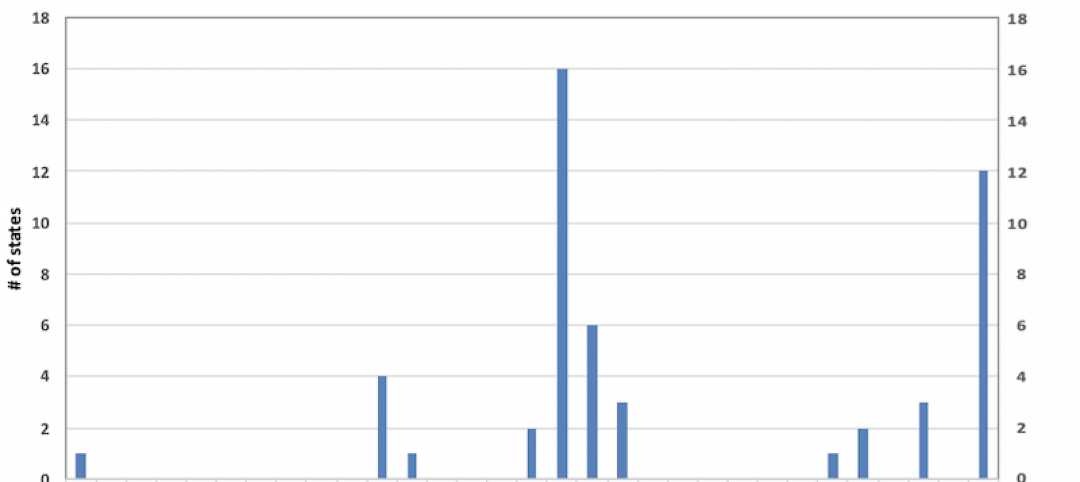

Only eight states top February peak construction employment despite gains in 32 states last month

California and Vermont post worst losses since February as Virginia and South Dakota add the most.

Market Data | Oct 20, 2020

AIA releases updated contracts for multi-family residential and prototype residential projects

New resources provide insights into mitigating and managing risk on complex residential design and construction projects.

Market Data | Oct 20, 2020

Construction officials call on Trump and Biden to establish a nationwide vaccine distribution plan to avoid confusion and delays

Officials say nationwide plan should set clear distribution priorities.

Market Data | Oct 19, 2020

5 must reads for the AEC industry today: October 19, 2020

Lower cost metros outperform pricey gateway markets and E-commerce fuels industrial's unstoppable engine.

Market Data | Oct 19, 2020

Lower-cost metros continue to outperform pricey gateway markets, Yardi Matrix reports

But year-over-year multifamily trendline remained negative at -0.3%, unchanged from July.