At the end of 2018, analysts at Lodging Econometrics (LE) reported that the total U.S. construction pipeline continued to trend upward with 5,530 projects/669,456 rooms, both up a strong 7% year-over-year (YOY). However, pipeline totals continue to trail the all-time high of 5,883 projects/785,547 rooms reached in the second quarter of 2008.

Project counts in the early planning stage continue to rise reaching an all-time high of 1,723 projects/199,326 rooms, up 14% by projects and 12% by rooms YOY. Projects scheduled to start construction in the next 12 months stand at 2,153 projects/255,083 rooms. Projects currently under construction are at 1,654 projects/215,047 rooms, the highest counts since early 2008.

Also noteworthy at year-end, the upscale, upper-midscale, and midscale categories are at record-highs, for both rooms and projects. Luxury room counts and upper-upscale project counts are also at record levels.

In 2018, the U.S. had 947 new hotels/112,050 rooms open, a 2% growth in new supply, bringing the total U.S. census to 56,909 hotels/5,381,090 rooms. The LE forecast for new hotel openings in 2019 anticipates a 2.2% supply growth rate with 1,022 new hotels/116,357 rooms expected to open. The pace for new hotel openings has slowed slightly because of construction delays largely caused by shortages in skilled labor.

Lending at attractive rates is still accessible to developers, but lenders are growing more selective as we move deeper into the existing cycle.

The pipeline has completed its seventh consecutive year of growth. Moving forward the growth rate is expected to slow as the economies of most countries, including the United States, more firmly settle into the “new normal" marked by slow growth and low inflation.

While there are no visible signs of a recession on the horizon, the risks to the economy are not insignificant and include tariff conflicts, swings in the stock market, unforeseen geopolitical problems, any of which could send the economy lower.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

A nascent commercial wireless sensor market is poised to ascend in the next decade

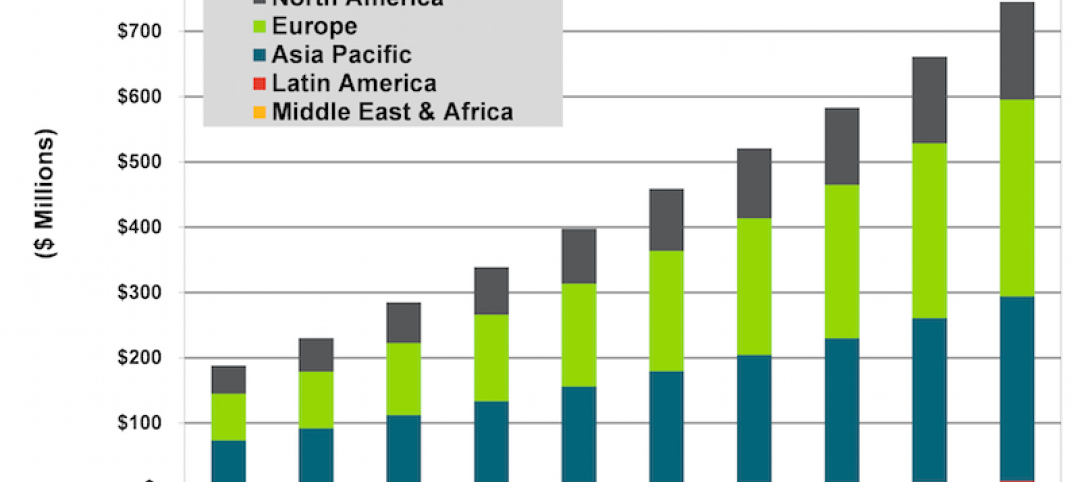

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.