The challenge of finding an available rental continues to increase for Americans nation-wide. On average, there are eight prospective tenants vying for the same vacant apartment, according to the latest RentCafe Market Competitivity Report.

The report looks through 139 of the nation’s largest markets to find where the hottest renting spots are located. Overall, there is slightly less strain at the start of the 2024 moving season compared to last year—but the landscape is still moderately competitive.

RentCafe determined the landscape by analyzing Yardi Matrix data against five metrics:

- Number of days apartments were vacant

- Percentage of apartments that were occupied by renters

- Number of prospective renters competing for an apartment

- Percentage of renters who renewed their leases

- Share of new apartments completed recently

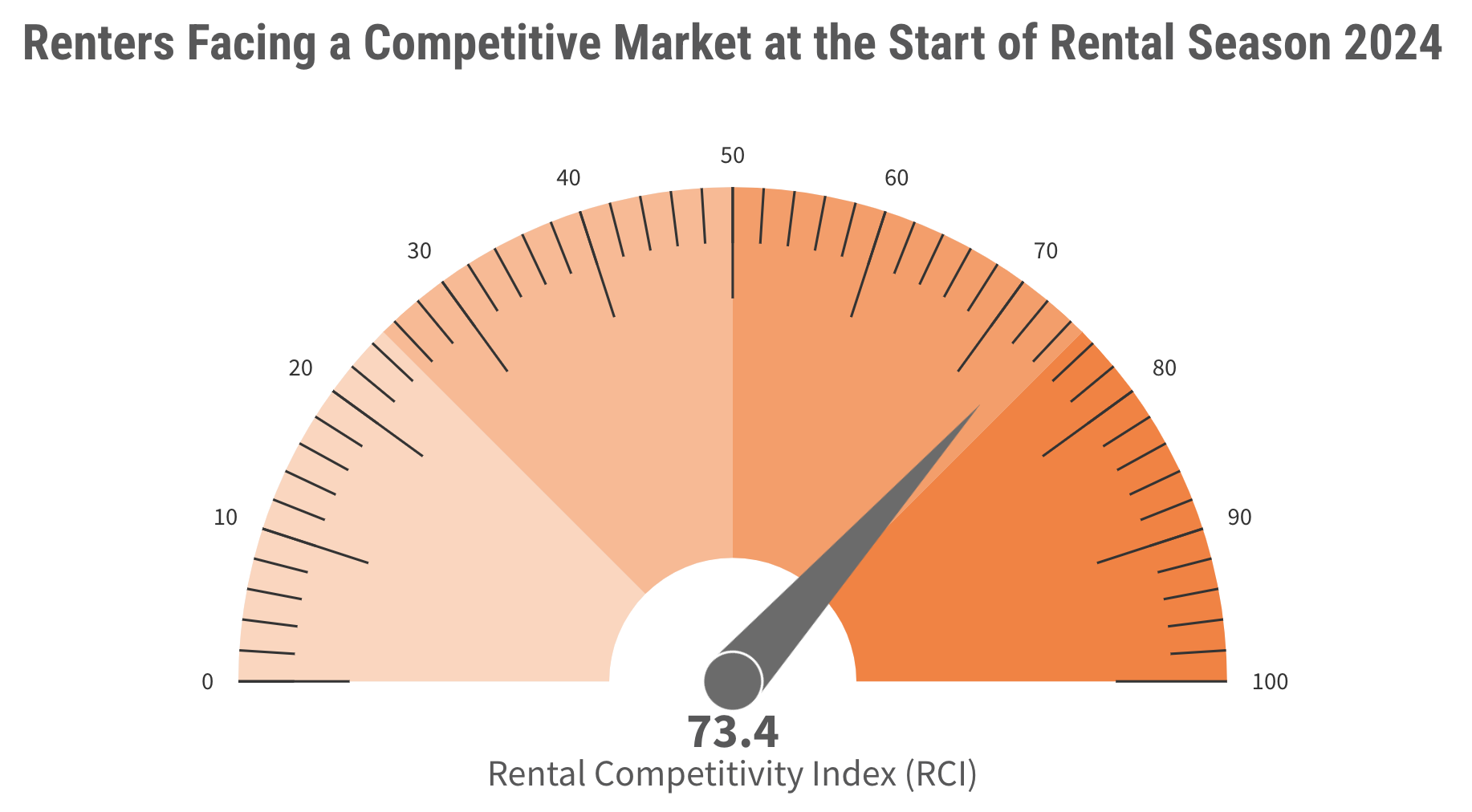

When scored into a Rental Competitivity Index (RCI), RentCafe has determined that the national RCI score is 73.4. Some markets boast high occupancy rates while others simply have no new apartments for renters to move into.

Top 10 Most Competitive Rental Markets in Summer 2024

Many metros, like Miami and Orlando, Fla., remain to no surprise at the top of the list. However, others have jumped into the top 10 following migration trends and apartment availability.

These are the 10 most competitive rental markets at the start of the 2024 rental season.

1. Miami, Fla.

In Miami, Fla., the Sunshine State continues to draw in renters as the number one spot on the list. A whopping 19 renters have to compete for a vacant apartment as nearly 97% of all units are occupied.

Miami-Dade County yields a competitive score of 94.1, with a lease renewal rate of 74% and an average vacancy span of 36 days.

2. Chicago, Ill.

Chicago, Ill. lept up to second place from tenth in the summer 2023 analysis as renters continue to flock to its many suburbs. Over 95% of its apartments are occupied.

Suburban Chicago yields a competitive score of 83.6, with a lease renewal rate of 69% and an average vacancy span of 44 days.

3. North Jersey, N.J.

In North Jersey, N.J., 96% of apartments are occupied and 13 renters compete for vacant units.

North Jersey yields a competitive score of 82.3, with a lease renewal rate of 72% and an average vacancy span of 43 days.

4. Grand Rapids, Mich.

Grand Rapids, Mich., yields a competitive score of 82.2, with a lease renewal rate of 71% and an average vacancy span of 43 days. 95% of apartments are occupied.

5. Milwaukee, Wis.

Milwaukee, Wis., yields a competitive score of 81.2, with a lease renewal rate of 70% and an average vacancy span of 47 days. 95% of apartments are occupied.

RELATED: Most competitive rental markets of early 2024

6. Silicon Valley, Calif.

Silicon Valley, Calif., yields a competitive score of 80.8, with a lease renewal rate of 54% and an average vacancy span of 40 days. 95% of apartments are occupied.

7. Orlando, Fla.

Orlando, Fla., yields a competitive score of 80, with a lease renewal rate of 68% and an average vacancy span of 39 days. 95% of apartments are occupied.

8. Orange County, Calif.

Orange County, Calif., yields a competitive score of 78.8, with a lease renewal rate of 63% and an average vacancy span of 44 days. 96% of apartments are occupied.

9. Los Angeles, Calif.

Eastern Los Angeles, Calif., yields a competitive score of 78.5, with a lease renewal rate of 53% and an average vacancy span of 45 days. 96% of apartments are occupied.

10. Philadelphia, Pa.

Suburban Philadelphia, Pa., yields a competitive score of 78.4, with a lease renewal rate of 76% and an average vacancy span of 50 days. 94% of apartments are occupied.

Related Stories

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Multifamily Housing | Feb 5, 2024

Wood Partners transfers all property management operations to Greystar

Greystar and Wood have entered into a long-term agreement whereby Greystar will serve as property manager for all current and future Wood developed and owned assets.

Products and Materials | Jan 31, 2024

Top building products for January 2024

BD+C Editors break down January's top 15 building products, from SloanStone Quartz Molded Sinks to InvisiWrap SA housewrap.

Luxury Residential | Jan 30, 2024

Lumen Fox Valley mall-to-apartments conversion completes interiors

Architecture and interior design firm Morgante Wilson Architects (MWA) today released photos of its completed interiors work at Lumen Fox Valley, a 304-unit luxury rental community and mall-to-apartments conversion.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Senior Living Design | Jan 24, 2024

Former Walgreens becomes affordable senior living community

Evergreen Real Estate Group has announced the completion of Bellwood Senior Apartments. The 80-unit senior living community at 542 25th Ave. in Bellwood, Ill., provides independent living options for low-income seniors.

Adaptive Reuse | Jan 23, 2024

Adaptive reuse report shows 55K impact of office-to-residential conversions

The latest RentCafe annual Adaptive Reuse report shows that there are 55,300 office-to-residential units in the pipeline as of 2024—four times as much compared to 2021.

Mixed-Use | Jan 19, 2024

Trademark secures financing to develop Fort Worth multifamily community

National real estate developer, investor, and operator, Trademark Property Company, has closed on the land and secured the financing for The Vickery, a multifamily-led mixed-use community located on five acres at W. Vickery Boulevard and Hemphill Street overlooking Downtown Fort Worth.