The challenge of finding an available rental continues to increase for Americans nation-wide. On average, there are eight prospective tenants vying for the same vacant apartment, according to the latest RentCafe Market Competitivity Report.

The report looks through 139 of the nation’s largest markets to find where the hottest renting spots are located. Overall, there is slightly less strain at the start of the 2024 moving season compared to last year—but the landscape is still moderately competitive.

RentCafe determined the landscape by analyzing Yardi Matrix data against five metrics:

- Number of days apartments were vacant

- Percentage of apartments that were occupied by renters

- Number of prospective renters competing for an apartment

- Percentage of renters who renewed their leases

- Share of new apartments completed recently

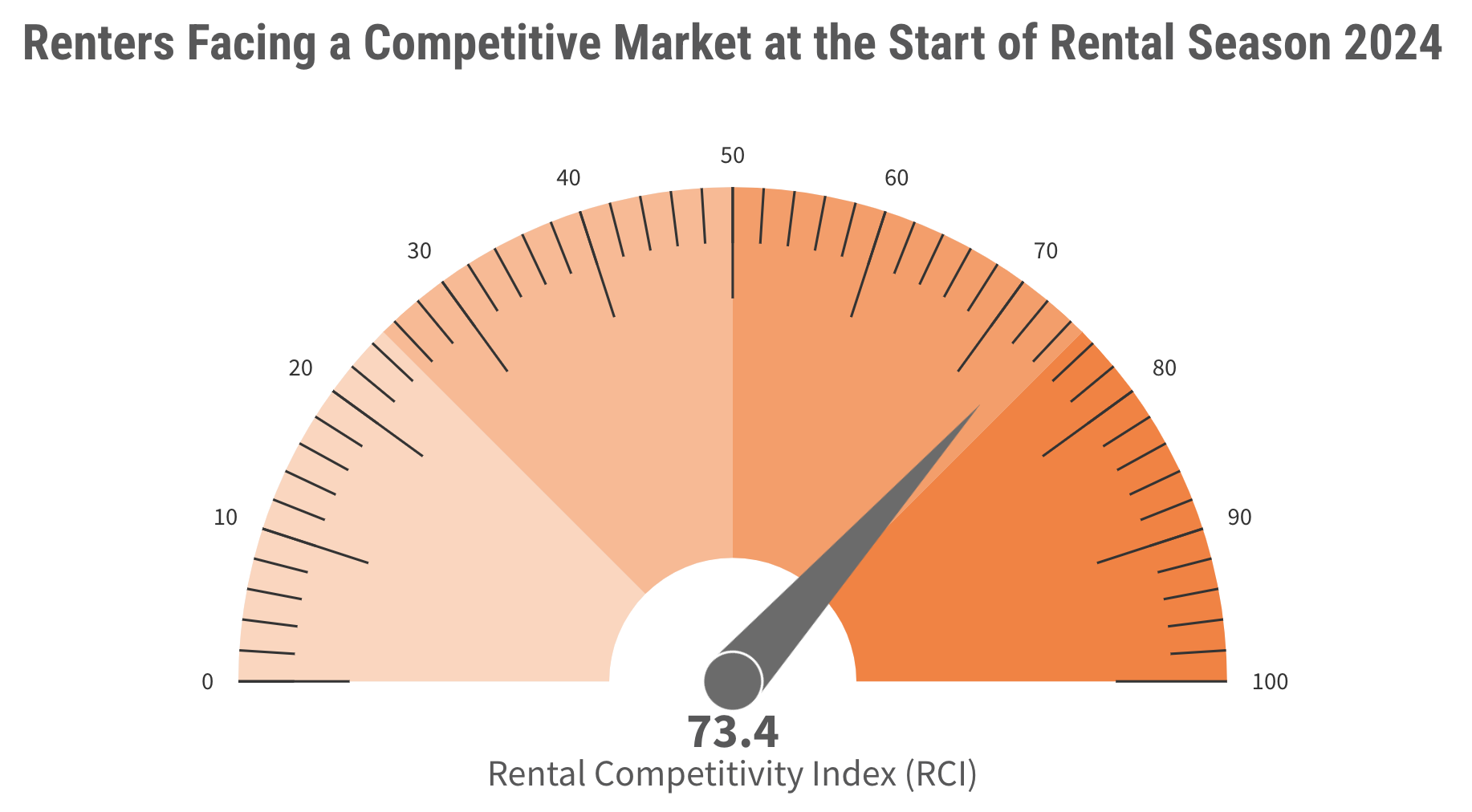

When scored into a Rental Competitivity Index (RCI), RentCafe has determined that the national RCI score is 73.4. Some markets boast high occupancy rates while others simply have no new apartments for renters to move into.

Top 10 Most Competitive Rental Markets in Summer 2024

Many metros, like Miami and Orlando, Fla., remain to no surprise at the top of the list. However, others have jumped into the top 10 following migration trends and apartment availability.

These are the 10 most competitive rental markets at the start of the 2024 rental season.

1. Miami, Fla.

In Miami, Fla., the Sunshine State continues to draw in renters as the number one spot on the list. A whopping 19 renters have to compete for a vacant apartment as nearly 97% of all units are occupied.

Miami-Dade County yields a competitive score of 94.1, with a lease renewal rate of 74% and an average vacancy span of 36 days.

2. Chicago, Ill.

Chicago, Ill. lept up to second place from tenth in the summer 2023 analysis as renters continue to flock to its many suburbs. Over 95% of its apartments are occupied.

Suburban Chicago yields a competitive score of 83.6, with a lease renewal rate of 69% and an average vacancy span of 44 days.

3. North Jersey, N.J.

In North Jersey, N.J., 96% of apartments are occupied and 13 renters compete for vacant units.

North Jersey yields a competitive score of 82.3, with a lease renewal rate of 72% and an average vacancy span of 43 days.

4. Grand Rapids, Mich.

Grand Rapids, Mich., yields a competitive score of 82.2, with a lease renewal rate of 71% and an average vacancy span of 43 days. 95% of apartments are occupied.

5. Milwaukee, Wis.

Milwaukee, Wis., yields a competitive score of 81.2, with a lease renewal rate of 70% and an average vacancy span of 47 days. 95% of apartments are occupied.

RELATED: Most competitive rental markets of early 2024

6. Silicon Valley, Calif.

Silicon Valley, Calif., yields a competitive score of 80.8, with a lease renewal rate of 54% and an average vacancy span of 40 days. 95% of apartments are occupied.

7. Orlando, Fla.

Orlando, Fla., yields a competitive score of 80, with a lease renewal rate of 68% and an average vacancy span of 39 days. 95% of apartments are occupied.

8. Orange County, Calif.

Orange County, Calif., yields a competitive score of 78.8, with a lease renewal rate of 63% and an average vacancy span of 44 days. 96% of apartments are occupied.

9. Los Angeles, Calif.

Eastern Los Angeles, Calif., yields a competitive score of 78.5, with a lease renewal rate of 53% and an average vacancy span of 45 days. 96% of apartments are occupied.

10. Philadelphia, Pa.

Suburban Philadelphia, Pa., yields a competitive score of 78.4, with a lease renewal rate of 76% and an average vacancy span of 50 days. 94% of apartments are occupied.

Related Stories

MFPRO+ News | Mar 12, 2024

Multifamily housing starts and permitting activity drop 10% year-over-year

The past year saw over 1.4 million new homes added to the national housing inventory. Despite the 4% growth in units, both the number of new homes under construction and the number of permits dropped year-over-year.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.

MFPRO+ News | Mar 1, 2024

Housing affordability, speed of construction are top of mind for multifamily architecture and construction firms

The 2023 Multifamily Giants get creative to solve the affordability crisis, while helping their developer clients build faster and more economically.

MFPRO+ Research | Feb 28, 2024

New download: BD+C's 2023 Multifamily Amenities report

New research from Building Design+Construction and Multifamily Pro+ highlights the 127 top amenities that developers, property owners, architects, contractors, and builders are providing in today’s apartment, condominium, student housing, and senior living communities.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Building Tech | Feb 20, 2024

Construction method featuring LEGO-like bricks wins global innovation award

A new construction method featuring LEGO-like bricks made from a renewable composite material took first place for building innovations at the 2024 JEC Composites Innovation Awards in Paris, France.

Multifamily Housing | Feb 16, 2024

5 emerging multifamily trends for 2024

As priorities realign and demographic landscapes transform, multifamily designers and developers find themselves in a continuous state of adaptation to resonate with residents.

MFPRO+ News | Feb 15, 2024

Nine states pledge to transition to heat pumps for residential HVAC and water heating

Nine states have signed a joint agreement to accelerate the transition to residential building electrification by significantly expanding heat pump sales to meet heating, cooling, and water heating demand. The Memorandum of Understanding was signed by directors of environmental agencies from California, Colorado, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, and Rhode Island.

MFPRO+ News | Feb 15, 2024

Oregon, California, Maine among states enacting policies to spur construction of missing middle housing

Although the number of new apartment building units recently reached the highest point in nearly 50 years, construction of duplexes, triplexes, and other buildings of from two to nine units made up just 1% of new housing units built in 2022. A few states have recently enacted new laws to spur more construction of these missing middle housing options.