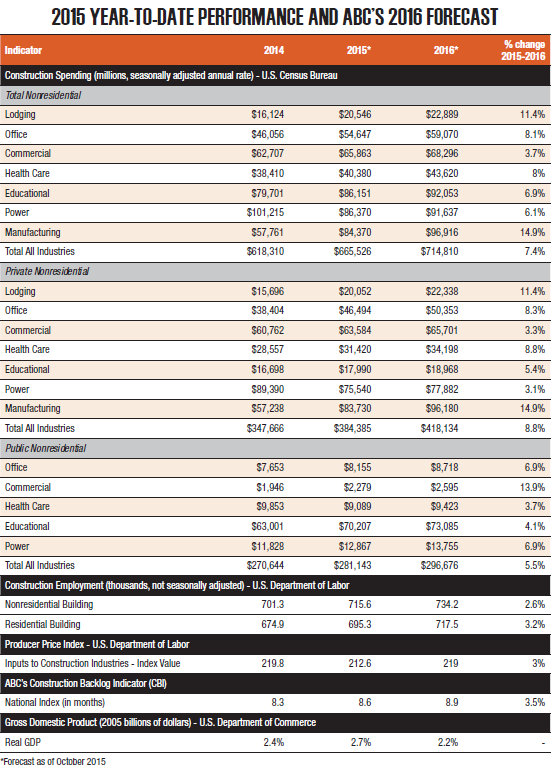

Despite a weak global economy, the industry's solid economic recovery in 2015 should continue in 2016, led by strong consumer spending, according to the 2016 construction industry forecast from the Associated Builders and Contractors (ABC).

The group forecasts growth in nonresidential construction spending of 7.4% next year, along with growth in employment and backlog.

"The mid-phase of the recovery is typically the lengthiest part and ultimately gives way to the late phase, when the economy overheats,” ABC Chief Economist Anirban Basu said. "Already, signs of overheating are evident, particularly with respect to emerging skills shortages in key industry categories such as trucking and construction."

Basu said that average hourly earnings across all industries are up only 2% in the past year, below the Federal Reserve's goal of 3.5%. Purchase prices in real estate and technology segments are rocketing higher and capitalization rates remain unusually low.

According to the most recent ABC Construction Confidence Index, overall contractor confidence has increased with respect to both sales (67.3 to 69.4) and profit margins (61 to 62.9). While the pace of hiring is not expected to increase rapidly during the next six months, largely because of the lack of suitably trained skilled personnel, the rate of new hires will continue at a steady pace.

ABC's Construction Backlog Indicator also signals strong demand. According to the latest survey, average contractor backlog stood at 8.5 months by mid-year 2015, with backlog surging in the western United States and the heavy industrial category.

Basu's full forecast is available in the December edition of ABC's Construction Executive magazine, along with the regional outlook for commercial and industrial construction by economist Bernard Markstein, PhD. Free subscriptions are available to construction industry professionals.

Related Stories

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.