Last year’s boon in single-family housing construction will have an impact on the availability and cost of building materials for nonresidential construction in 2021, which is expected to be a year of “decreasing work volume,” according to JLL’s latest Construction Forecast being released today.

Nonresidential starts were down 24% last year, and are expected to decline again in 2021. Yet, JLL sees an industry that has become more resilient and better positioned to function during the pandemic recovery.

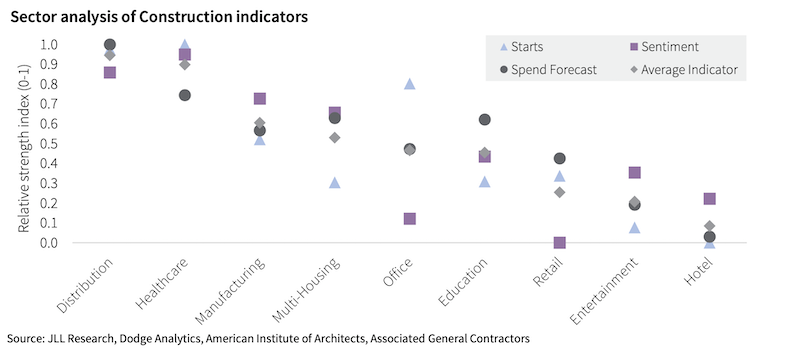

Healthcare and industrial should be the growth winners in construction spending this year. Chart: JLL

Healthcare and industrial should be the growth winners in construction spending this year. Chart: JLL

This recovery won’t be like the last one during the Great Recession in the late 2000s. For one thing, the range between sector forecasts is wider.

JLL analyzed three indicators of future growth: construction starts, construction industry sentiment, and forecast construction spending across nine nonresidential sectors. The clear winners, in its estimation, will be distribution and healthcare. The clear stragglers: hotels and entertainment. The office sector shows the least consensus.

LUMBER PRICING WILL CONTINUE TO BE VOLATILE

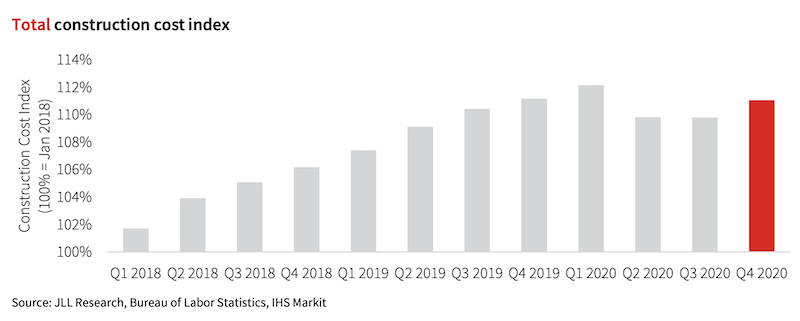

The boon in new-home construction is having an impact on overall construction costs. Chart: JLL

The boon in new-home construction is having an impact on overall construction costs. Chart: JLL

In addition, this has not been a total construction shutdown. Single-family housing starts increased by 11% last year, and have continued to grow since last May. (According to the latest Census Bureau estimates, single-family starts in January, at an annualized rate of 1,269,000 units, were up 29.9% over the same month in 2020.)

Residential construction employment was also up last year, by 1.2%, while nonres construction employment dipped 3.9%. That growth is affecting labor and materials markets. “The growth in residential is the primary cause of our forecast for elevated cost inflation in the coming year,” states JLL.

This year, it predicts that construction cost increases will be in the higher range between 3.5% and 5.5%. Labor costs will be up in the 2-5% range. Material costs will rise 4-6% and volatility “will remain elevated.” Nonres construction spending will stabilize from the early stages of the pandemic, but still decline between 5% and 8%, although JLL foresees an upswing in the third and fourth quarter, and more typical industry growth in 2022.

One silver lining from the pandemic is that it “spurred three years of construction tech adoption to be condensed into the last nine months of 2020,” observes JLL. It cites a recent Associated General Contractors survey that found contractors planning to increase their spending for all 14 ConTech categories listed.

Labor demand should also continue, although the key to any construction recovery, states JLL, will be how quickly the population is vaccinated against COVID-19. The industry’s labor shortage was a big enough buffer to absorb some of the pandemic’s shock, and through the entire post-pandemic period “there have been more active job openings in construction than at the peak of the last expansion in 2006-2007.”

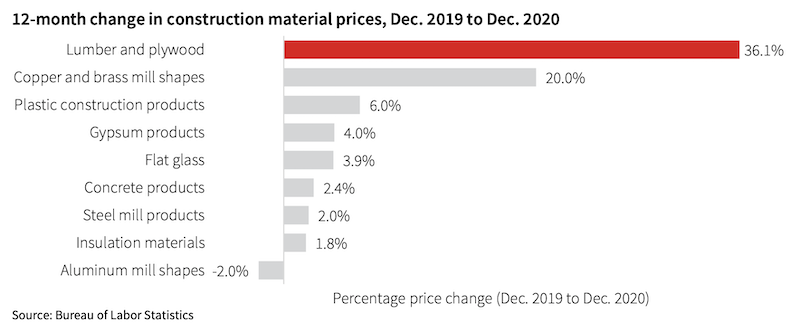

As for materials pricing, volatility will affect lumber, plywood, copper and brass mill shapes. The least volatile, price-wise, should be concrete, flat glass, insulation, and plastic construction products.

Lumber and plywood pricing is expected to remain unpredictable. Chart: JLL

Lumber and plywood pricing is expected to remain unpredictable. Chart: JLL

NEW ADMINISTRATION COULD SHAKE UP CONSTRUCTION

JLL weighed in on the potential impact of the Biden Administration on the construction industry. The next stimulus package, if passed by Congress, should keep the economy’s growth from reversing. A large infrastructure bill “is a good possibility later this year,” which JLL thinks could be an “accelerant” to construction inflation.

Interestingly, JLL doesn’t think either a reduction in immigration restrictions or an increase in the minimum wage to $15 per hour would have a substantive impact on projects, wages, or costs, except in states like Texas where construction wages are lower than the federal rate.

Related Stories

Market Data | Apr 21, 2020

ABC's Construction Backlog Indicator down in February

Backlog for firms working in the infrastructure segment rose by 1.3 months in February while backlog for commercial and institutional and heavy industrial firms declined by 0.6 months and 0.7 months, respectively.

Market Data | Apr 21, 2020

5 must reads for the AEC industry today: April 21, 2020

IoT system helps contractors keep their distance and the multifamily market flattens.

Market Data | Apr 20, 2020

6 must reads for the AEC industry today: April 20, 2020

The continent's tallest living wall and NMHC survey shows significant delays in apartment construction.

Market Data | Apr 17, 2020

Construction employment declines in 20 states and D.C. in March, in line with industry survey showing growing job losses for the sector

New monthly job loss data foreshadows more layoffs amid project cancellations and state cutbacks in road projects as association calls for more small business relief and immediate aid for highway funding.

Market Data | Apr 17, 2020

5 must reads for the AEC industry today: April 17, 2020

Meet the 'AEC outsiders' pushing the industry forward and the world's largest Living Building.

Market Data | Apr 16, 2020

5 must reads for the AEC industry today: April 16, 2020

The SMPS Foundation and Building Design+Construction are studying the impact of the coronavirus pandemic on the ability to attain and retain clients and conduct projects and Saks Fifth Avenue plans a sanitized post-coronavirus opening.

Market Data | Apr 15, 2020

5 must reads for the AEC industry today: April 15, 2020

Buildings as "open source platforms" and 3D printing finds its grove producing face shields.

Market Data | Apr 14, 2020

6 must reads for the AEC industry today: April 14, 2020

A robot dog conducts site inspections and going to the library with little kids just got easier.

Market Data | Apr 13, 2020

6 must reads for the AEC industry today: April 13, 2020

How prefab can enable the AEC industry to quickly create new hospital beds and Abu Dhabi launches a design competition focused on reducing urban heat island effect.

Market Data | Apr 10, 2020

5 must reads for the AEC industry today: April 10, 2020

Designing for the next generation of student life and a mass timber Ramada Hotel rises in British Columbia.