Last year’s boon in single-family housing construction will have an impact on the availability and cost of building materials for nonresidential construction in 2021, which is expected to be a year of “decreasing work volume,” according to JLL’s latest Construction Forecast being released today.

Nonresidential starts were down 24% last year, and are expected to decline again in 2021. Yet, JLL sees an industry that has become more resilient and better positioned to function during the pandemic recovery.

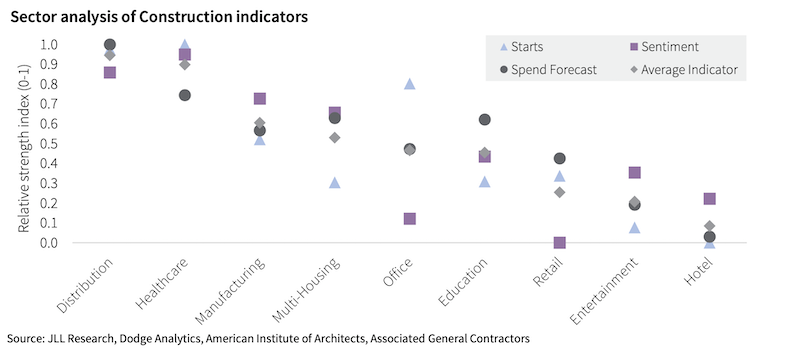

Healthcare and industrial should be the growth winners in construction spending this year. Chart: JLL

Healthcare and industrial should be the growth winners in construction spending this year. Chart: JLL

This recovery won’t be like the last one during the Great Recession in the late 2000s. For one thing, the range between sector forecasts is wider.

JLL analyzed three indicators of future growth: construction starts, construction industry sentiment, and forecast construction spending across nine nonresidential sectors. The clear winners, in its estimation, will be distribution and healthcare. The clear stragglers: hotels and entertainment. The office sector shows the least consensus.

LUMBER PRICING WILL CONTINUE TO BE VOLATILE

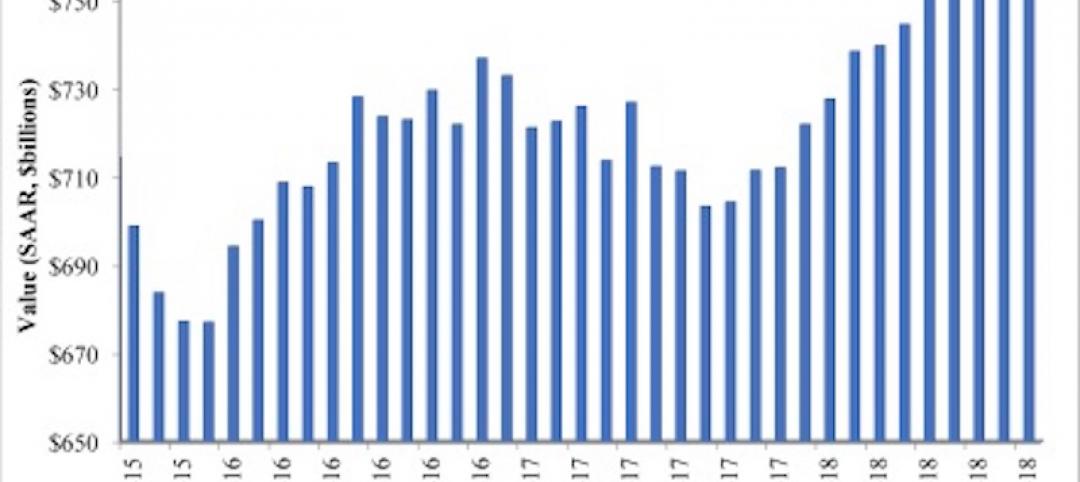

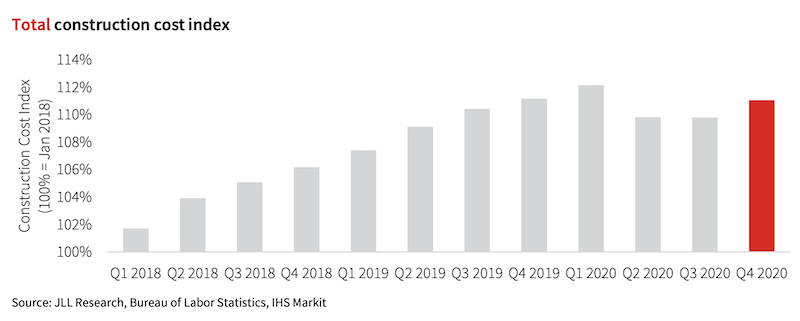

The boon in new-home construction is having an impact on overall construction costs. Chart: JLL

The boon in new-home construction is having an impact on overall construction costs. Chart: JLL

In addition, this has not been a total construction shutdown. Single-family housing starts increased by 11% last year, and have continued to grow since last May. (According to the latest Census Bureau estimates, single-family starts in January, at an annualized rate of 1,269,000 units, were up 29.9% over the same month in 2020.)

Residential construction employment was also up last year, by 1.2%, while nonres construction employment dipped 3.9%. That growth is affecting labor and materials markets. “The growth in residential is the primary cause of our forecast for elevated cost inflation in the coming year,” states JLL.

This year, it predicts that construction cost increases will be in the higher range between 3.5% and 5.5%. Labor costs will be up in the 2-5% range. Material costs will rise 4-6% and volatility “will remain elevated.” Nonres construction spending will stabilize from the early stages of the pandemic, but still decline between 5% and 8%, although JLL foresees an upswing in the third and fourth quarter, and more typical industry growth in 2022.

One silver lining from the pandemic is that it “spurred three years of construction tech adoption to be condensed into the last nine months of 2020,” observes JLL. It cites a recent Associated General Contractors survey that found contractors planning to increase their spending for all 14 ConTech categories listed.

Labor demand should also continue, although the key to any construction recovery, states JLL, will be how quickly the population is vaccinated against COVID-19. The industry’s labor shortage was a big enough buffer to absorb some of the pandemic’s shock, and through the entire post-pandemic period “there have been more active job openings in construction than at the peak of the last expansion in 2006-2007.”

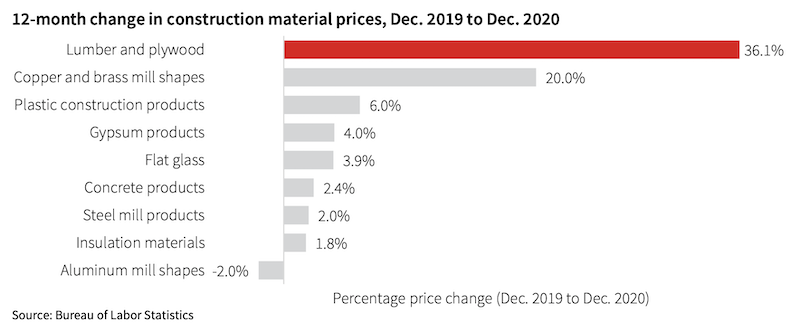

As for materials pricing, volatility will affect lumber, plywood, copper and brass mill shapes. The least volatile, price-wise, should be concrete, flat glass, insulation, and plastic construction products.

Lumber and plywood pricing is expected to remain unpredictable. Chart: JLL

Lumber and plywood pricing is expected to remain unpredictable. Chart: JLL

NEW ADMINISTRATION COULD SHAKE UP CONSTRUCTION

JLL weighed in on the potential impact of the Biden Administration on the construction industry. The next stimulus package, if passed by Congress, should keep the economy’s growth from reversing. A large infrastructure bill “is a good possibility later this year,” which JLL thinks could be an “accelerant” to construction inflation.

Interestingly, JLL doesn’t think either a reduction in immigration restrictions or an increase in the minimum wage to $15 per hour would have a substantive impact on projects, wages, or costs, except in states like Texas where construction wages are lower than the federal rate.

Related Stories

Market Data | Nov 2, 2018

Nonresidential spending retains momentum in September, up 8.9% year over year

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

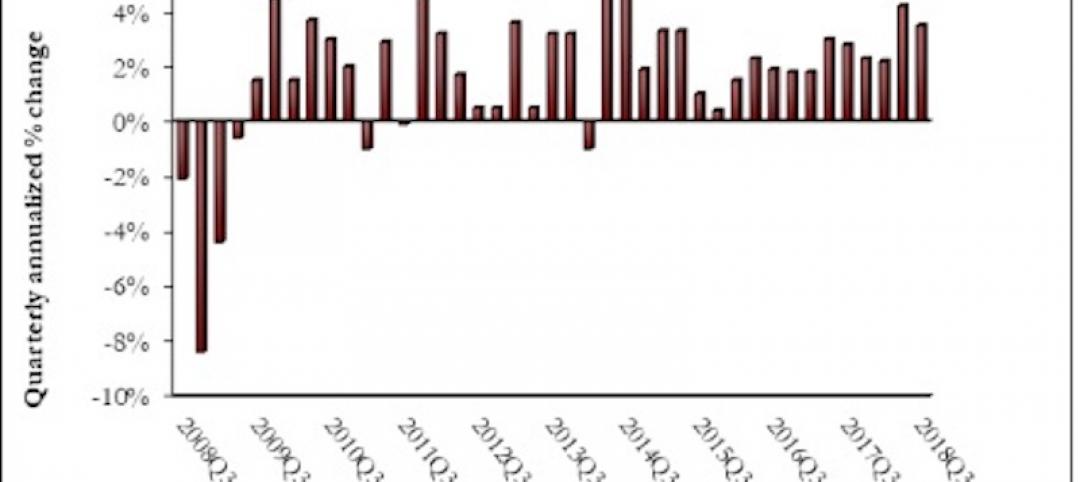

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

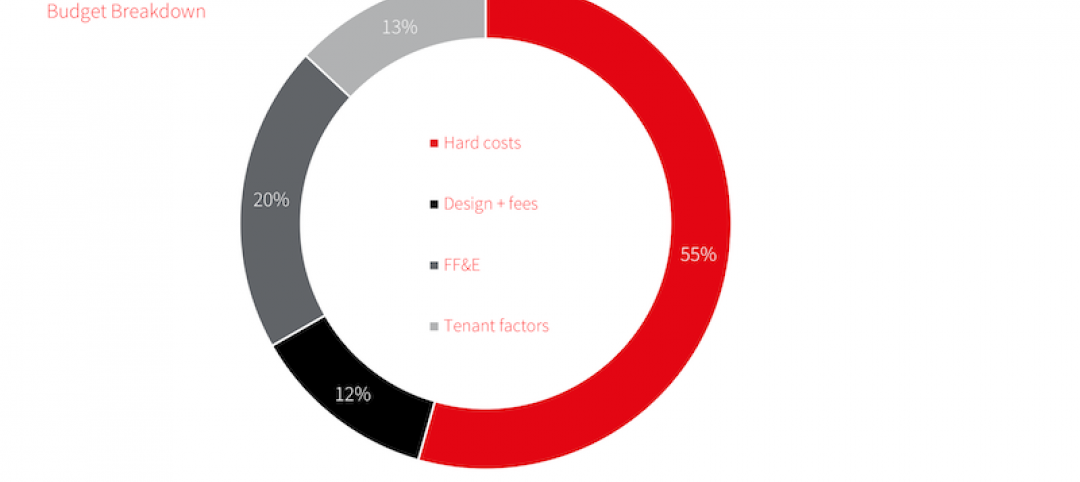

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.