According to a new report from the American Institute of Architects, the nonresidential building sector is expected to see a healthy rebound through next year after failing to recover with the broader economy last year.

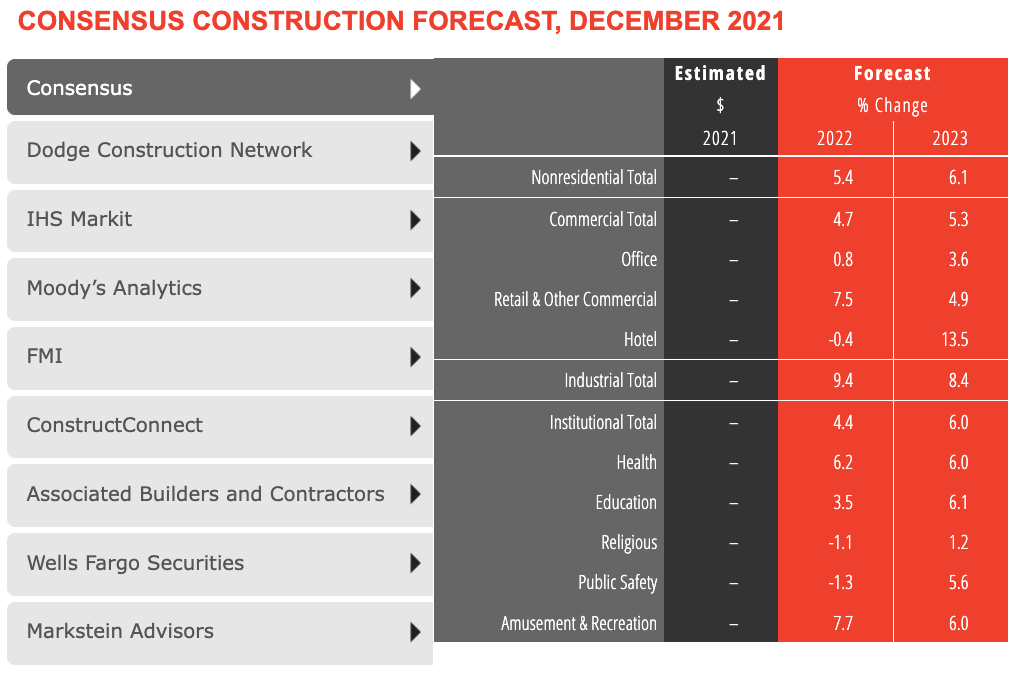

The AIA’s Consensus Construction Forecast panel—comprising leading economic forecasters—expects spending on nonresidential building construction to increase by 5.4 percent in 2022, and accelerate to an additional 6.1 percent increase in 2023. With a five percent decline in construction spending on buildings last year, only retail and other commercial, industrial, and health care facilities managed spending increases.

This year, only the hotel, religious, and public safety sectors are expected to continue to decline. By 2023, all the major commercial, industrial, and institutional categories are projected to see at least reasonably healthy gains.

“The pandemic, supply chain disruptions, growing inflation, labor shortages, and the potential passage of all or part of the Build Back Better legislation could have a dramatic impact on the construction sector this year,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Challenges to the economy and the construction industry notwithstanding, the outlook for the nonresidential building market looks promising for this year and next.”

CLICK HERE TO VIEW INTERACTIVE CHART

More from AIA:

- The recovery in the broader economy in 2021 didn’t carry over to the nonresidential building sector. Spending on the construction of these facilities declined about 5%, on top of the 2% decline in 2020.

- The broader economy has seen a solid recovery since the depths of the pandemic-induced recession. It grew by about 5% last year and now has fully recovered from the past recession. There were almost 4 million net new payroll positions added last year, bringing national employment almost back to the level it was at in February 2020 prior to the pandemic. The national unemployment rate was 3.9% at the end of last year, just above the 3.5% rate in February 2020.

- In spite of these positive economic indicators, there are several headwinds to future economic growth. The uncertainty surrounding combatting Covid and its variants have added tremendous uncertainty to future building needs. The Biden Administration’s Build Back Better program was slated to add significant support to the construction sector, but its funding is very much in doubt at present (January 2022). Supply chain disruptions are likely to continue slow economic growth well into this year. Inflation accelerated during the second half of last year to its highest rate in almost four decades, which is expected to put upward pressure on interest rates. Finally, the already-serious labor shortages look to become even more severe this year and next.

- Industries throughout the economy are finding it challenging to retain their current employees and are having difficulty recruiting new ones. Most workers feel that jobs are plentiful, and therefore are increasingly comfortable leaving their current job in favor of searching for a better one. A recent survey of architecture firm leaders found that more than four in ten feel that recruiting architectural staff is a serious problem at present, and that it may create difficulties for the firm over the coming months given anticipated project workloads.

Related Stories

Office Buildings | Jul 22, 2024

U.S. commercial foreclosures increased 48% in June from last year

The commercial building sector continues to be under financial pressure as foreclosures nationwide increased 48% in June compared to June 2023, according to ATTOM, a real estate data analysis firm.

Construction Costs | Jul 18, 2024

Data center construction costs for 2024

Gordian’s data features more than 100 building models, including computer data centers. These localized models allow architects, engineers, and other preconstruction professionals to quickly and accurately create conceptual estimates for future builds. This table shows a five-year view of costs per square foot for one-story computer data centers.

Healthcare Facilities | Jul 16, 2024

Watch on-demand: Key Trends in the Healthcare Facilities Market for 2024-2025

Join the Building Design+Construction editorial team for this on-demand webinar on key trends, innovations, and opportunities in the $65 billion U.S. healthcare buildings market. A panel of healthcare design and construction experts present their latest projects, trends, innovations, opportunities, and data/research on key healthcare facilities sub-sectors. A 2024-2025 U.S. healthcare facilities market outlook is also presented.

Market Data | Jul 16, 2024

Construction spending expected to rise, despite labor and materials snags

In the first half of 2024, construction costs stabilized. And through the remainder of this year, total cost growth is projected to be modest, and matched by an overall increase in construction spending. That prediction can be found in JLL’s 2024 Midyear Construction Update and Reforecast.

Healthcare Facilities | Jul 11, 2024

New download: BD+C's 2024 Healthcare Annual Report

Welcome to Building Design+Construction’s 2024 Healthcare Annual Report. This free 66-page special report is our first-ever “state of the state” update on the $65 billion healthcare construction sector.

Contractors | Jul 9, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of June 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.4 months in June, according to an ABC member survey conducted June 20 to July 3. The reading is down 0.5 months from June 2023.

Office Buildings | Jul 8, 2024

Office vacancy peak of 22% to 28% forecasted for 2026

The work from home trend will continue to put pressure on the office real estate market, with peak vacancy of between 22% and 28% in 2026, according to a forecast by Moody’s.

Apartments | Jun 25, 2024

10 hardest places to find an apartment in 2024

The challenge of finding an available rental continues to increase for Americans nation-wide. On average, there are eight prospective tenants vying for the same vacant apartment.

Contractors | Jun 12, 2024

The average U.S. contractor has 8.3 months worth of construction work in the pipeline, as of May 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator fell to 8.3 months in May, according to an ABC member survey conducted May 20 to June 4. The reading is down 0.6 months from May 2023.

MFPRO+ News | Jun 11, 2024

Rents rise in multifamily housing for May 2024

Multifamily rents rose for the fourth month in a row, according to the May 2024 National Multifamily Report. Up 0.6% year-over-year, the average U.S. asking rent increased by $6 in May, up to $1,733.