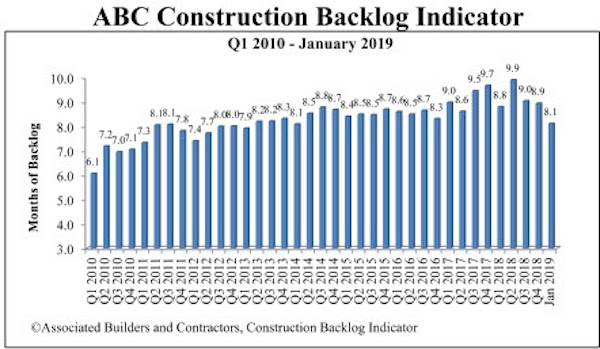

Associated Builders and Contractors recently reported that its Construction Backlog Indicator contracted to 8.1 months during January 2019, down 0.8 months or 9.3% compared to the fourth quarter 2018 reading of 8.9 months.

“This represents the latest in a number of indicators suggesting that U.S. economic momentum has begun to wane,” said Anirban Basu, ABC’s chief economist. “Other data tracking retail sales, employment growth and the trade deficit suggest that in contrast to 2018, this year will not be as strong from an economic growth perspective.

“January’s decline in nonresidential backlog was significant, slipping to levels last observed in 2014,” said Basu. “From an industry segment perspective, the decline in backlog was especially sharp in the infrastructure category, which may have been related to the federal shutdown in January.

“There was one meaningful exception in the Middle States, where backlog continues to rise,” said Basu. “This is potentially a result of stronger industrial production growth in 2017 and 2018, which has produced greater demand for modern industrial space. As with any January data release, weather may also have played a role in shaping the results. Accordingly, more clarity regarding contractual activity will arrive during the months ahead.”

Related Stories

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

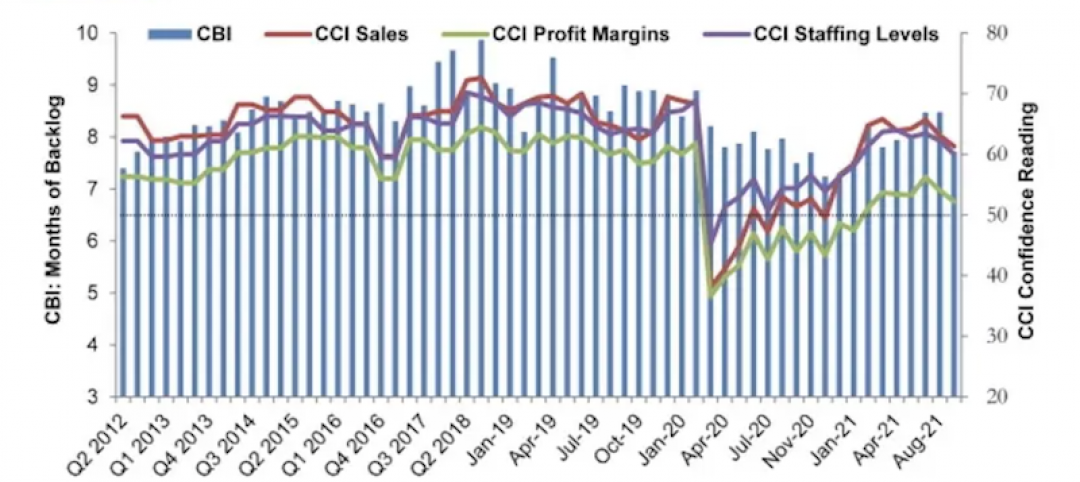

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.

Market Data | Sep 7, 2021

Construction sheds 3,000 jobs in August

Gains are limited to homebuilding as other contractors struggle to fill both craft and salaried positions.

Market Data | Sep 3, 2021

Construction workforce shortages reach pre-pandemic levels

Coronavirus continues to impact projects and disrupt supply chains.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Market Data | Sep 1, 2021

Construction spending posts small increase in July

Coronavirus, soaring costs, and supply disruptions threaten to erase further gains.

Market Data | Sep 1, 2021

Bradley Corp. survey finds office workers taking coronavirus precautions

Due to the rise in new strains of the virus, 70% of office workers have implemented a more rigorous handwashing regimen versus 59% of the general population.

Market Data | Aug 31, 2021

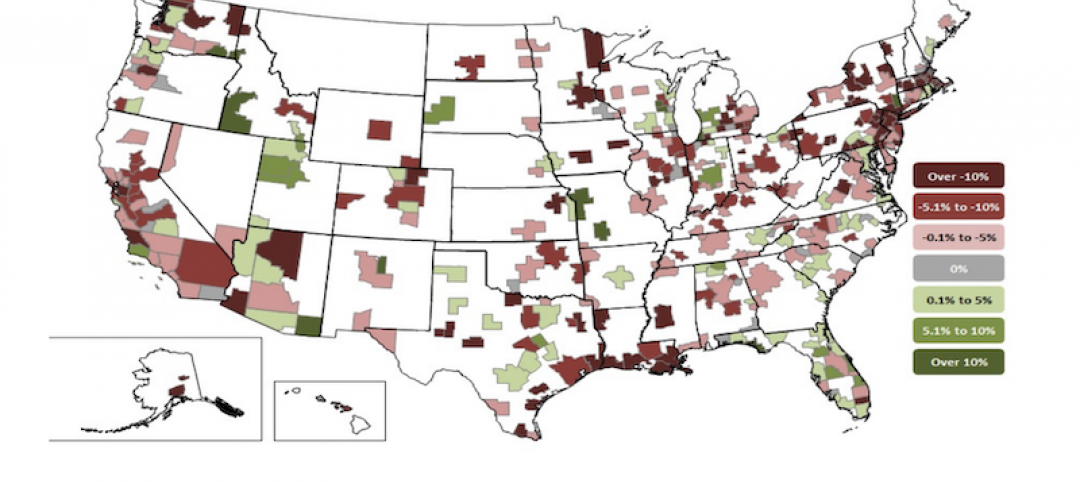

Three out of four metro areas add construction jobs from July 2020 to July 2021

COVID, rising costs, and supply chain woes may stall gains.

Market Data | Aug 24, 2021

July construction employment lags pre-pandemic peak in 36 states

Delta variant of coronavirus threatens to hold down further gains.

Market Data | Aug 17, 2021

Demand for design activity continues to expand

The ABI score for July was 54.6.