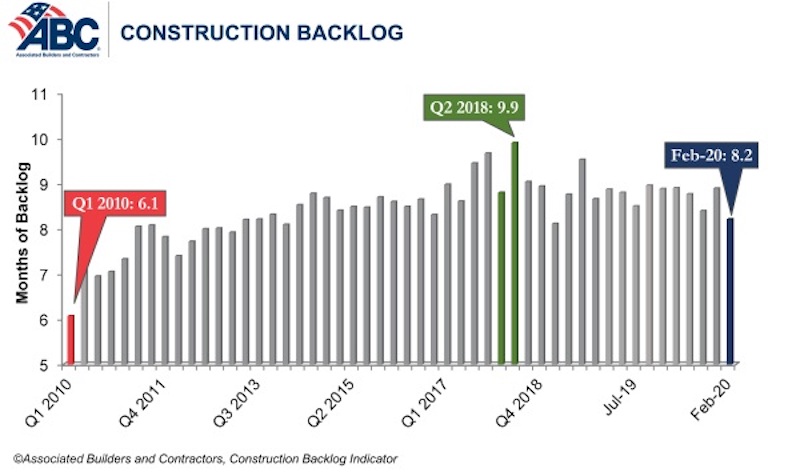

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in February, a 7.7% decrease from January’s reading. Backlog for firms working in the infrastructure segment rose by 1.3 months in February while backlog for commercial and institutional and heavy industrial firms declined by 0.6 months and 0.7 months, respectively.

“The impact of the pandemic on backlog was immediate,” said ABC Chief Economist Anirban Basu. “While financial markets, the National Basketball Association and other elements of American society didn’t respond meaningfully to the emerging crisis until early-March, those who consume construction services appear to have begun responding to the crisis in February, resulting in a significant decline in backlog in commercial and industrial segments. Declining backlog was registered in every region of the country with the exception of the Middle States, where social distancing directives were implemented at a slower rate.

“Backlog is likely to decline further,” said Basu. “Many economic actors are striving to preserve as much liquidity as possible, inducing them into postponing construction projects or perhaps canceling them altogether. While infrastructure-related backlog expanded in February, this is unlikely to persist, as the crisis has crushed the finances of many state and local governments. These governments will complete their current fiscal year with substantial shortfalls—shortfalls that must be addressed during the next fiscal year absent significant additional financial assistance from the federal government.”

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.