The market outlook is brighter for U.S. architecture, engineering, and construction companies, with a majority of AEC firms reporting higher revenues, strong forecasts, and sound financial health, according to Building Design+Construction’s fourth annual Market Forecast Survey.

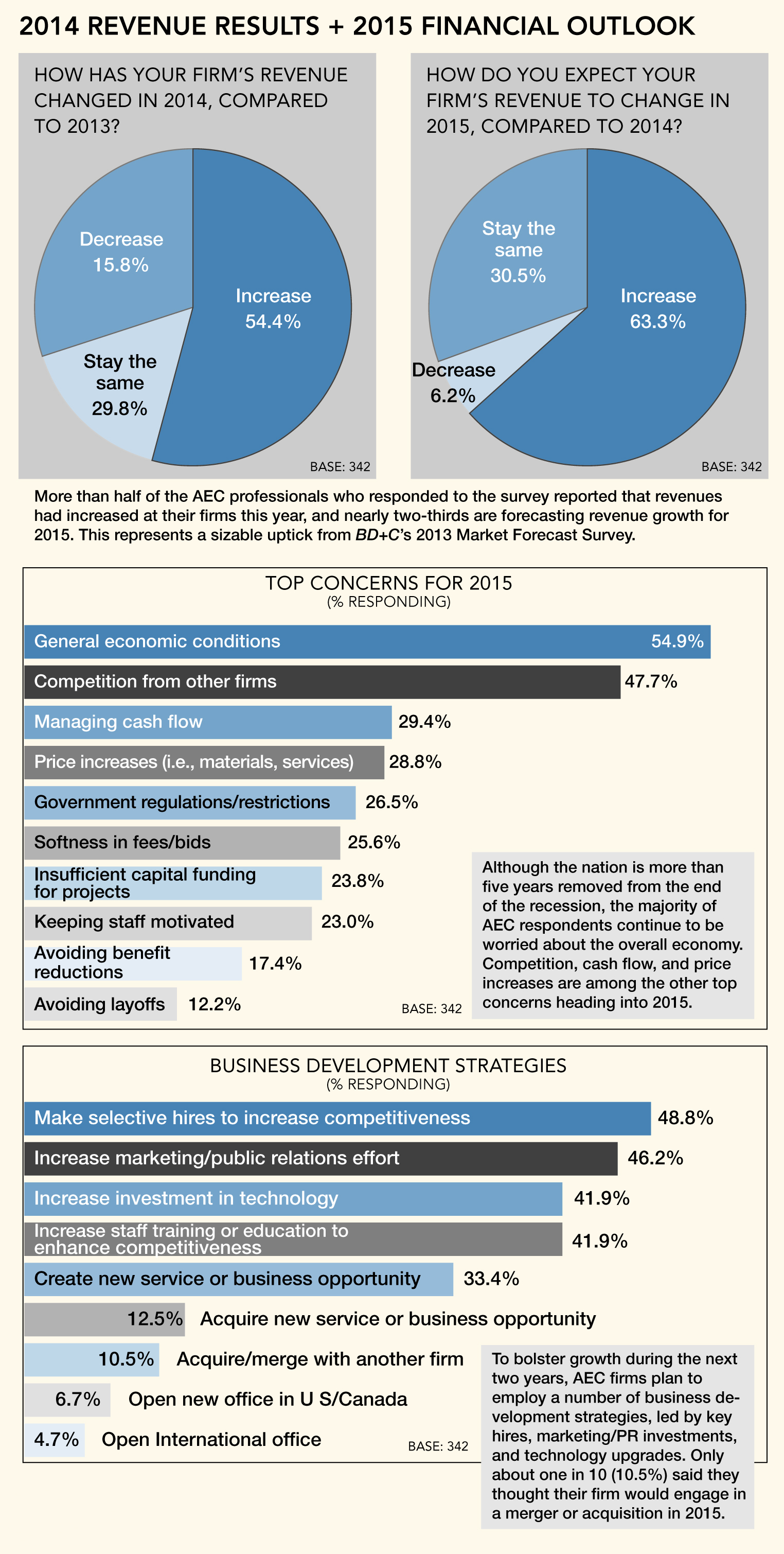

More than half (54.4%) of the 342 AEC professionals who responded to the survey reported that revenues had increased at their firms this year, and nearly two-thirds (63.4%) are forecasting revenue growth for 2015. This represents a sizable uptick from BD+C’s 2013 market forecast survey, in which 46.1% of respondents reported higher revenue for the year and 56.8% predicted growth for 2014.

Asked to rate their firms’ overall financial health, almost three-quarters (72.6%) responded either “good” (50.4%) or “very good” (22.2%), compared to just 55.5% in last year’s survey. Only 8.8% indicated that their firm is in a weakened state financially.

Firms are looking to sustain growth during the next two years through a variety of business development strategies, including strategic hires (48.8% rated it as a top tactic for growth), strengthened marketing/public relations efforts (46.2%), more staff training and education (41.9%), technology upgrades (41.9%), and launching a new service or business opportunity (33.4%).

Top concerns heading into 2015: general economic conditions (54.9% ranked it as a top concern), competition from other firms (47.7%), managing cash flow (29.4%), price increases in materials/services (28.8%), government regulations/restrictions (26.5%), and insufficient capital funding for projects (23.8%).

Healthcare keeps chugging, multifamily moves up

Survey respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale, from “excellent” to “very weak.” (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• For the second consecutive year, the healthcare sector ranked as one of the most active building sectors, with nearly two-thirds of respondents (63.6%) in the good/excellent category, compared to 62.5% in 2013 and 58.8% the previous year.

• Multifamily saw a nice bump in activity over last year, thanks primarily to the nation’s continued rental housing boom. More than six in 10 respondents (62.3%) gave the sector a good or excellent rating, up from 56.1% in the 2013 survey.

• As more Baby Boomers leave the workforce and enter their retirement years, the demand for senior and assisted living facilities is expected to spike. This trend is reflected in the survey results, with 59.2% of respondents indicating good/excellent prospects for this sector in 2015—down a bit from the 2013 survey (66.0%), but up strongly from the previous year (50.5%).

• The data center sector continues to be a powerhouse market for AEC firms, as data center providers, corporations, institutions, and government agencies rush to keep pace with the boom in mobile and cloud computing. The majority of respondents (58.2%) had either good or excellent prospects for the sector in 2015, up from 56.0% in 2013 and 45.2% the year before.

• The industrial/warehouse and office building sectors saw the largest year-over-year jump in activity among the respondent firms. Nearly half (43.3%) ranked the industrial sector in the good/excellent category, up from 33.0% last year, while 35.4% said they were upbeat about the office sector, versus 26.9% the previous year.

• Other sectors with sizable YoY percentage growth: retail (up 6.5 points, to 37.9%), multifamily (up 6.2 points, to 62.3%), K-12 schools (up 5.9 points, to 36.8%), and office interiors/fitouts (up 5.6 points, to 57.7%). The senior/assisted living sector was the only market to see a significant YoY percentage decline, but it still ranked as one of the industry’s most active sectors, according to the survey.

Uptick in BIM/VDC adoption

Following three years of relatively stagnant growth in the adoption of BIM/VDC software tools among BD+C readers, this segment saw modest growth in 2014. Eighty percent of respondents said their firm uses BIM/VDC tools on at least some of their projects, up slightly from 77.3% in the 2013 survey. The number of BIM power users increased, as well: 17.3% indicated that their firm uses BIM on more than 75% of projects, up from 12.2% last year.

The respondent breakdown by profession: architect/designer (45.3%), contractor (19.0%), engineer (16.7%), owner/developer (7.0%), consultant (4.1%), facility manager (3.8%), other (4.1%).

Related Stories

Curtain Wall | Aug 15, 2024

7 steps to investigating curtain wall leaks

It is common for significant curtain wall leakage to involve multiple variables. Therefore, a comprehensive multi-faceted investigation is required to determine the origin of leakage, according to building enclosure consultants Richard Aeck and John A. Rudisill with Rimkus.

MFPRO+ News | Aug 14, 2024

Report outlines how Atlanta can collaborate with private sector to spur more housing construction

A report by an Urban Land Institute’s Advisory Services panel, commissioned by the city’s housing authority, Atlanta Housing (AH), offered ways the city could collaborate with developers to spur more housing construction.

Adaptive Reuse | Aug 14, 2024

KPF unveils design for repositioning of Norman Foster’s 8 Canada Square tower in London

8 Canada Square, a Norman Foster-designed office building that’s currently the global headquarters of HSBC Holdings, will have large sections of its façade removed to create landscaped terraces. The project, designed by KPF, will be the world’s largest transformation of an office tower into a sustainable mixed-use building.

Sustainability | Aug 14, 2024

World’s first TRUE Zero Waste for Construction-certified public project delivered in Calif.

The Contra Costa County Administration Building in Martinez, Calif., is the world’s first public project to achieve the zero-waste-focused TRUE Gold certification for construction. The TRUE Certification for Construction program, administered by Green Business Certification Inc. (GBCI), recognizes projects that achieve exceptional levels of waste reduction, reuse, and recycling.

Modular Building | Aug 13, 2024

Strategies for attainable housing design with modular construction

Urban, market-rate housing that lower-income workers can actually afford is one of our country’s biggest needs. For multifamily designers, this challenge presents several opportunities for creating housing that workers can afford on their salaries.

University Buildings | Aug 12, 2024

Planning for growing computer science programs

Driven by emerging AI developments and digital transformation in the business world, university computer science programs are projected to grow by nearly 15% by 2030.

Energy Efficiency | Aug 9, 2024

Artificial intelligence could help reduce energy consumption by as much as 40% by 2050

Artificial intelligence could help U.S. buildings to significantly reduce energy consumption and carbon emissions, according to a paper by researchers at the Lawrence Berkeley National Laboratory.

Sponsored | Healthcare Facilities | Aug 8, 2024

U.S. healthcare building sector trends and innovations for 2024-2025

As new medicines, treatment regimens, and clinical protocols radically alter the medical world, facilities and building environments in which they take form are similarly evolving rapidly. Innovations and trends related to products, materials, assemblies, and building systems for the U.S. healthcare building sector have opened new avenues for better care delivery. Discussions with leading healthcare architecture, engineering, and construction (AEC) firms and owners-operators offer insights into some of the most promising directions. This course is worth 1.0 AIA/HSW learning unit.

Office Buildings | Aug 8, 2024

6 design trends for the legal workplace

Law firms differ from many professional organizations in their need for private offices to meet confidentiality with clients and write and review legal documents in quiet, focused environments

Data Centers | Aug 8, 2024

Global edge data center market to cross $300 billion by 2026, says JLL

Technological megatrends, including IoT and generative AI, will require computing power to be closer to data generation and consumption, fueling growth of edge IT infrastructure, according to a new JLL report.