Nearly one-third of architecture, engineering and construction (A/E/C) firms have furloughed or laid off employees due to COVID-19, and more than 90% say they have experienced at least some project delays or cancellations, according to a new survey of firm leaders conducted by PSMJ Resources. In general, however, the industry has weathered the crisis better than most. The survey also found that less than 5% of responding firms suffered “significant” staff reductions, and under 15% said that their project delays and cancellations were “major” as opposed to moderate or minor.

The data is from a new monthly supplement to PSMJ’s Quarterly Market Forecast (QMF) survey of A/E/C firms. The QMF, produced quarterly by PSMJ since 2003, measures proposal activity overall and for a variety of markets and submarkets served by A/E/C firms. The August results for proposal opportunities suggest that the bleeding has stopped and the industry’s recovery is well underway. After reaching lows in the 2nd Quarter unseen since the Great Recession, proposal activity rebounded in July and August, overall and across most market sectors.

"The A/E/C Industry has fared much better than most industries during the Covid-19 pandemic. In fact, many firms are reporting their best year ever,” says PSMJ Senior Principal David Burstein, P.E., AECPM. “The Paycheck Protection loan program designed to limit staff reductions has certainly helped keep layoffs down to about 5% of the industry workforce, and hiring has been accelerating for the past three months. At the same time, proposal activity has returned to a level where the number of firms reporting growth in opportunities is equal to or slightly higher than those saying proposal activity is down."

Quarterly Market Forecast Supplement– COVID’s Impact on Layoffs through March vs. August

Earlier data on the effects of COVID, collected by PSMJ as part of its 1st Quarter QMF survey, found that fewer than one of every five firms had conducted layoffs by the end of March, while a percentage of firms that had experienced no project delays or cancellations fell from 12.4% in March to 8.4% in August

Quarterly Market Forecast Supplement– COVID’s Impact on Projects through March vs. August

After bottoming out at -41% in April and -22% for the 2nd Quarter, the QMF’s Net Plus/Minus Index (NPMI) for overall proposal activity improved to +2% in July and stayed relatively level at +1% in August. PSMJ’s NPMI represents the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease for the subject period. For August, 33.1% of respondents said they saw increased proposal activity compared with 31.8% who reported a decrease. The remainder said proposal activity was about the same from July to August.

Among the 12 markets measured, healthcare returned to the top spot with an NPMI of +31% after slipping in the 2nd Quarter. It was followed by Energy/Utilities (29%) and a surging Housing market (27%). Water/Wastewater (20%) continues to be solid amid the COVID crisis, while Heavy Industry and Environmental (both 9%) rounded out the Top 6. Education (-29%) remains a troubled market, tied for second-worst with Commercial Developers and trailing only Commercial Users (-36%).

PSMJ has been using the QMF as a measure of the design and construction industry’s health every quarter for the past 17 years, assessing the results overall and across 12 major markets and 58 submarkets. The company chose proposal activity because it represents one of the earliest stages of the project lifecycle. A consistent group of over 300 firm leaders participate, including 155 responding for the August supplement.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

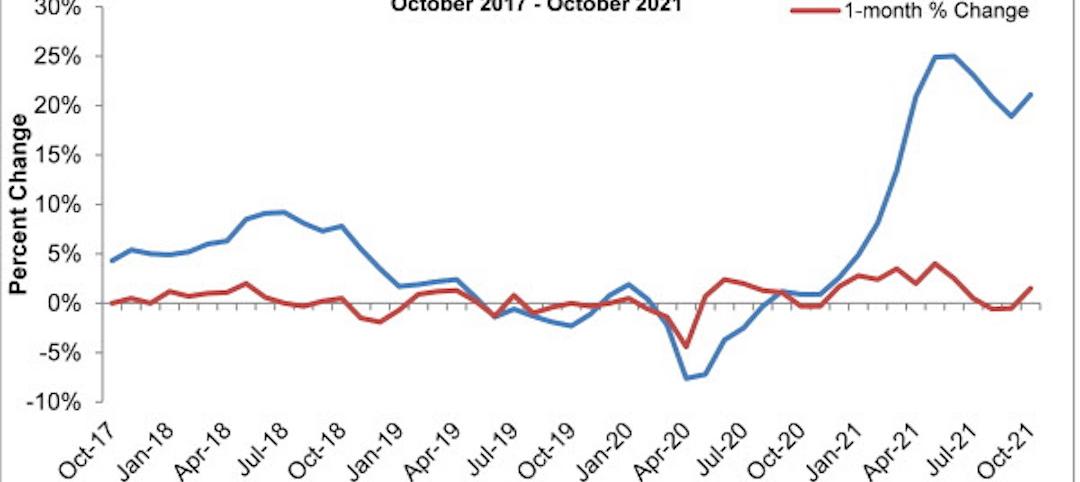

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

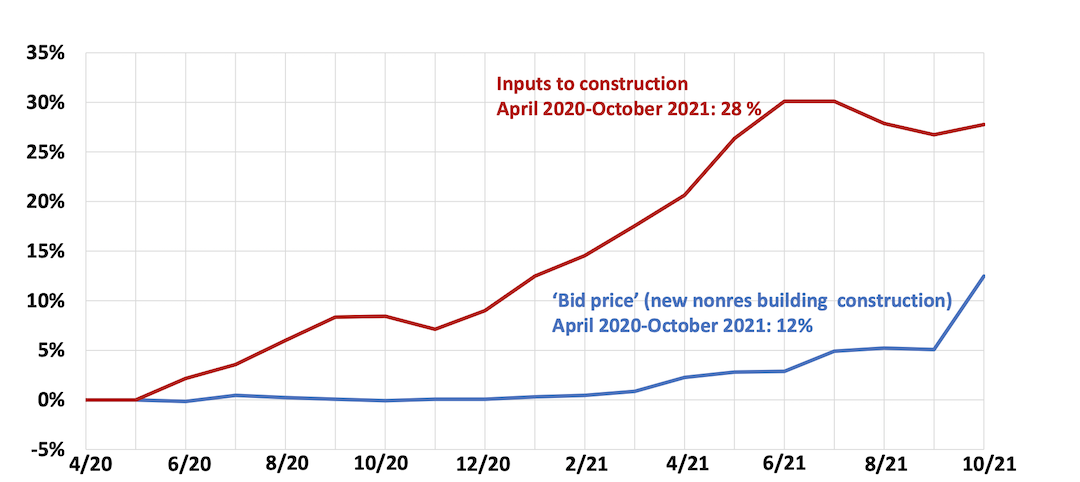

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.