Nearly one-third of architecture, engineering and construction (A/E/C) firms have furloughed or laid off employees due to COVID-19, and more than 90% say they have experienced at least some project delays or cancellations, according to a new survey of firm leaders conducted by PSMJ Resources. In general, however, the industry has weathered the crisis better than most. The survey also found that less than 5% of responding firms suffered “significant” staff reductions, and under 15% said that their project delays and cancellations were “major” as opposed to moderate or minor.

The data is from a new monthly supplement to PSMJ’s Quarterly Market Forecast (QMF) survey of A/E/C firms. The QMF, produced quarterly by PSMJ since 2003, measures proposal activity overall and for a variety of markets and submarkets served by A/E/C firms. The August results for proposal opportunities suggest that the bleeding has stopped and the industry’s recovery is well underway. After reaching lows in the 2nd Quarter unseen since the Great Recession, proposal activity rebounded in July and August, overall and across most market sectors.

"The A/E/C Industry has fared much better than most industries during the Covid-19 pandemic. In fact, many firms are reporting their best year ever,” says PSMJ Senior Principal David Burstein, P.E., AECPM. “The Paycheck Protection loan program designed to limit staff reductions has certainly helped keep layoffs down to about 5% of the industry workforce, and hiring has been accelerating for the past three months. At the same time, proposal activity has returned to a level where the number of firms reporting growth in opportunities is equal to or slightly higher than those saying proposal activity is down."

Quarterly Market Forecast Supplement– COVID’s Impact on Layoffs through March vs. August

Earlier data on the effects of COVID, collected by PSMJ as part of its 1st Quarter QMF survey, found that fewer than one of every five firms had conducted layoffs by the end of March, while a percentage of firms that had experienced no project delays or cancellations fell from 12.4% in March to 8.4% in August

Quarterly Market Forecast Supplement– COVID’s Impact on Projects through March vs. August

After bottoming out at -41% in April and -22% for the 2nd Quarter, the QMF’s Net Plus/Minus Index (NPMI) for overall proposal activity improved to +2% in July and stayed relatively level at +1% in August. PSMJ’s NPMI represents the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease for the subject period. For August, 33.1% of respondents said they saw increased proposal activity compared with 31.8% who reported a decrease. The remainder said proposal activity was about the same from July to August.

Among the 12 markets measured, healthcare returned to the top spot with an NPMI of +31% after slipping in the 2nd Quarter. It was followed by Energy/Utilities (29%) and a surging Housing market (27%). Water/Wastewater (20%) continues to be solid amid the COVID crisis, while Heavy Industry and Environmental (both 9%) rounded out the Top 6. Education (-29%) remains a troubled market, tied for second-worst with Commercial Developers and trailing only Commercial Users (-36%).

PSMJ has been using the QMF as a measure of the design and construction industry’s health every quarter for the past 17 years, assessing the results overall and across 12 major markets and 58 submarkets. The company chose proposal activity because it represents one of the earliest stages of the project lifecycle. A consistent group of over 300 firm leaders participate, including 155 responding for the August supplement.

Related Stories

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

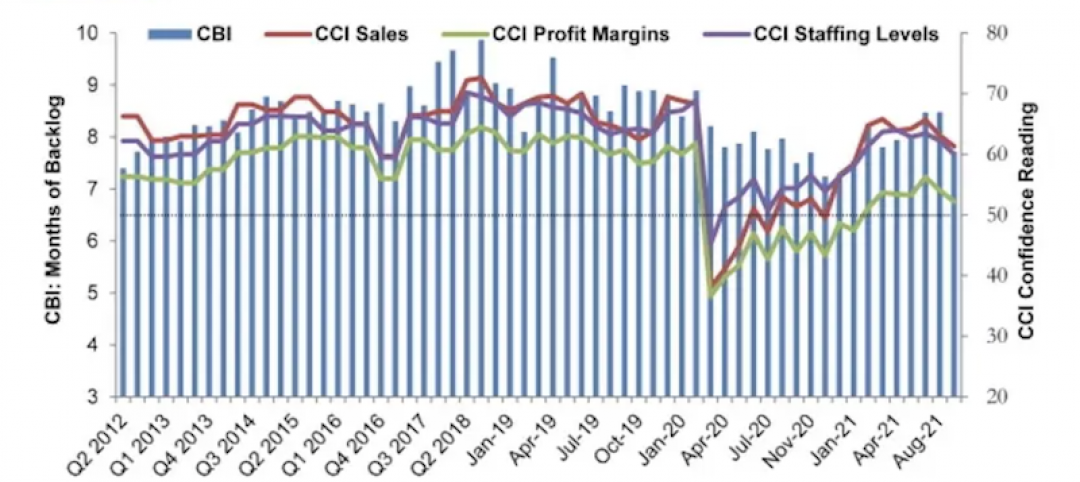

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.

Market Data | Sep 7, 2021

Construction sheds 3,000 jobs in August

Gains are limited to homebuilding as other contractors struggle to fill both craft and salaried positions.

Market Data | Sep 3, 2021

Construction workforce shortages reach pre-pandemic levels

Coronavirus continues to impact projects and disrupt supply chains.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Market Data | Sep 1, 2021

Construction spending posts small increase in July

Coronavirus, soaring costs, and supply disruptions threaten to erase further gains.

Market Data | Sep 1, 2021

Bradley Corp. survey finds office workers taking coronavirus precautions

Due to the rise in new strains of the virus, 70% of office workers have implemented a more rigorous handwashing regimen versus 59% of the general population.

Market Data | Aug 31, 2021

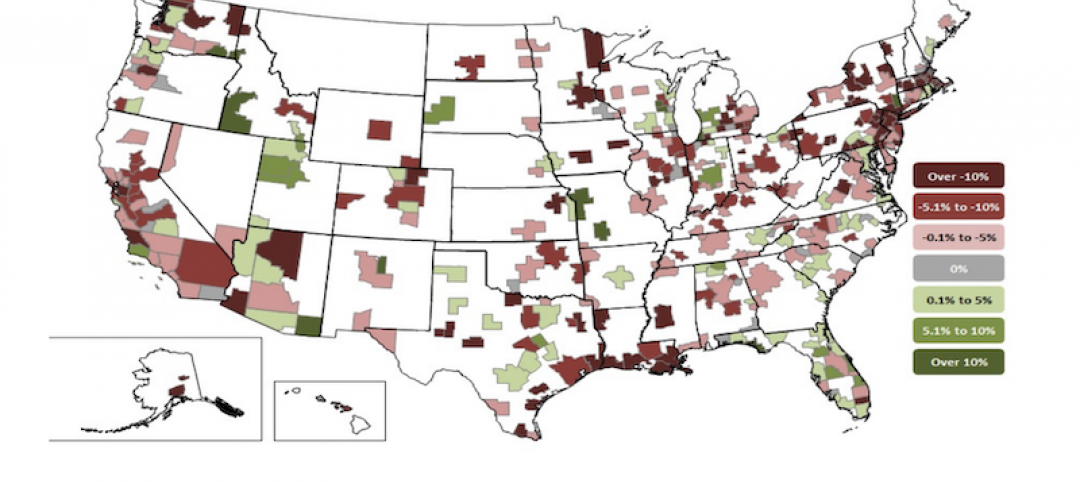

Three out of four metro areas add construction jobs from July 2020 to July 2021

COVID, rising costs, and supply chain woes may stall gains.

Market Data | Aug 24, 2021

July construction employment lags pre-pandemic peak in 36 states

Delta variant of coronavirus threatens to hold down further gains.

Market Data | Aug 17, 2021

Demand for design activity continues to expand

The ABI score for July was 54.6.