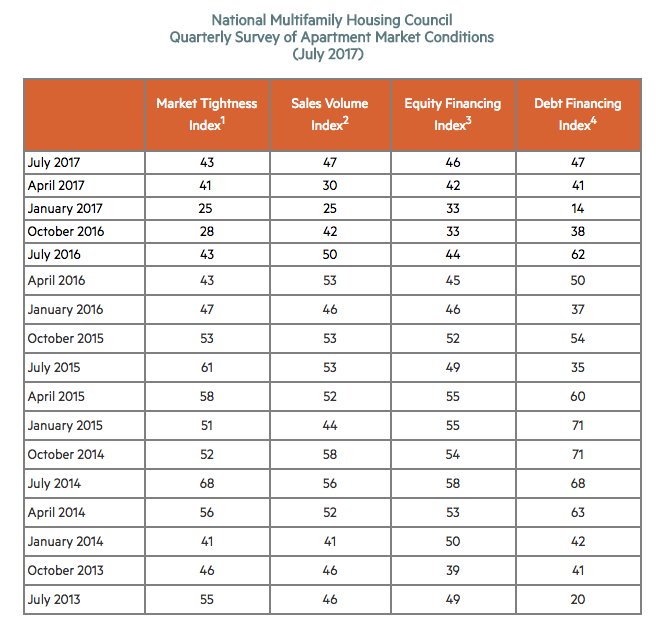

All four indexes of the National Multifamily Housing Council’s (NMHC) July Quarterly Survey of Apartment Market Conditions remained slightly below the breakeven level of 50, the fourth consecutive quarter indicating softening conditions. The Market Tightness (43), Sales Volume (47), Equity Financing (46), and Debt Financing (47) Indexes all improved from April, but still hovered just below 50.

“All four indexes are below 50 but rising, suggesting that the softening is less wide-spread than in previous quarters,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Despite some softness at the high end of the apartment market—due to construction having finally ramped up to the level needed—demand for apartments will continue to be substantial for years to come.”

The Market Tightness Index edged up from 41 to 43, as almost half of respondents (48 percent) reported unchanged conditions. One-third (33 percent) of respondents saw conditions as looser than three months ago, while the remaining 19 percent reported tighter conditions. This marks the seventh consecutive quarter of overall declining conditions.

The Sales Volume Index increased from 30 to 47, just shy of the breakeven level of 50. Twenty-seven percent of respondents reported higher sales volume than three months prior, compared to 33 percent that reported lower volume.

The Equity Financing Index increased four points to 46, with almost a quarter (24 percent) of respondents believing that equity financing was less available than three months prior. Sixteen percent thought that equity financing was more available compared to three months ago.

The Debt Financing Index increased from 41 to 47, showing a similar trend to the equity market. While a quarter of respondents (25 percent) reported worse conditions for debt financing compared to three months prior, another 19 percent disagreed, believing conditions had become more favorable.

About the Survey:

The July 2017 Quarterly Survey of Apartment Market Conditions was conducted July 10-July 17, 2017; 123 CEOs and other senior executives of apartment-related firms nationwide responded.

Related Stories

Multifamily Housing | Oct 17, 2019

Development enlivens a city on Texas’ Gulf Coast

Three mixed-use communities in Port Aransas are expanding.

Multifamily Housing | Oct 16, 2019

Covenant House New York will support the city’s homeless youth

FXCollaborative designed the building.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Multifamily Housing | Oct 14, 2019

Eleven, Minneapolis’ tallest condo tower, breaks ground

RAMSA designed the project.

| Oct 11, 2019

Tips on planning for video surveillance cameras for apartment and condominium projects

“Cameras can be part of a security program, but they’re not the security solution itself.” That’s the first thing to understand about video surveillance systems for apartment and condominium projects, according to veteran security consultant Michael Silva, CPP.

Multifamily Housing | Oct 9, 2019

Multifamily developers vs. Peloton: Round 2... Fight!

Readers and experts offer alternatives to Peloton bicycles for their apartment and condo projects.

Multifamily Housing | Oct 7, 2019

Plant Prefab and Brooks + Scarpa design scalable, multifamily kit-of-parts

It is Plant Prefab’s first multifamily system.

Multifamily Housing | Oct 3, 2019

50 Penn breaks ground in New York, will provide 218 units of affordable housing

Dattner Architects is designed the project.

Multifamily Housing | Sep 12, 2019

Meet the masters of offsite construction

Prescient combines 5D software, clever engineering, and advanced robotics to create prefabricated assemblies for apartment buildings and student housing.