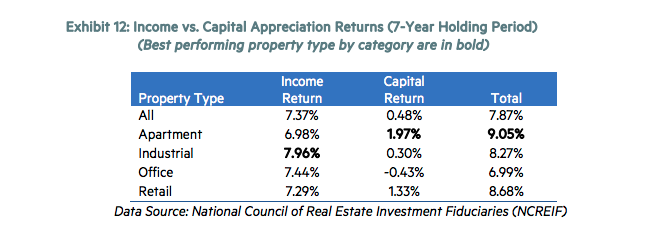

Apartments outperform other commercial real estate property types, on both a risk-adjusted and unadjusted basis, regardless of holding period, geographic region, metro size, and growth rate according to new research from the National Multifamily Housing Council Research Foundation.

In the first work of research funded by NMHC’s Research Foundation since it was launched in late 2016, Professors Dr. Mark J. Eppli (Marquette University) and Dr. Charles C. Tu (University of San Diego) examine a wide range of property and financial market characteristics to try to determine if apartment market over-performance stands up to the test of time.

“Over the last three decades, apartments have become a desired asset class among both domestic and foreign real estate investors because of their strong returns coupled with relatively low risk,” said Mark Obrinsky, NMHC’s Chief Economist. “Despite the different characteristics of apartment, office, retail, and industrial properties, one might expect competitive markets to reduce, even eliminate, the higher risk-adjusted returns on apartments. This research finds that not to be the case, however.”

According to the authors, part of the reason that apartment returns outperform other asset classes is because investors tend to underestimate capital expenditures for both office and industrial properties.

Drs. Eppli and Tu examined a wide range of property and financial market characteristics to try to find insights into expected investment returns. One result they documented is that acquiring properties immediately after a downturn boosts returns.

“We are delighted to publish this first research report from the NMHC Research Foundation,” said NMHC President and CEO Doug Bibby. “As the multifamily industry grows in sophistication, so must the quality and breadth of our analysis. Filling that need was our goal in creating the Foundation and this paper is one of many forthcoming works that will provide leading, actionable information for the apartment market.”

Related Stories

| Jul 22, 2011

Five award-winning modular innovations

The Modular Building Institute's 2011 Awards of Distinction highlight fresh ideas in manufactured construction projects.

| May 16, 2011

Autodesk and the USGBC announce multifamily design competition

Autodesk is partnering with the U.S. Green Building Council to sponsor the organization’s multifamily midrise design competition, which will give design professionals and students an opportunity to present their solutions to sustainable, multifamily midrise design.

| May 3, 2011

Would apartment shells help the housing market?

One reason the U.S. government pushed for homeownership is because it’s thought to reduce turnover and build strong communities. Owners have a vested interest in their properties whereas renters don’t—but what if were to change?

| Apr 12, 2011

Luxury New York high rise adjacent to the High Line

Located adjacent to New York City’s High Line Park, 500 West 23rd Street will offer 111 luxury rental apartments when it opens later this year.