Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth.

“We anticipate that rents will continue to increase modestly over the course of the year as demand has firmed, albeit at a more moderate rate in line with historic growth levels,” say Yardi Matrix experts in a newly released U.S. Multifamily Outlook.

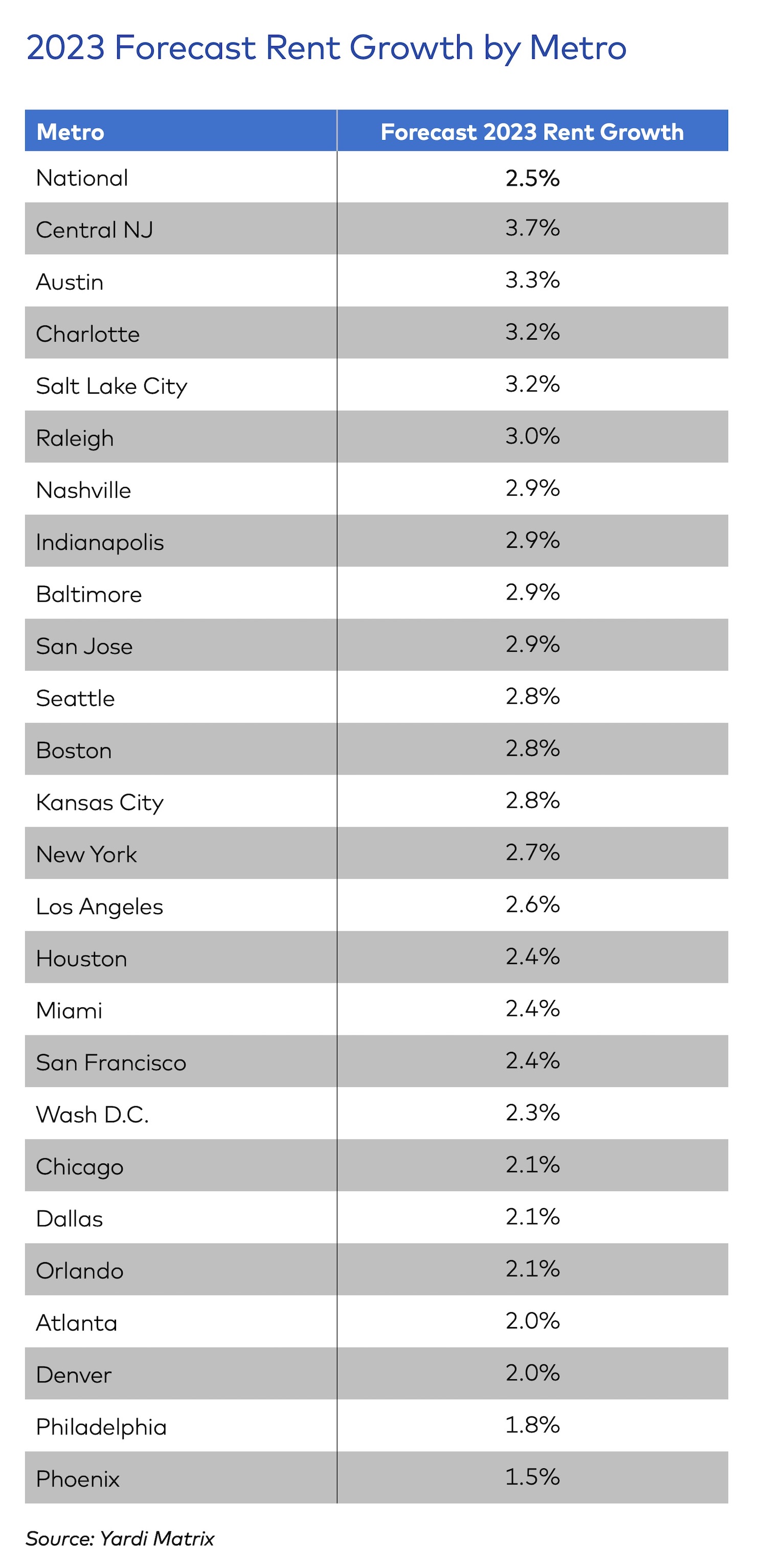

Through the first five months of 2023, U.S. asking rents rose $17, or 0.9%, with year-over-year growth falling to 2.6%.

“We expect continued deceleration, with rent growth of 2.5% for the full year,” states the outlook. The average U.S. apartment rent reached an all-time high of $1,716 in May.

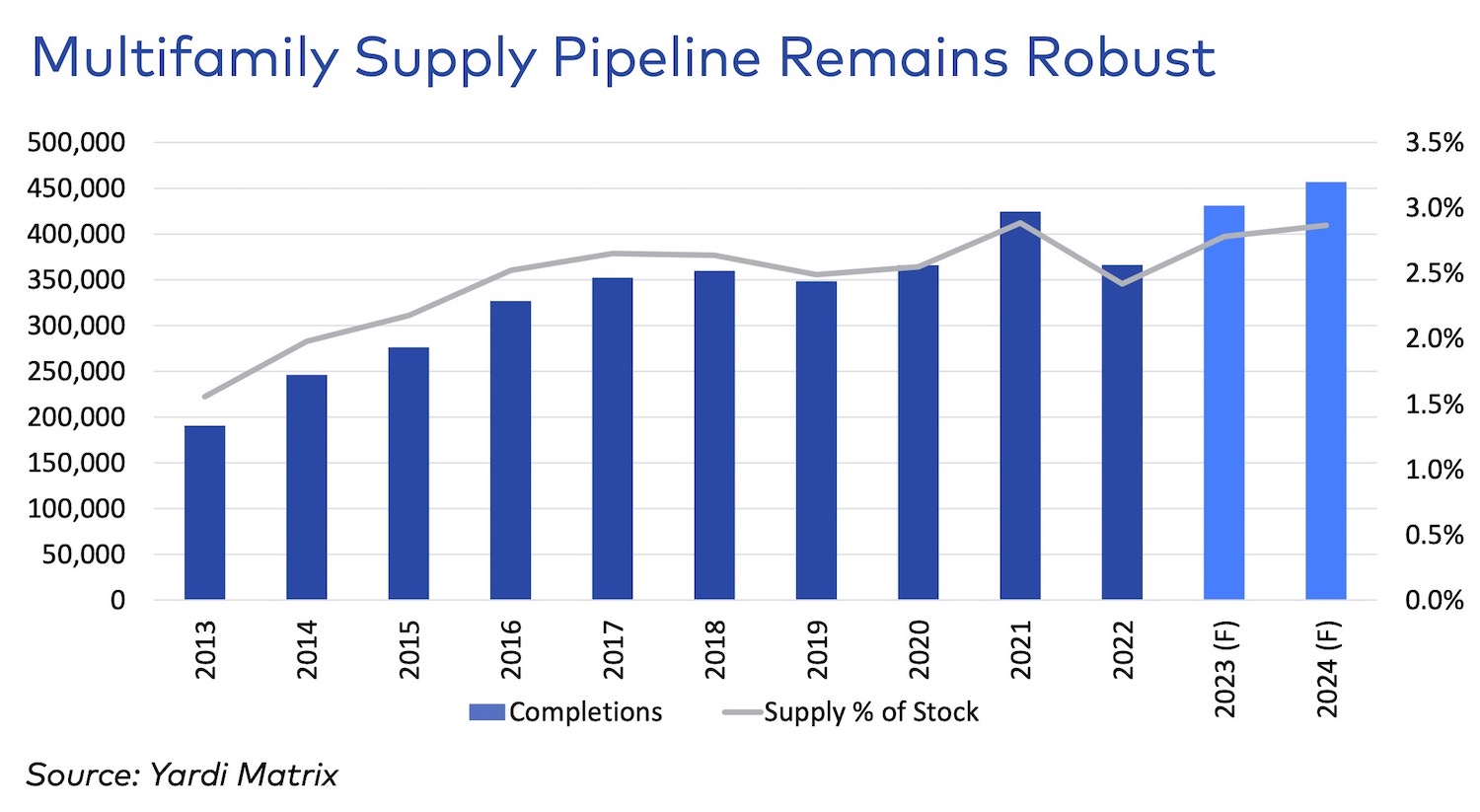

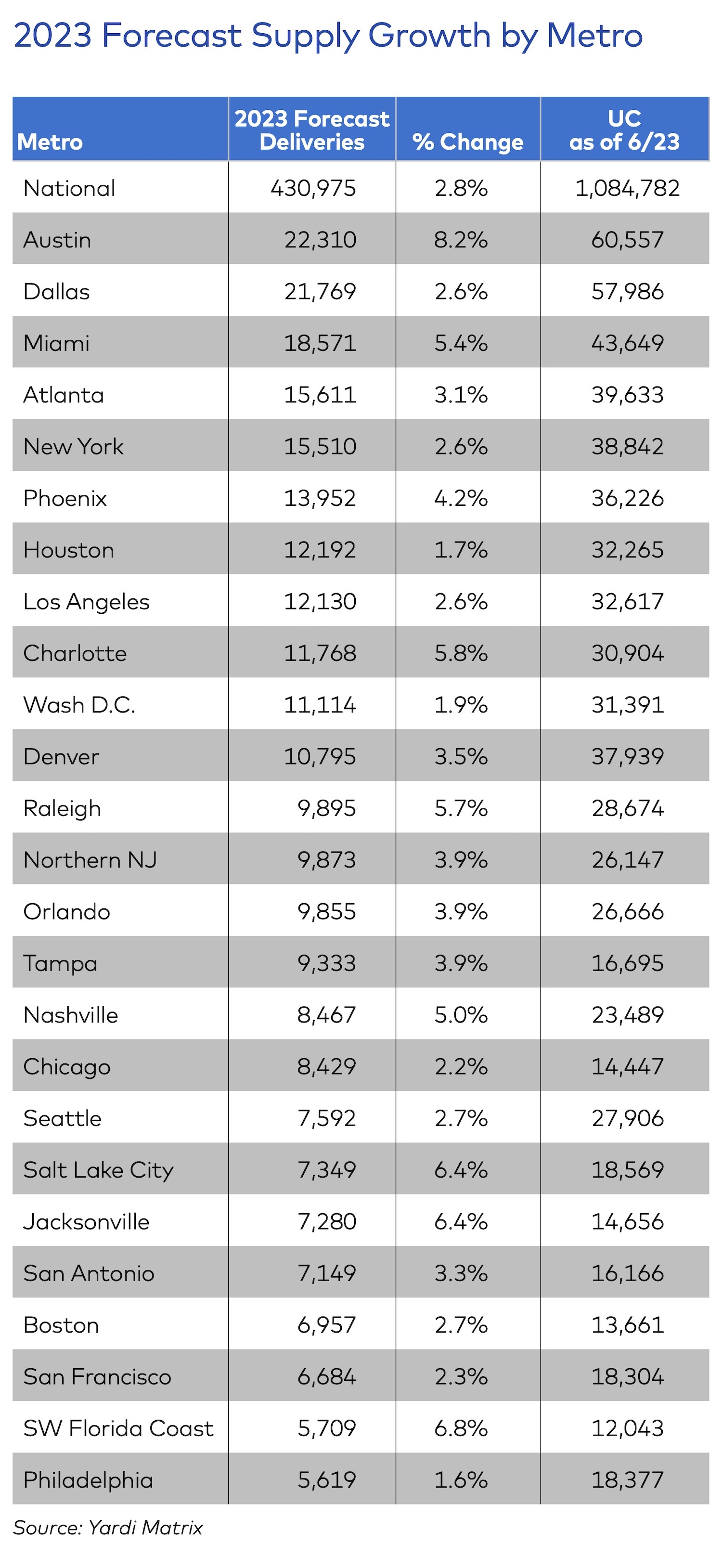

Challenges for the sector include slowing demand, growing issues with affordability, slower population growth and competition from a large number of new units coming online through 2024.

The capital side of the industry has suffered due to heightened interest rates, which show little sign of decreasing in the near-term. Property values are down 15-20% from their peak and are still declining due to the higher cost of capital.

New deliveries will be high at least through the end of 2024, as the 1 million units under construction come online. New starts are now declining, however, because debt is more expensive and fewer banks are financing construction.

Household formation, which drove the 22% cumulative growth in U.S. asking rents over 2021 and 2022, has slowed but remains positive. Although some pandemic demographic trends are moderating, the desire for more space to balance living, working and family appears to have staying power and should continue to drive demand.

Demand is also boosted by the sharp drop in home sales, which keeps renters in apartments. High mortgage rates also create an affordability hurdle for first-time buyers and middle-income families looking to trade up.

Home mortgage rates rose to 6.5% in March 2023, up 230 basis points from March 2022, increasing monthly mortgage costs by 29% and overall ownership costs by 20%, according to the Harvard Joint Center of Housing Studies.

Related Stories

Adaptive Reuse | Mar 30, 2024

Hotel vs. office: Different challenges in commercial to residential conversions

In the midst of a national housing shortage, developers are examining the viability of commercial to residential conversions as a solution to both problems.

Green | Mar 25, 2024

Zero-carbon multifamily development designed for transactive energy

Living EmPower House, which is set to be the first zero-carbon, replicable, and equitable multifamily development designed for transactive energy, recently was awarded a $9 million Next EPIC Grant Construction Loan from the State of California.

Adaptive Reuse | Mar 21, 2024

Massachusetts launches program to spur office-to-residential conversions statewide

Massachusetts Gov. Maura Healey recently launched a program to help cities across the state identify underused office buildings that are best suited for residential conversions.

Affordable Housing | Mar 20, 2024

240-unit affordable housing community to be built on site of former shopping center

Jefferson Plaza Apartments, being built on a 7.6 acre site of a former shopping center, will comprise seven 3-story buildings with 147 one-bedroom and 93 two-bedroom units.

Multifamily Housing | Mar 19, 2024

Jim Chapman Construction Group completes its second college town BTR community

JCCG's 200-unit Cottages at Lexington, in Athens, Ga., is fully leased.

Multifamily Housing | Mar 19, 2024

Two senior housing properties renovated with 608 replacement windows

Renovation of the two properties, with 200 apartments for seniors, was financed through a special public/private arrangement.

MFPRO+ New Projects | Mar 18, 2024

Luxury apartments in New York restore and renovate a century-old residential building

COOKFOX Architects has completed a luxury apartment building at 378 West End Avenue in New York City. The project restored and renovated the original residence built in 1915, while extending a new structure east on West 78th Street.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

Adaptive Reuse | Mar 15, 2024

San Francisco voters approve tax break for office-to-residential conversions

San Francisco voters recently approved a ballot measure to offer tax breaks to developers who convert commercial buildings to residential use. The tax break applies to conversions of up to 5 million sf of commercial space through 2030.