In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

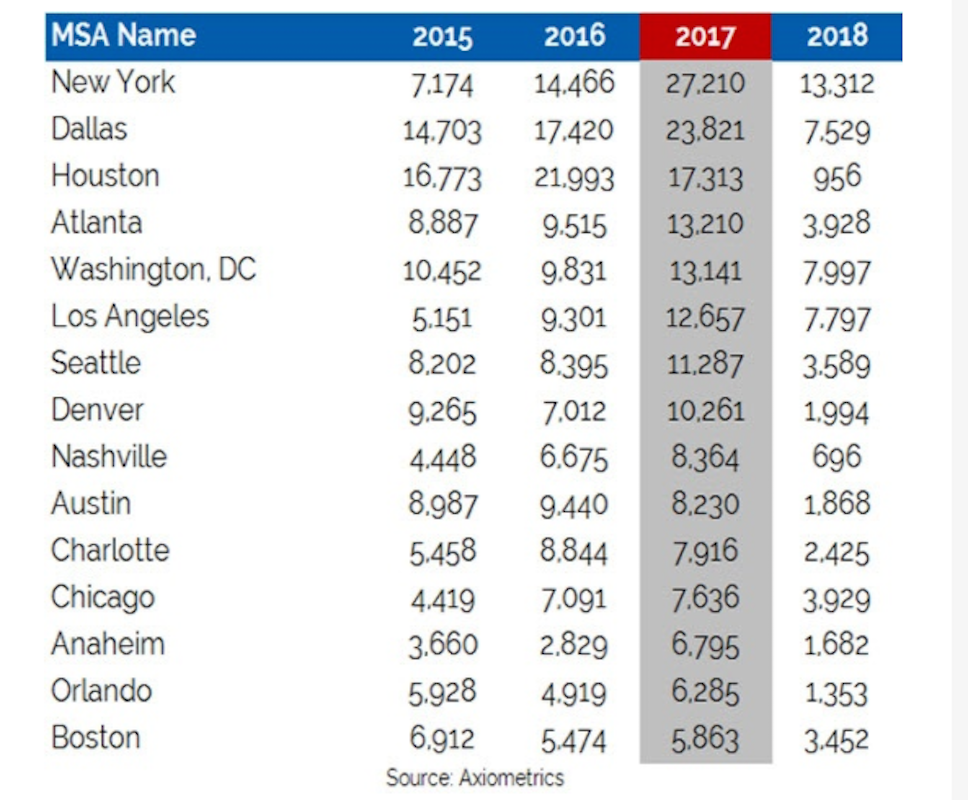

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Feb 18, 2015

Make It Right unveils six designs for affordable housing complex

BNIM is among the six firms involved in the project.

Office Buildings | Feb 18, 2015

Commercial real estate developers optimistic, but concerned about taxes, jobs outlook

The outlook for the commercial real estate industry remains strong despite growing concerns over sluggish job creation and higher taxes, according to a new survey of commercial real estate professionals by NAIOP.

Multifamily Housing | Feb 17, 2015

NYC multifamily sales increased by 39% in 2014

For New York City as a whole, $20 million-plus deals accounted for more than half of all transactions.

Multifamily Housing | Feb 17, 2015

California launches pilot program to finance multifamily retrofits for energy efficiency

The Obama Administration and the state of California are teaming with the Chicago-based MacArthur Foundation on a pilot program whose goal is to unlock Property-Assessed Clean Energy financing for multifamily housing.

Multifamily Housing | Feb 17, 2015

Young Millennials likely to return home

Ninety percent of individuals born between 1980 and 1984 and who hold a Bachelor’s degree left home before they were 27 years hold. However, half of this group later returned to their parents’ home, according to a study by the National Longitudinal Study of Youth.

High-rise Construction | Feb 17, 2015

Work begins on Bjarke Ingels' pixelated tower in Calgary

Construction on Calgary’s newest skyscraper, the 66-story Telus Sky Tower, recently broke ground.

Mixed-Use | Feb 13, 2015

First Look: Sacramento Planning Commission approves mixed-use tower by the new Kings arena

The project, named Downtown Plaza Tower, will have 16 stories and will include a public lobby, retail and office space, 250 hotel rooms, and residences at the top of the tower.

Codes and Standards | Feb 12, 2015

New Appraisal Institute form aids in analysis of green commercial building features

The Institute’s Commercial Green and Energy Efficient Addendum offers a communication tool that lenders can use as part of the scope of work.

Multifamily Housing | Feb 9, 2015

GSEs and their lenders were active on the multifamily front in 2014

Fannie Mae and Freddie Mac securitized more than $57 billion for 850,000-plus units.

Multifamily Housing | Feb 6, 2015

Fannie Mae to offer lower interest rates to LEED-certified multifamily properties

For certified properties, Fannie Mae is now granting a 10 basis point reduction in the interest rate of a multifamily refinance, acquisition, or supplemental mortgage loan.