In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

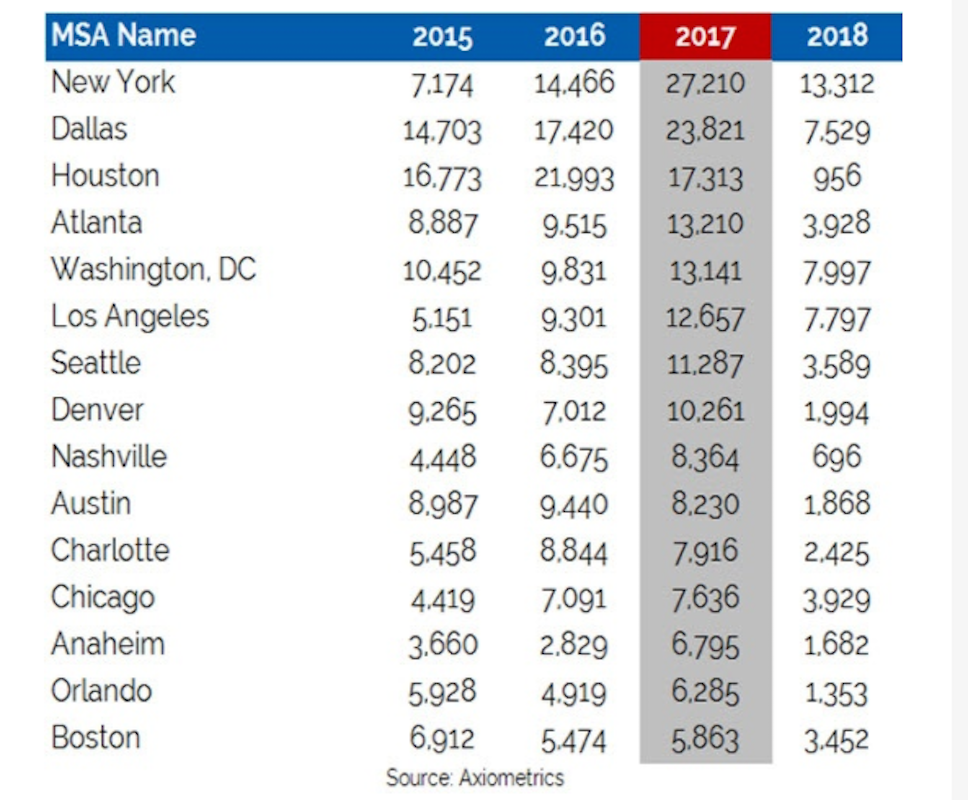

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Cultural Facilities | Feb 5, 2015

5 developments selected as 'best in urban placemaking'

Falls Park on the Reedy in Greenville, S.C., and the Grand Rapids (Mich.) Downtown Market are among the finalists for the 2015 Rudy Bruner Award for Urban Excellence.

Multifamily Housing | Feb 2, 2015

D.C. developer sees apartment project as catalyst for modeling neighborhood after N.Y.'s popular High Line district

It’s no accident that the word “Highline” is in this project’s name. The goal is for the building to be a kind of gateway into the larger redevelopment of the surrounding neighborhood to resemble New York’s City’s trendy downtown Meatpacking District, through which runs a portion the High Line elevated park.

Multifamily Housing | Jan 31, 2015

5 intriguing trends to track in the multifamily housing game

Demand for rental apartments and condos hasn’t been this strong in years, and our experts think the multifamily sector still has legs. But you have to know what developers, tenants, and buyers are looking for to have any hope of succeeding in this fast-changing market sector.

Multifamily Housing | Jan 31, 2015

20% down?!! Survey exposes how thin renters’ wallets are

A survey of more than 25,000 adults found the renters to be more burdened by debt than homeowners and severely short of emergency savings.

Multifamily Housing | Jan 31, 2015

Production builders are still shying away from rental housing

Toll Brothers, Lennar, and Trumark are among a small group of production builders to engage in construction for rental customers.

Multifamily Housing | Jan 29, 2015

5 predictions for the multifamily sector in 2015

Brian Carlock of PwC expects more younger adults to get into the game, despite continuing affordability issues.

Multifamily Housing | Jan 27, 2015

Multifamily construction, focused on rentals, expected to slow in the coming years

New-home purchases, which recovered strongly in 2014, indicate that homeownership might finally be making a comeback.

Multifamily Housing | Jan 22, 2015

Sales of apartment buildings hit record high in 2014

Investors bet big time on demand for rental properties over homeownership in 2014, when sales of apartment buildings hit a record $110.1 billion, or nearly 15% higher than the previous year.

Modular Building | Jan 21, 2015

Chinese company 3D prints six-story multifamily building

The building components were prefabricated piece by piece using a printer that is 7 meters tall, 10 meters wide, and 40 meters long.

| Jan 19, 2015

Four Seasons tower will be Boston's tallest

On Jan. 14, 2015, developer Carpenter & Company and executives from the Four Seasons broke ground on the Four Seasons Hotel & Private Residences, which will become the tallest building in Boston at 699 feet.