In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

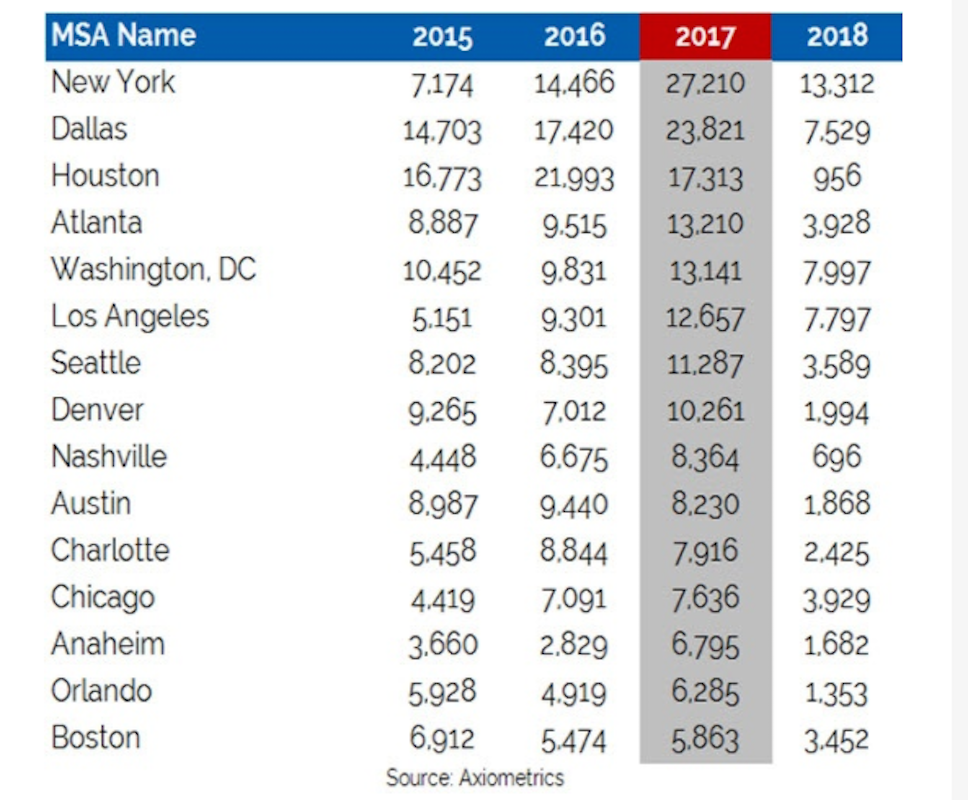

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

| May 2, 2012

Public housing can incorporate sustainable design

Sustainable design achievable without having to add significant cost; owner and residents reap benefits

| Apr 27, 2012

GreenExpo365.com to offer webinars on EPA’s WaterSense Program

Architects and builders interested in developing water-efficient buildings invited to attend free sessions featuring experts discussing water-efficient building practices.

| Apr 19, 2012

KTGY Group’s Arista Uptown Apartments in Broomfield, Colo. completed

First of eight buildings highlights unique amenities.

| Apr 6, 2012

Batson-Cook breaks ground on hotel adjacent to Infantry Museum & Fort Benning

The four-story, 65,000-ft property will feature 102 hotel rooms, including 14 studio suites.

| Mar 27, 2012

Precast concrete used for affordable, sustainable housing in New York

Largest affordable housing development in the nation will provide housing for close to 500,000 people.

| Mar 19, 2012

Mixed-use project redefines Midtown District in Plantation, Fla.

Stiles Construction is building the residential complex, which is one of Broward County’s first multifamily rental communities designed to achieve LEED certification from the USGBC.

| Mar 6, 2012

Country’s first Green House home for veterans completed

Residences at VA Danville to provide community-centered housing for military veterans.

| Mar 1, 2012

Reconstruction of L.A.’s Dunbar Hotel underway

Withee Malcolm Architects’ designs for the project include the complete renovation of the Dunbar Hotel and the Somerville Apartments I and II.

| Feb 15, 2012

NAHB sees gradual improvement in multifamily sales for boomers

However, since the conditions of the current overall housing market are limiting their ability to sell their existing homes, this market is not recovering as quickly as might have been expected.

| Feb 10, 2012

Atlanta Housing Authority taps Johnson Controls to improve public housing efficiency

Energy-efficiency program to improve 13 senior residential care facilities and save nearly $18 million.