In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

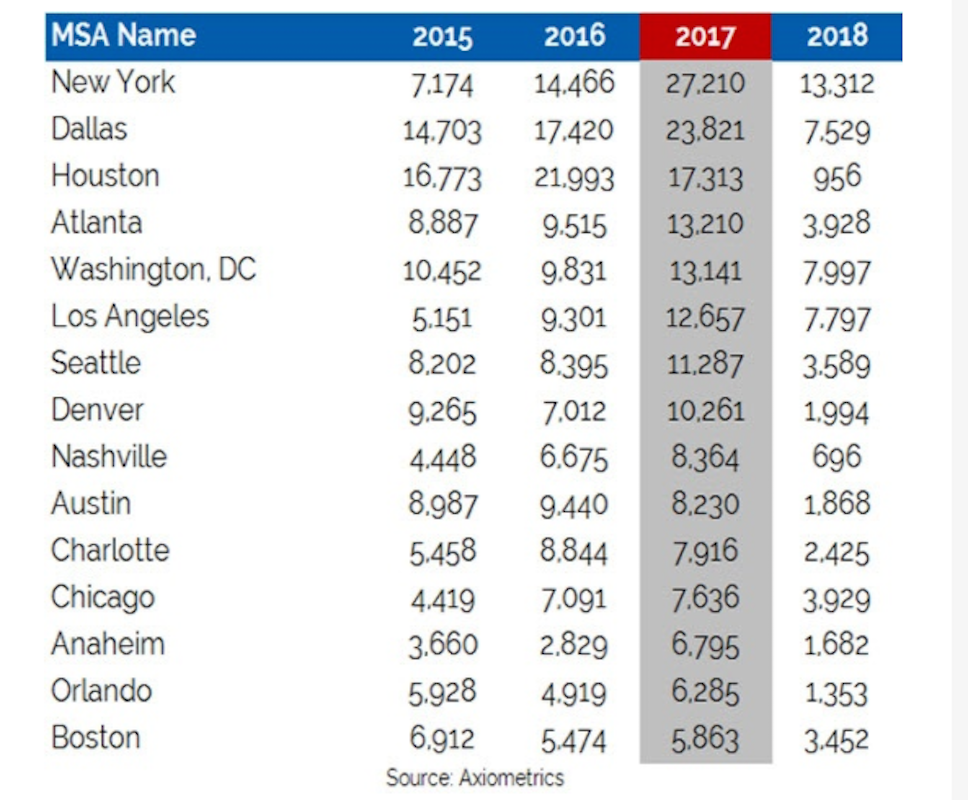

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Seismic Design | Feb 27, 2023

Turkey earthquakes provide lessons for California

Two recent deadly earthquakes in Turkey and Syria offer lessons regarding construction practices and codes for California. Lax building standards were blamed for much of the devastation, including well over 35,000 dead and countless building collapses.

Multifamily Housing | Feb 21, 2023

Watch: DBA Architects' Bryan Moore talks micro communities and the benefits of walkable neighborhoods

What is a micro-community? Where are they most prevalent? What’s the future for micro communities? These questions (and more) addressed by Bryan Moore, President and CEO of DBA Architects.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.

Multifamily Housing | Feb 21, 2023

New multifamily housing and mixed-use buildings in Portland, Ore., must be ready for electric vehicle charging

The Portland, Ore., City Council recently voted unanimously to require all new residential and mixed-use buildings to be ready for electric vehicle charging. The move amends Portland’s zoning laws to require all new multi-dwelling and mixed-use development of five or more units with onsite parking to provide electric vehicle charging infrastructure.

Reconstruction & Renovation | Feb 16, 2023

Insights from over 300 potential office-to-residential conversions

Research from Gensler finds that, surprisingly, the features that result in an unpleasant office often make for a superlative multifamily product.

Multifamily Housing | Feb 16, 2023

Coastal Construction Group establishes an attainable multifamily housing division

Coastal Construction Group, one of the largest privately held construction companies in the Southeast, has announced a new division within their multifamily sector that will focus on the need for attainable housing in South Florida.

High-rise Construction | Feb 15, 2023

Bjarke Ingels' 'leaning towers' concept wins Qianhai Prisma Towers design competition

A pair of sloped high-rises—a 300-meter residential tower and a 250-meter office tower—highlight the Qianhai Prisma Towers development in Qianhai, Shenzhen, China. BIG recently won the design competition for the project.

Senior Living Design | Feb 15, 2023

Passive House affordable senior housing project opens in Boston

Work on Phase Three C of The Anne M. Lynch Homes at Old Colony, a 55-apartment midrise building in Boston that stands out for its use of Passive House design principles, was recently completed. Designed by The Architectural Team (TAT), the four-story structure was informed throughout by Passive House principles and standards.

Multifamily Housing | Feb 11, 2023

8 Gold and Platinum multifamily projects from the NAHB's BALA Awards

This year's top BALA multifamily winners showcase leading design trends, judged by eight industry professionals from across the country.

Multifamily Housing | Feb 10, 2023

Dallas to get a 19-story, 351-unit residential high-rise

In Dallas, work has begun on a new multifamily high-rise called The Oliver. The 19-story, 351-unit apartment building will be located within The Central, a 27-acre mixed-use development near the Knox/Henderson neighborhood north of downtown Dallas.