In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

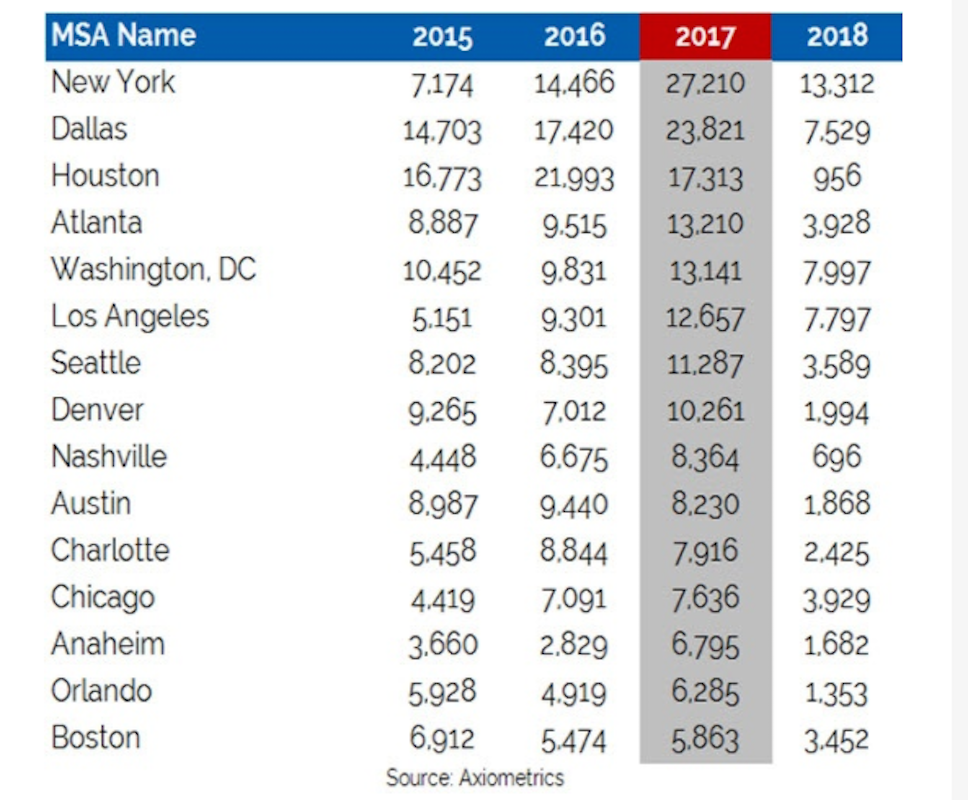

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Student Housing | Mar 13, 2023

University of Oklahoma, Missouri S&T add storm-safe spaces in student housing buildings for tornado protection

More universities are incorporating reinforced rooms in student housing designs to provide an extra layer of protection for students. Storm shelters have been included in recent KWK Architects-designed university projects in the Great Plains where there is a high incidence of tornadoes. Projects include Headington and Dunham Residential Colleges at the University of Oklahoma and the University Commons residential complex at Missouri S&T.

Mixed-Use | Mar 11, 2023

Austin mixed-use development will provide two million sf of office, retail, and residential space

In Austin, Texas, the seven-building East Riverside Gateway complex will provide a mixed-use community next to the city’s planned Blue Line light rail, which will connect the Austin Bergstrom International Airport with downtown Austin. Planned and designed by Steinberg Hart, the development will include over 2 million sf of office, retail, and residential space, as well as amenities, such as a large park, that are intended to draw tech workers and young families.

Multifamily Housing | Mar 7, 2023

Multifamily housing development in Chicago takes design inspiration from patchwork and quilting

HUB 32, a 65-unit multifamily housing development, will provide affordable housing and community amenities in Chicago’s Garfield Park neighborhood. Brooks + Scarpa’s recently unveiled design takes inspiration from the American tradition of patchwork and quilting.

Adaptive Reuse | Mar 5, 2023

Pittsburgh offers funds for office-to-residential conversions

The City of Pittsburgh’s redevelopment agency is accepting applications for funding from developers on projects to convert office buildings into affordable housing. The city’s goals are to improve downtown vitality, make better use of underutilized and vacant commercial office space, and alleviate a housing shortage.

Student Housing | Mar 5, 2023

Calif. governor Gavin Newsom seeks to reform environmental law used to block student housing

California Gov. Gavin Newsom wants to reform a landmark state environmental law that he says was weaponized by wealthy homeowners to block badly needed housing for students at the University of California, Berkeley.

Green Renovation | Mar 5, 2023

Dept. of Energy offers $22 million for energy efficiency and building electrification upgrades

The Buildings Upgrade Prize (Buildings UP) sponsored by the U.S. Department of Energy is offering more than $22 million in cash prizes and technical assistance to teams across America. Prize recipients will be selected based on their ideas to accelerate widespread, equitable energy efficiency and building electrification upgrades.

AEC Innovators | Mar 3, 2023

Meet BD+C's 2023 AEC Innovators

More than ever, AEC firms and their suppliers are wedding innovation with corporate responsibility. How they are addressing climate change usually gets the headlines. But as the following articles in our AEC Innovators package chronicle, companies are attempting to make an impact as well on the integrity of their supply chains, the reduction of construction waste, and answering calls for more affordable housing and homeless shelters. As often as not, these companies are partnering with municipalities and nonprofit interest groups to help guide their production.

Modular Building | Mar 3, 2023

Pallet Shelter is fighting homelessness, one person and modular pod at a time

Everett, Wash.-based Pallet Inc. helped the City of Burlington, Vt., turn a municipal parking lot into an emergency shelter community, complete with 30 modular “sleeping cabins” for the homeless.

Multifamily Housing | Mar 1, 2023

Multifamily construction startup Cassette takes a different approach to modular building

Prefabricated modular design and construction have made notable inroads into such sectors as industrial, residential, hospitality and, more recently, office and healthcare. But Dafna Kaplan thinks that what’s held back the modular building industry from even greater market penetration has been suppliers’ insistence that they do everything: design, manufacture, logistics, land prep, assembly, even onsite construction. Kaplan is CEO and Founder of Cassette, a Los Angeles-based modular building startup.