In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

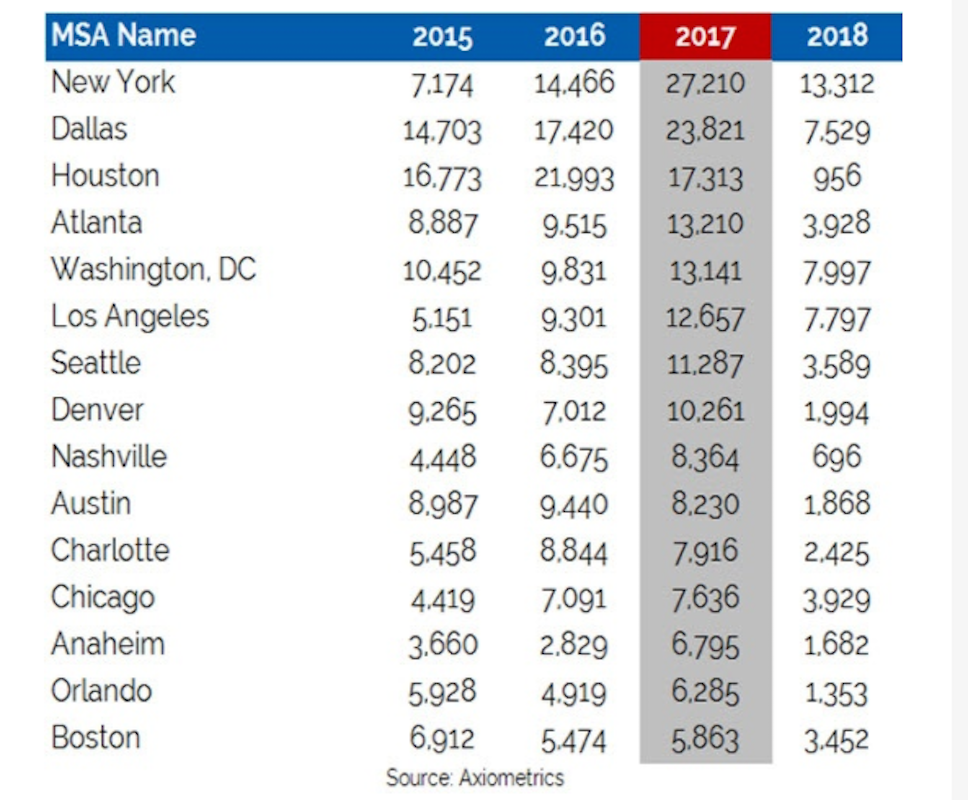

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Apr 26, 2022

Investment firm Blackstone makes $13 billion acquisition in student-housing sector

Blackstone Inc., a New York-based investment firm, has agreed to buy student-housing owner American Campus Communities Inc.

Mixed-Use | Apr 22, 2022

San Francisco replaces a waterfront parking lot with a new neighborhood

A parking lot on San Francisco’s waterfront is transforming into Mission Rock—a new neighborhood featuring rental units, offices, parks, open spaces, retail, and parking.

Multifamily Housing | Apr 20, 2022

A Frankfurt tower gives residents greenery-framed views

In Frankfurt, Germany, the 27-floor EDEN tower boasts an exterior “living wall system”: 186,000 plants that cover about 20 percent of the building’s facade.

Multifamily Housing | Apr 20, 2022

Prism Capital Partners' Avenue & Green luxury/affordable rental complex is 96% leased

The 232-unit rental property, in Woodbridge, N.J., has surpassed the 96 percent mark in leases.

Senior Living Design | Apr 19, 2022

Affordable housing for L.A. veterans and low-income seniors built on former parking lot site

The Howard and Irene Levine Senior Community, designed by KFA Architecture for Mercy Housing of California, provides badly needed housing for Los Angeles veterans and low-income seniors

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Wood | Apr 13, 2022

Mass timber: Multifamily’s next big building system

Mass timber construction experts offer advice on how to use prefabricated wood systems to help you reach for the heights with your next apartment or condominium project.

Codes and Standards | Apr 13, 2022

LEED multifamily properties fetch higher rents and sales premiums

LEED-certified multifamily properties consistently receive higher rents than non-certified rental complexes, according to a Cushman & Wakefield study of two decades of data on Class A multifamily assets with 50 units or more.

Multifamily Housing | Apr 7, 2022

Ken Soble Tower becomes world’s largest residential Passive House retrofit

The project team for the 18-story high-rise for seniors slashed the building’s greenhouse gas emissions by 94 percent and its heating energy demand by 91 percent.