In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

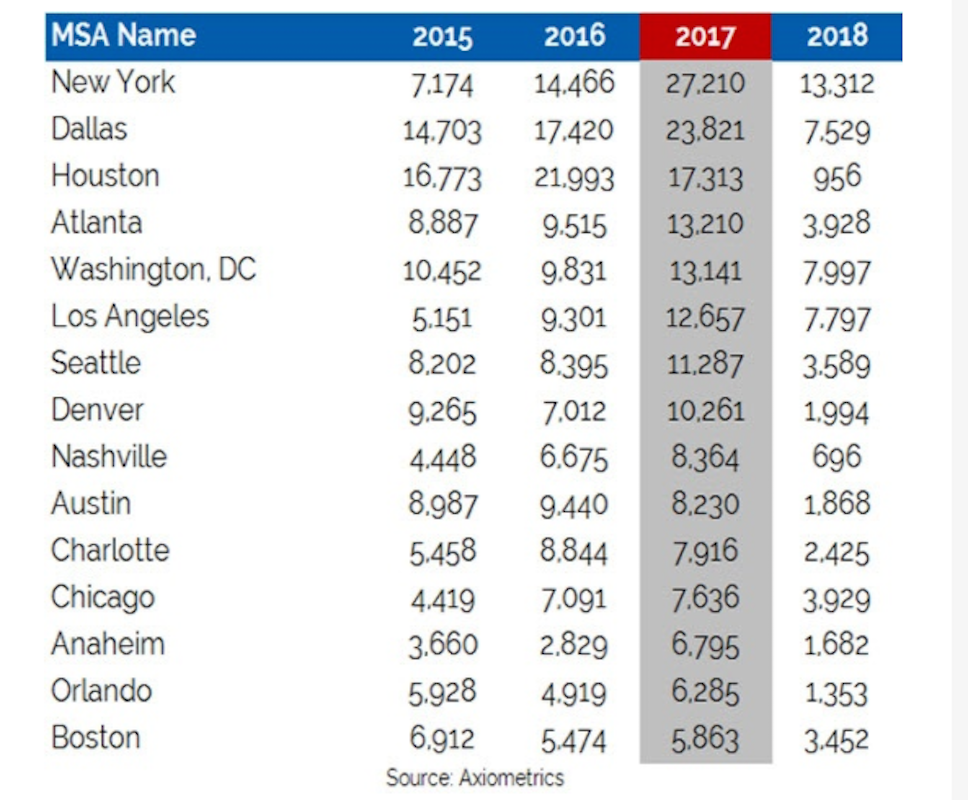

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Aug 3, 2022

7 tips for designing fitness studios in multifamily housing developments

Cortland’s Karl Smith, aka “Dr Fitness,” offers advice on how to design and operate new and renovated gyms in apartment communities.

Multifamily Housing | Aug 3, 2022

NEW DEADLINE for Senior Living and Student Housing projects for "MULTIFAMILY Design+Construction" Fall issue

Fall 2022 issue of MULTIFAMILY Design+Construction will have reports on Senior Living and Student Housing.

Multifamily Housing | Jul 28, 2022

GM working to make EV charging accessible to multifamily residents

General Motors, envisioning a future where electric vehicles will be commonplace, is working to boost charging infrastructure for those who live in multifamily residences.

Multifamily Housing | Jul 26, 2022

All-electric buildings – great! But where's all that energy going to be stored?

There's a call for all-electric buildings, but can we generate and store enough electricity to meet that need?

Green | Jul 26, 2022

Climate tech startup BlocPower looks to electrify, decarbonize the nation's buildings

The New York-based climate technology company electrifies and decarbonizes buildings—more than 1,200 of them so far.

Sponsored | Multifamily Housing | Jul 19, 2022

Engineering Solutions for a More Inclusive Community

Affordable housing complex uses engineered wood to keep construction costs low, tackle a public predicament and give rise to a stronger, more inclusive community.

Multifamily Housing | Jul 14, 2022

Multifamily rents rise again in June, Yardi Matrix reports

Average U.S. multifamily rents rose another $19 in June to edge over $1,700 for the first time ever, according to the latest Yardi® Matrix Multifamily Report.

Building Team | Jul 7, 2022

Amenity-rich rental property in Chicago includes seven-story atrium with vertical landscaping

The recently opened 198-unit Optima Lakeview luxury rental apartment building in Chicago is bursting with amenities such as the region’s first year-round rooftop pool, contact-free in-home package delivery, housekeeping services, on-site room service, fitness programming, and a virtual personal assistant.

Multifamily Housing | Jul 6, 2022

The power of contextual housing development

Creating urban villages and vibrant communities starts with a better understanding of place, writes LPA's Matthew Porreca.

Green | Jun 22, 2022

The business case for passive house multifamily

A trio of Passive House experts talk about the true costs and benefits of passive house design and construction for multifamily projects.