A familiar, if time-worn, cliché depicts owner-developers as cost obsessed and hostile to regulations, genuflecting at the altar of value engineering and choosing architects, engineers, and contractors on their track records for delivering projects within budgets so tight they squeak.

Owners, understandably, don’t see themselves that way. A more nuanced picture emerges from BD+C’s inaugural survey of owner-developers about what they expect from their AEC partners. Sure, cost control is a primary consideration for any project. And some owners voiced their frustrations at finding collaborative teams that listen to their cost concerns—and problem-solve accordingly.

Owners who responded to the survey also indicate they lean toward AEC teams that will expose them to new products, innovations, and delivery methods that make a building’s construction and operations more efficient. Energy management, occupant health, and wellness are priorities that owners expect AEC partners to integrate into their designs and engineering.

STEMMING PROBLEMS BEFORE THEY OCCUR

When asked about leading factors that restrict development, owners’ identified availability and cost of capital to finance projects, regulations, and economic uncertainty. Owners don’t have much control over any of these potential barriers, so their influence on a project’s course is more keenly wielded by their choices of AEC firms to work with.

Click To Download BD+C's 2021 Owners Survey Report

This exclusive BD+C survey of 156 building owners and developers explores the changing and most-pressing needs of this highly influential group. From project financing to client service to design, construction, and operations, this research breaks down emerging trends, innovations, and the biggest wants and needs among owners/developers. The survey covers:

• What owners/developers look for in an AEC firm

• Biggest development challenges

• Top health/wellness/environmental strategies on projects

• Single-biggest innovation implemented on projects

• Response to the COVID-19 pandemic.

Download the 16-page PDF report with the complete findings from BD+C's 2021 Owners Survey. Thanks!

As owners weigh their partners’ suitability, their criteria centers on an AEC firm’s capacity to complete a project, its past performance, and how adeptly it interacts with clients. At least one owner said his company tests design and construction management teams on their collaborative skills, which “has led to teams who listen to the owners’ needs and design facilities, solving a multitude of problems such as durability, low maintenance, [and] ease of access.”

But some owners remain unimpressed with certain aspects of AEC firms’ expertise. One owner lamented many firms’ insufficient understanding of contract law. Another owner observed that builders, architects, and designers “need to get much smarter” about incorporating “amazing” technology into buildings, which this owner believes “is going to be the key to the new built environment.”

An owner who works for the U.S. Forest Service noted that his agency struggles to find technologically sophisticated AEC firms with LEED or Green Globes credentials to design and build small projects for rural areas.

THE ENVIRONMENTAL MELTING POT

More developers see the wisdom in making buildings energy efficient and sustainable, but with as few mandates as possible. One owner spoke approvingly of “prescriptive minimum program requirements” to achieve LEED Gold certification on 30 campus buildings, which led to a 30-35% reduction in site energy use and an 18-30% reduction in water use.

The top-ranked environment, health, and wellness strategies that owners polled expect their AEC partners to provide include energy-related modeling, products and systems, and mechanicals optimization.

Thanks to the coronavirus pandemic, energy efficiency and sustainability are checkboxes on a longer list of essentials to create healthier and cost-saving environments. That list runs the gamut from upgrading HVAC systems for better air quality, to carving out wellness spaces within buildings.

An owner who was 18 months into a four-year, $615 million replacement hospital project in Pensacola, Fla., recounted how he “paused to reflect” on the COVID-19 outbreak, and then made “numerous adjustments” to this project’s design that touched the building’s critical care capacity, isolation room availability, and reduced its office space.

“Greater emphasis needs to be placed on the health and wellness of people, which in turn promotes stronger, viable, and more sustainable communities, as well as higher ROIs,” asserted another owner. An owner-developer whose company specializes in theme parks said that ROI derives mostly from savings on water and energy usage. Another owner has moved its projects entirely to heat pumps and 100% electric buildings (except for basements and garages), and maximizes indoor air quality.

Cost is inevitably in the background of these decisions. When injecting these strategies into a project, one owner said he asks his project teams for “reasonableness” that balances goals with budget resources. Another owner spoke of the “lack of professionalism” by design teams that “obsess” over sustainability “with zero regard for capital costs.” A third owner said that achieving net-zero energy and sustainability in buildings, while environmentally responsible, is difficult because their costs impact rents and, therefore, the willingness of financial institutions to lend for such projects.

‘NEW’ IN THE EYE OF THE BEHOLDER

Energy and environmental solutions have piqued owners’ interests over the past few years. Anything technological has also captured owners’ attention. For example, one owner spoke of converting a chilled water system into a low-grade heat system by running water through a surface condenser. Another recently started integrating all building systems into one graphical interface.

Just don’t expect owners to be pioneers. Among the products and construction techniques they cited as “innovations” were tilt-up concrete walls for building offices, 3D design to detect clashes, and UV lighting for infection control.

We can only speculate about why so few owners mentioned prefabrication or modular design and construction as something they’ve tried or are at least watching. One thought is that neither has caught on in nonresidential construction to the extent predicted. More likely, owners might not perceive prefab or modular as something new, as more projects have turned to offsite manufacturing to counter in-field manpower shortages and to control costs.

Owners’ wish lists can be edgier. One owner would like to see a device that measures indoor air quality like a thermometer measures temperature. Another craves hydrogen-powered backup generators (which some companies, including Microsoft, have been using for a while). Several owners put robots on their wish lists. Others are waiting for less-expensive options to meet Passive House standards and for cogeneration, electrical storage, even curtain wall for arctic construction.

Some owners listed alternate delivery methods that smooth projects’ completions and reduce costs. “A lean IPD poly-party agreement that includes critical equipment and materials suppliers as signatories” is one owner’s dream contract. Another owner observed that “teams have demonstrated, when using structured collaborative partnering on all types of projects, that time and money can be saved while maintaining or increasing quality.”

Owner-developers also want better methods to track projects during and after construction. One owner envisions a “Google Street View” for construction sites that allows teams to remotely monitor progress and quality control, perhaps through drones or camera-equipped robots.

Dashboards and command centers are gaining acceptance among owners to manage a building’s programming and obtain real-time data to assess its performance, especially when changes are made in such areas as lighting and airflow. “It’s always a struggle to get the data and display it so others can understand it,” said one owner about dashboards.

DOWNLOAD THE BD+C 2021 OWNERS SURVEY REPORT

Related Stories

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

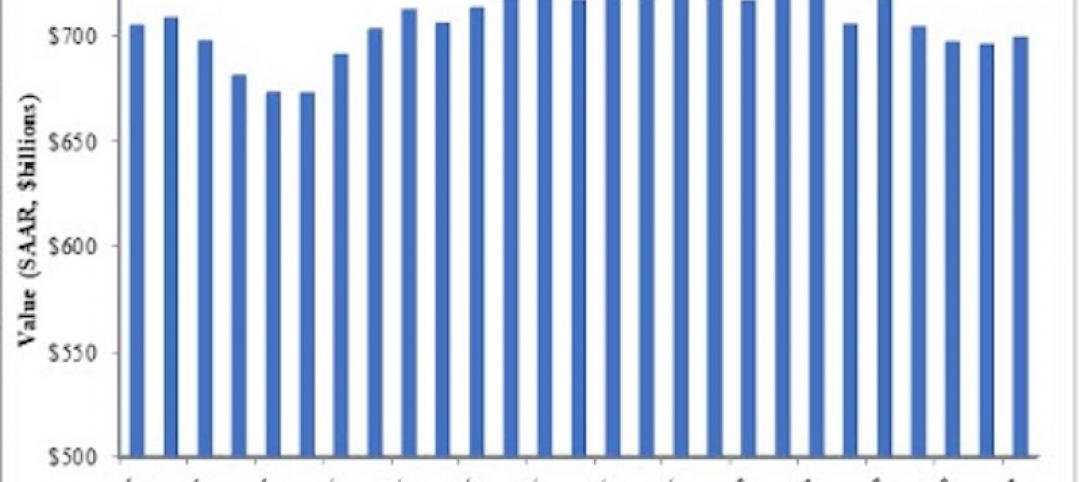

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.

Sponsored | Industry Research | Oct 26, 2017

Get clients to pay you faster with these five tips

Here are 5 ways to avoid a cash crunch by doing your part to help clients make their payments on time.

Market Data | Oct 19, 2017

Architecture Billings Index backslides slightly

Business conditions easing in the West.

Industry Research | Oct 9, 2017

AEC website design trends in 2017 – Planning for 2018

A website that’s behind the times is hurting your business.

Industry Research | Oct 3, 2017

Nonresidential construction spending stabilizes in August

Spending on nonresidential construction services is still down on a YOY basis.

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.

Contractors | Sep 19, 2017

Commercial Construction Index finds high optimism in U.S. commercial construction industry

Hurricane recovery efforts expected to heighten concerns about labor scarcities in the south, where two-thirds of contractors already face worker shortages.