In markets where labor continues to be in short supply, contractors that can attract and retain workers are capable of accepting projects that other manpower-deficient competitors might be turning away.

Labor availability is an important distinction in a construction market that “has stabilized at a comfortable level.” The backlog for the nation’s largest contractors stands at a record 12 months, according to the latest estimates from Associated Builders and Contractors (ABC), a national trade association representing 70 chapters with nearly 21,000 members.

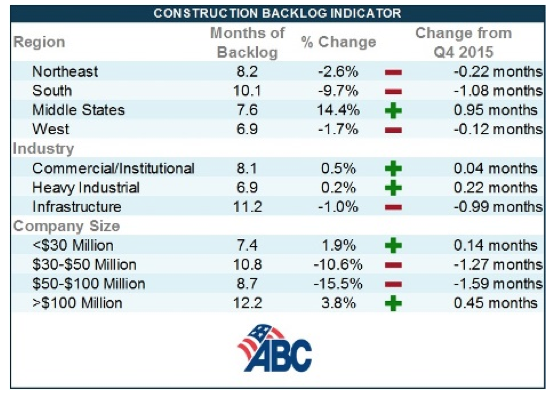

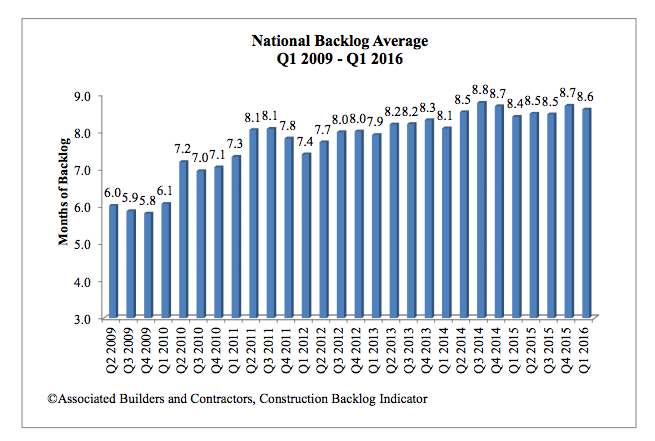

The group’s Construction Backlog Indicator, which has measured the national backlog average for every quarter since Q2 2009, stood at 8.6 months, compared to 8.7 months in Q4 2015 and 8.5 months for Q1 2015.

Where contractor backlogs in the Midwest increased by double digit percentages in the latest quarter measured, they fell in the Northeast, South, and West compared to the previous quarter.

ABC's latest Construction Backlog Index shows that contractors in the Midwest saw the biggest change in their backlogs during the first quarter of this year, as did companies whose revenues range from $50 million to $100 million. Image: Associated Builders and Contractors.

However, contractors in the South have reported average backlogs in excess of 10 months for three consecutive quarters, which is unprecedented in the history of ABC’s series. And while the Northeast isn’t expanding, the region “continues to experience a considerable volume of activity related to commercial development,” including ecommerce fulfillment centers, said ABC.

Backlogs for Commercial/Institutional (which have exceeded eight months for 3½ years), and heavy industrial were up in the most recent quarter tracked, where infrastructure backlogs, while outpacing other sectors at 11.2 months, were down slightly. “The passage of the FAST Act and growing focus among many state and local government policymakers should allow backlog in the infrastructure category to remain elevated,” ABC stated.

Companies with more than $100 million in revenue reported an average 12.25 months of backlog, representing a 3.8% gain over the previous quarter, which itself had set the previous record.

Apparently, the largest firms have recently been taking market share primarily from companies in the $30 million to $100 million range, which reported backlog declines. Companies under $30 million in revenue, on the other hand, enjoyed a modest backlog increase, and have collectively reported backlogs in excess of seven months for 11 consecutive quarters.

“Most contractors continue to express satisfaction regarding the amount of work they have under contract. This is of course truer in certain parts of the nation than others,” said Anirban Basu, ABC’s Chief Economist.

Indeed, backlogs in the West slipped in the latest quarter, even as technology generates “profound levels of activity” in markets like San Jose, Seattle, and San Diego.

ABC's data track a steady increase in national average backlogs dating back to the second quarter of 2009. Image: Associated Builders and Contractors.

Related Stories

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sustainability | Nov 1, 2023

Tool identifies financial incentives for decarbonizing heavy industry, transportation projects

Rocky Mountain Institute (RMI) has released a tool to identify financial incentives to help developers, industrial companies, and investors find financial incentives for heavy industry and transport projects.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

Giants 400 | Oct 30, 2023

Top 170 K-12 School Architecture Firms for 2023

PBK Architects, Huckabee, DLR Group, VLK Architects, and Stantec top BD+C's ranking of the nation's largest K-12 school building architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 100 K-12 School Construction Firms for 2023

CORE Construction, Gilbane, Balfour Beatty, Skanska USA, and Adolfson & Peterson top BD+C's ranking of the nation's largest K-12 school building contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 80 K-12 School Engineering Firms for 2023

AECOM, CMTA, Jacobs, WSP, and IMEG head BD+C's ranking of the nation's largest K-12 school building engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Giants 400 | Oct 23, 2023

Top 115 Multifamily Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, Whiting-Turner Contracting, and McShane Companies top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.