In markets where labor continues to be in short supply, contractors that can attract and retain workers are capable of accepting projects that other manpower-deficient competitors might be turning away.

Labor availability is an important distinction in a construction market that “has stabilized at a comfortable level.” The backlog for the nation’s largest contractors stands at a record 12 months, according to the latest estimates from Associated Builders and Contractors (ABC), a national trade association representing 70 chapters with nearly 21,000 members.

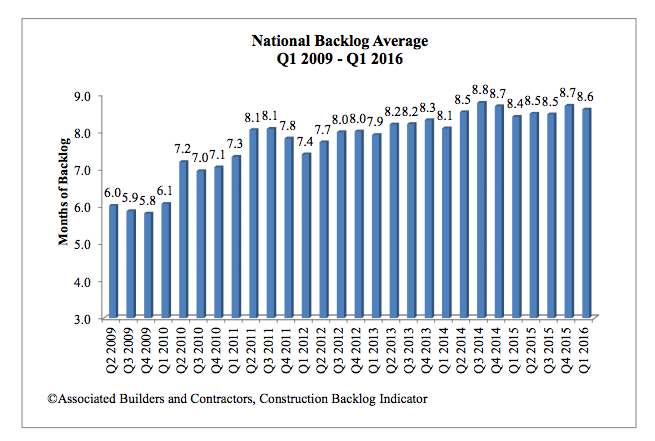

The group’s Construction Backlog Indicator, which has measured the national backlog average for every quarter since Q2 2009, stood at 8.6 months, compared to 8.7 months in Q4 2015 and 8.5 months for Q1 2015.

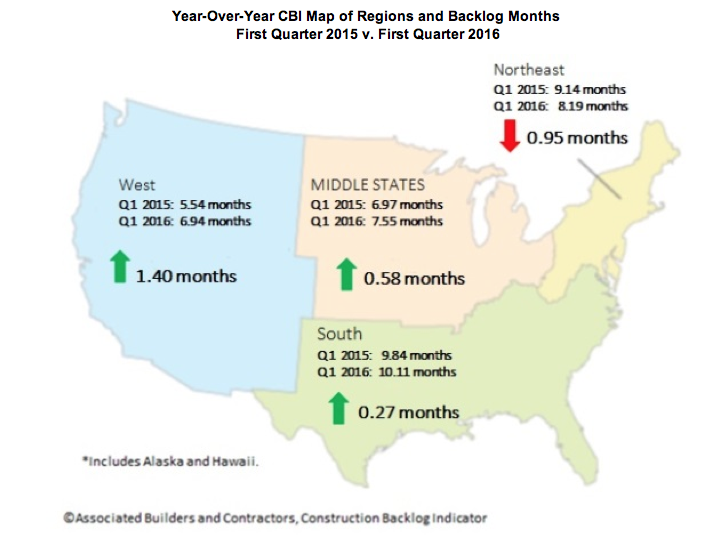

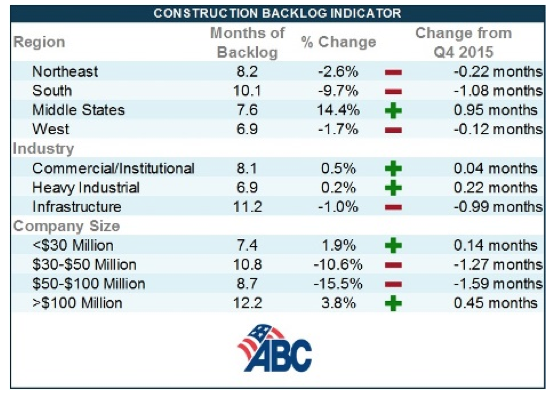

Where contractor backlogs in the Midwest increased by double digit percentages in the latest quarter measured, they fell in the Northeast, South, and West compared to the previous quarter.

ABC's latest Construction Backlog Index shows that contractors in the Midwest saw the biggest change in their backlogs during the first quarter of this year, as did companies whose revenues range from $50 million to $100 million. Image: Associated Builders and Contractors.

However, contractors in the South have reported average backlogs in excess of 10 months for three consecutive quarters, which is unprecedented in the history of ABC’s series. And while the Northeast isn’t expanding, the region “continues to experience a considerable volume of activity related to commercial development,” including ecommerce fulfillment centers, said ABC.

Backlogs for Commercial/Institutional (which have exceeded eight months for 3½ years), and heavy industrial were up in the most recent quarter tracked, where infrastructure backlogs, while outpacing other sectors at 11.2 months, were down slightly. “The passage of the FAST Act and growing focus among many state and local government policymakers should allow backlog in the infrastructure category to remain elevated,” ABC stated.

Companies with more than $100 million in revenue reported an average 12.25 months of backlog, representing a 3.8% gain over the previous quarter, which itself had set the previous record.

Apparently, the largest firms have recently been taking market share primarily from companies in the $30 million to $100 million range, which reported backlog declines. Companies under $30 million in revenue, on the other hand, enjoyed a modest backlog increase, and have collectively reported backlogs in excess of seven months for 11 consecutive quarters.

“Most contractors continue to express satisfaction regarding the amount of work they have under contract. This is of course truer in certain parts of the nation than others,” said Anirban Basu, ABC’s Chief Economist.

Indeed, backlogs in the West slipped in the latest quarter, even as technology generates “profound levels of activity” in markets like San Jose, Seattle, and San Diego.

ABC's data track a steady increase in national average backlogs dating back to the second quarter of 2009. Image: Associated Builders and Contractors.

Related Stories

Government Buildings | Oct 10, 2023

GSA names Elliot Doomes Public Buildings Service Commissioner

The U.S. General Services Administration (GSA) announced that the agency’s Public Buildings Service Commissioner Nina Albert will depart on Oct. 13 and that Elliot Doomes will succeed her.

Higher Education | Oct 10, 2023

Tracking the carbon footprint of higher education campuses in the era of online learning

With more effective use of their facilities, streamlining of administration, and thoughtful adoption of high-quality online learning, colleges and universities can raise enrollment by at least 30%, reducing their carbon footprint per student by 11% and lowering their cost per student by 15% with the same level of instruction and better student support.

MFPRO+ News | Oct 6, 2023

Announcing MultifamilyPro+

BD+C has served the multifamily design and construction sector for more than 60 years, and now we're introducing a central hub within BDCnetwork.com for all things multifamily.

Giants 400 | Oct 5, 2023

Top 115 Healthcare Construction Firms for 2023

Turner Construction, Brasfield & Gorrie, JE Dunn Construction, DPR Construction, and McCarthy Holdings top BD+C's ranking of the nation's largest healthcare sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue related to all healthcare buildings work, including hospitals, medical office buildings, and outpatient facilities.

Regulations | Oct 4, 2023

New York adopts emissions limits on concrete

New York State recently adopted emissions limits on concrete used for state-funded public building and transportation projects. It is the first state initiative in the U.S. to enact concrete emissions limits on projects undertaken by all agencies, according to a press release from the governor’s office.

Architects | Oct 4, 2023

Architects and contractors underestimate cyberattack risk

Design and construction industry firms underestimate their vulnerability to cyberattacks, according to a new report, Data Resilience in Design and Construction: How Digital Discipline Builds Stronger Firms by Dodge Construction Network and content security and management company Egnyte.

Giants 400 | Oct 2, 2023

Top 50 Data Center Construction Firms for 2023

Turner Construction, Holder Construction, HITT Contracting, DPR Construction, and Fortis Construction top BD+C's ranking of the nation's largest data center sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Oct 2, 2023

Nonresidential construction spending rises 0.4% in August 2023, led by manufacturing and public works sectors

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion.

Giants 400 | Sep 28, 2023

Top 100 University Building Construction Firms for 2023

Turner Construction, Whiting-Turner Contracting Co., STO Building Group, Suffolk Construction, and Skanska USA top BD+C's ranking of the nation's largest university sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all university/college-related buildings except student residence halls, sports/recreation facilities, laboratories, S+T-related buildings, parking facilities, and performing arts centers (revenue for those buildings are reported in their respective Giants 400 ranking).

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.