In markets where labor continues to be in short supply, contractors that can attract and retain workers are capable of accepting projects that other manpower-deficient competitors might be turning away.

Labor availability is an important distinction in a construction market that “has stabilized at a comfortable level.” The backlog for the nation’s largest contractors stands at a record 12 months, according to the latest estimates from Associated Builders and Contractors (ABC), a national trade association representing 70 chapters with nearly 21,000 members.

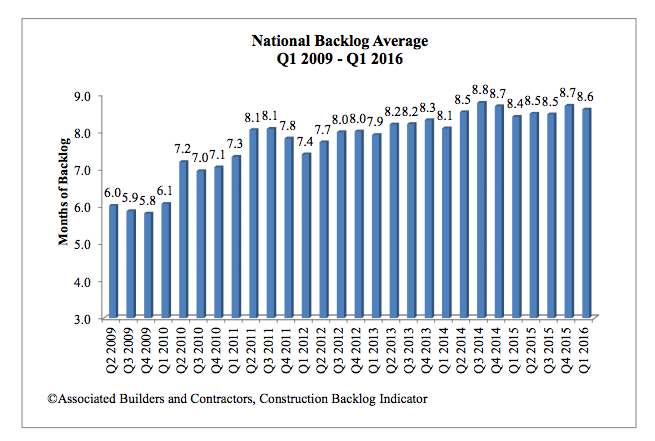

The group’s Construction Backlog Indicator, which has measured the national backlog average for every quarter since Q2 2009, stood at 8.6 months, compared to 8.7 months in Q4 2015 and 8.5 months for Q1 2015.

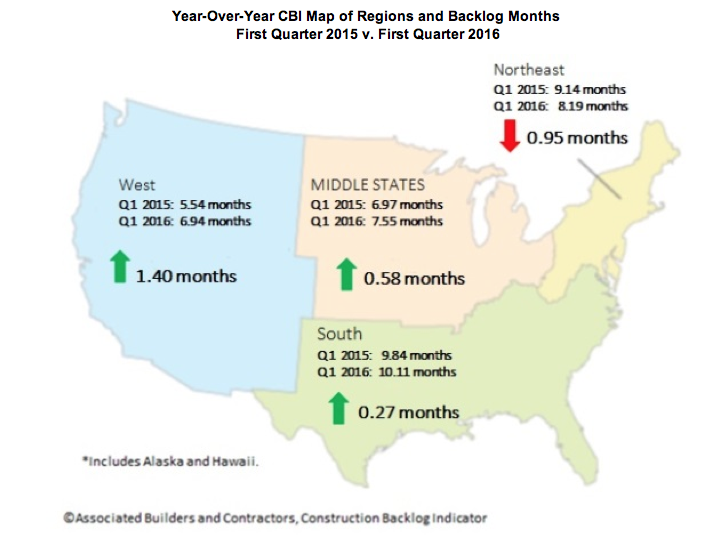

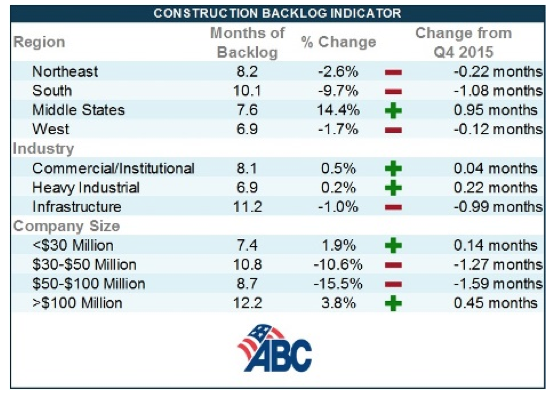

Where contractor backlogs in the Midwest increased by double digit percentages in the latest quarter measured, they fell in the Northeast, South, and West compared to the previous quarter.

ABC's latest Construction Backlog Index shows that contractors in the Midwest saw the biggest change in their backlogs during the first quarter of this year, as did companies whose revenues range from $50 million to $100 million. Image: Associated Builders and Contractors.

However, contractors in the South have reported average backlogs in excess of 10 months for three consecutive quarters, which is unprecedented in the history of ABC’s series. And while the Northeast isn’t expanding, the region “continues to experience a considerable volume of activity related to commercial development,” including ecommerce fulfillment centers, said ABC.

Backlogs for Commercial/Institutional (which have exceeded eight months for 3½ years), and heavy industrial were up in the most recent quarter tracked, where infrastructure backlogs, while outpacing other sectors at 11.2 months, were down slightly. “The passage of the FAST Act and growing focus among many state and local government policymakers should allow backlog in the infrastructure category to remain elevated,” ABC stated.

Companies with more than $100 million in revenue reported an average 12.25 months of backlog, representing a 3.8% gain over the previous quarter, which itself had set the previous record.

Apparently, the largest firms have recently been taking market share primarily from companies in the $30 million to $100 million range, which reported backlog declines. Companies under $30 million in revenue, on the other hand, enjoyed a modest backlog increase, and have collectively reported backlogs in excess of seven months for 11 consecutive quarters.

“Most contractors continue to express satisfaction regarding the amount of work they have under contract. This is of course truer in certain parts of the nation than others,” said Anirban Basu, ABC’s Chief Economist.

Indeed, backlogs in the West slipped in the latest quarter, even as technology generates “profound levels of activity” in markets like San Jose, Seattle, and San Diego.

ABC's data track a steady increase in national average backlogs dating back to the second quarter of 2009. Image: Associated Builders and Contractors.

Related Stories

Contractors | Sep 25, 2023

Balfour Beatty expands its operations in Tampa Bay, Fla.

Balfour Beatty is expanding its leading construction operations into the Tampa Bay area offering specialized and expert services to deliver premier projects along Florida’s Gulf Coast.

Resiliency | Sep 25, 2023

National Institute of Building Sciences, Fannie Mae release roadmap for resilience

The National Institute of Building Sciences and Fannie Mae have released the Resilience Incentivization Roadmap 2.0. The document is intended to guide mitigation investment to prepare for and respond to natural disasters.

Codes and Standards | Sep 25, 2023

Lendlease launches new protocol for Scope 3 carbon reduction

Lendlease unveiled a new protocol to monitor, measure, and disclose Scope 3 carbon emissions and called on built environment industry leaders to tackle this challenge.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.

Giants 400 | Sep 20, 2023

Top 80 Hospitality Facility Construction Firms for 2023

Suffolk Construction, The Yates Companies, STO Building Group, and PCL Construction Enterprises top BD+C's ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 18, 2023

Top 120 Office Building Construction Firms for 2023

Turner Construction, STO Building Group, AECOM, and DPR Construction top BD+C's ranking of the nation's largest office building sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all office building work, including core and shell projects and workplace/interior fitouts.

Adaptive Reuse | Sep 15, 2023

Salt Lake City’s Frank E. Moss U.S. Courthouse will transform into a modern workplace for federal agencies

In downtown Salt Lake City, the Frank E. Moss U.S. Courthouse is being transformed into a modern workplace for about a dozen federal agencies. By providing offices for agencies previously housed elsewhere, the adaptive reuse project is expected to realize an annual savings for the federal government of up to $6 million in lease costs.

Data Centers | Sep 15, 2023

Power constraints are restricting data center market growth

There is record global demand for new data centers, but availability of power is hampering market growth. That’s one of the key findings from a new CBRE report: Global Data Center Trends 2023.

Engineers | Sep 15, 2023

NIST investigation of Champlain Towers South collapse indicates no sinkhole

Investigators from the National Institute of Standards and Technology (NIST) say they have found no evidence of underground voids on the site of the Champlain Towers South collapse, according to a new NIST report. The team of investigators have studied the site’s subsurface conditions to determine if sinkholes or excessive settling of the pile foundations might have caused the collapse.

Office Buildings | Sep 14, 2023

New York office revamp by Kohn Pedersen Fox features new façade raising occupant comfort, reducing energy use

The modernization of a mid-century Midtown Manhattan office tower features a new façade intended to improve occupant comfort and reduce energy consumption. The building, at 666 Fifth Avenue, was originally designed by Carson & Lundin. First opened in November 1957 when it was considered cutting-edge, the original façade of the 500-foot-tall modernist skyscraper was highly inefficient by today’s energy efficiency standards.