U.S. architecture firms have experienced a near complete recovery from the Great Recession, which has allowed firm leaders to reinvest profits back into their businesses. These findings, along with an in depth look at topics such as firm billings, staffing, and international work, are covered in The Business of Architecture: 2016 Firm Survey Report.

Key highlights include:

- Net billings at architecture firms were $28.5 billion at the peak of the market in 2008 and had nearly recovered to $28.4 billion by 2015.

- Percentage of firms reporting a financial loss declined sharply in recent years from more than 20% in 2011 to fewer than 10% by 2015.

- Growing profitability has allowed firms to increase their marketing activities and expand into new geographical areas and building types to diversity their design portfolios.

- Renovations made up a large portion of design work with 45% of building design billings coming from work on existing facilities, including 30% from additions to buildings, and the remaining from historic preservation projects.

- Billings in the residential sector topped $7 billion, more than 30% over 2013 levels.

- Modest gains in diversity of profession with women now comprising 31% of architecture staff (up from 28% in 2013) and minorities making up 21% of staff (up from 20% in 2013).

- Use of Building Information Modeling (BIM) software has become standard at larger firms with 96% of firms with 50 or more employees report using it for billable work (compared to 72% of mid-sized firms and 28% of small firms).

- Newer technologies including 3D printing and 4D/5D modeling are reported being used at only 11% and 8% of firms respectively.

- Energy modeling currently has a low adoption rate with 13% of firms using it for billable work, although this share jumps to 59% for large firms.

“In the coming years we expect firms will be adding technological dimensions to their design work through greater utilization of cloud computing, 3D printing and the use of virtual reality software. This should help further efficiencies, minimize waste and project delivery delays, and lead to increased bottom line outcomes for their clients,” says AIA senior director of research, Michele Russo in a press release.

Related Stories

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

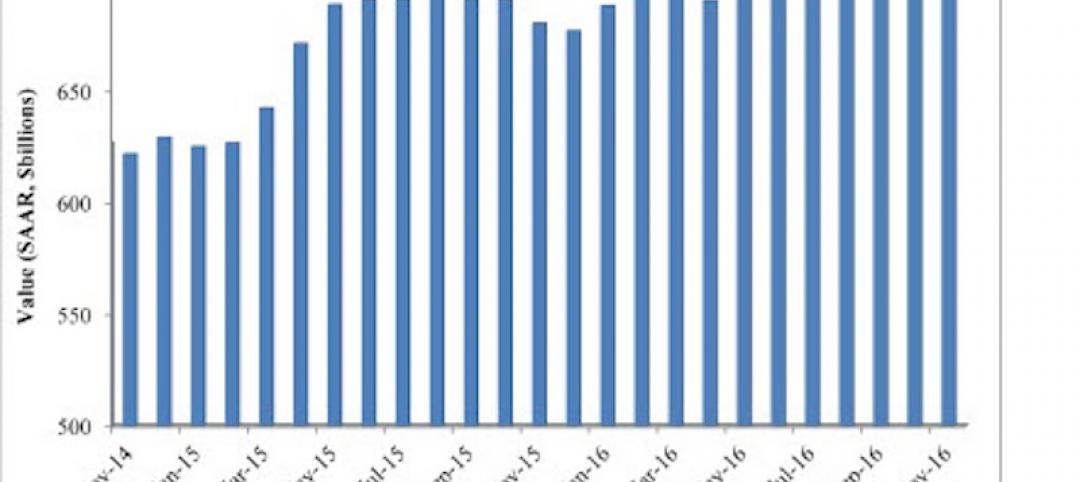

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

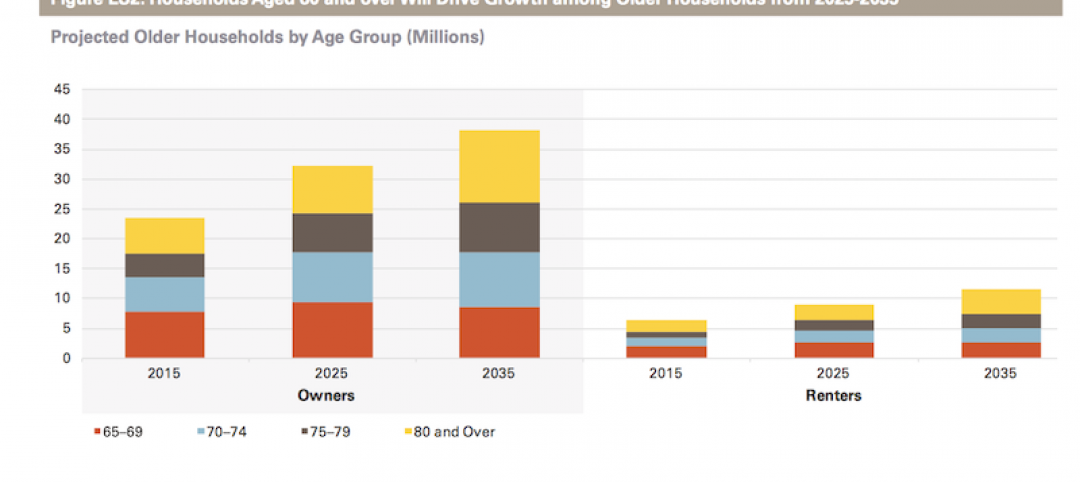

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.