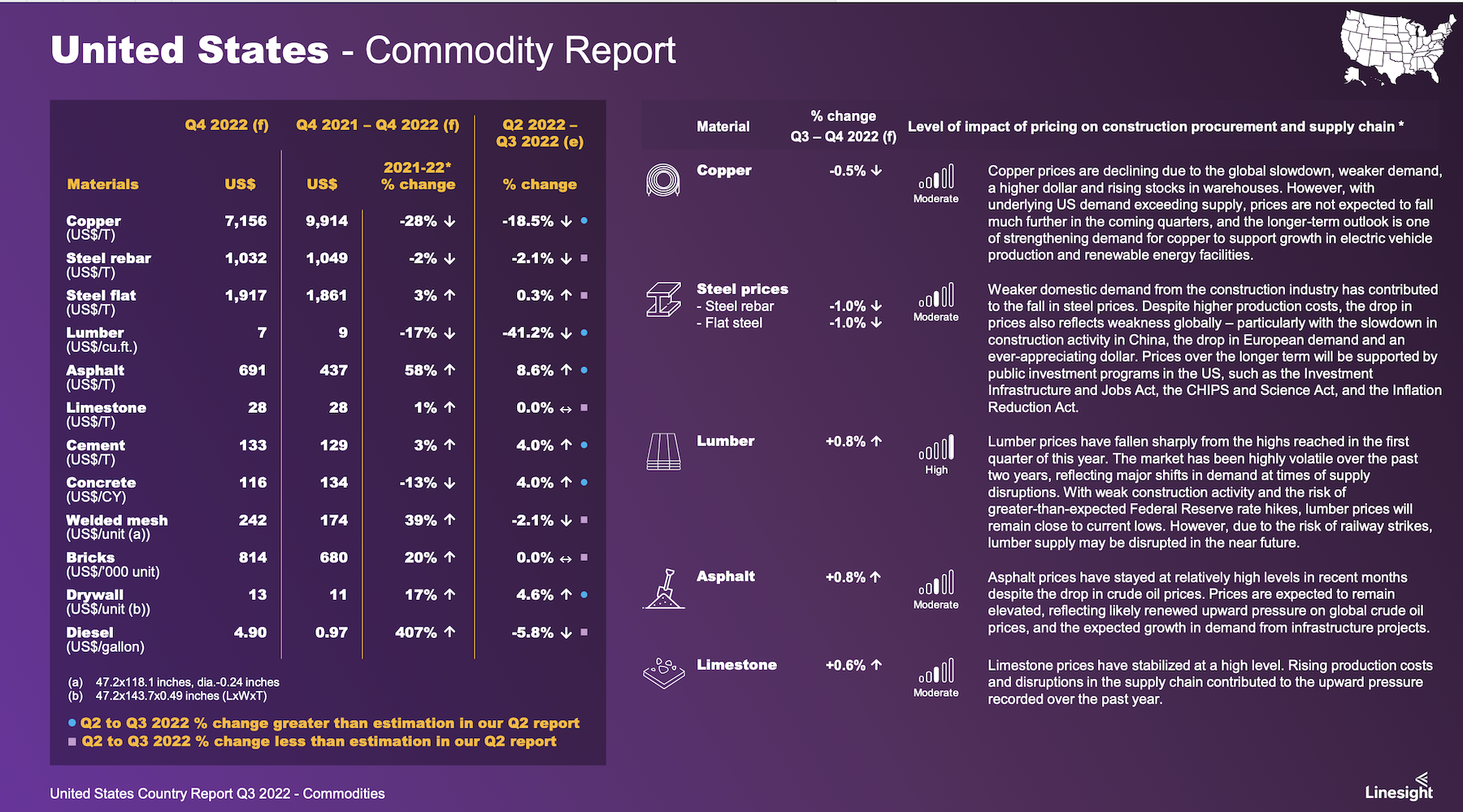

Commercial and institutional construction spending is projected to be down 6.9 percent and 13 percent, respectively, in 2022, impacted by macroeconomic factors that include increasing demand for long-lead equipment, material shortages caused by supply-chain snags and the Russia-Ukraine war, and the instability of costs for fuel and labor.

That easing of demand has allowed key commodity prices to stabilize, and there is reason for optimism despite uncertainty about the health of the U.S economy that is only expected to expand by 1 percent next year.

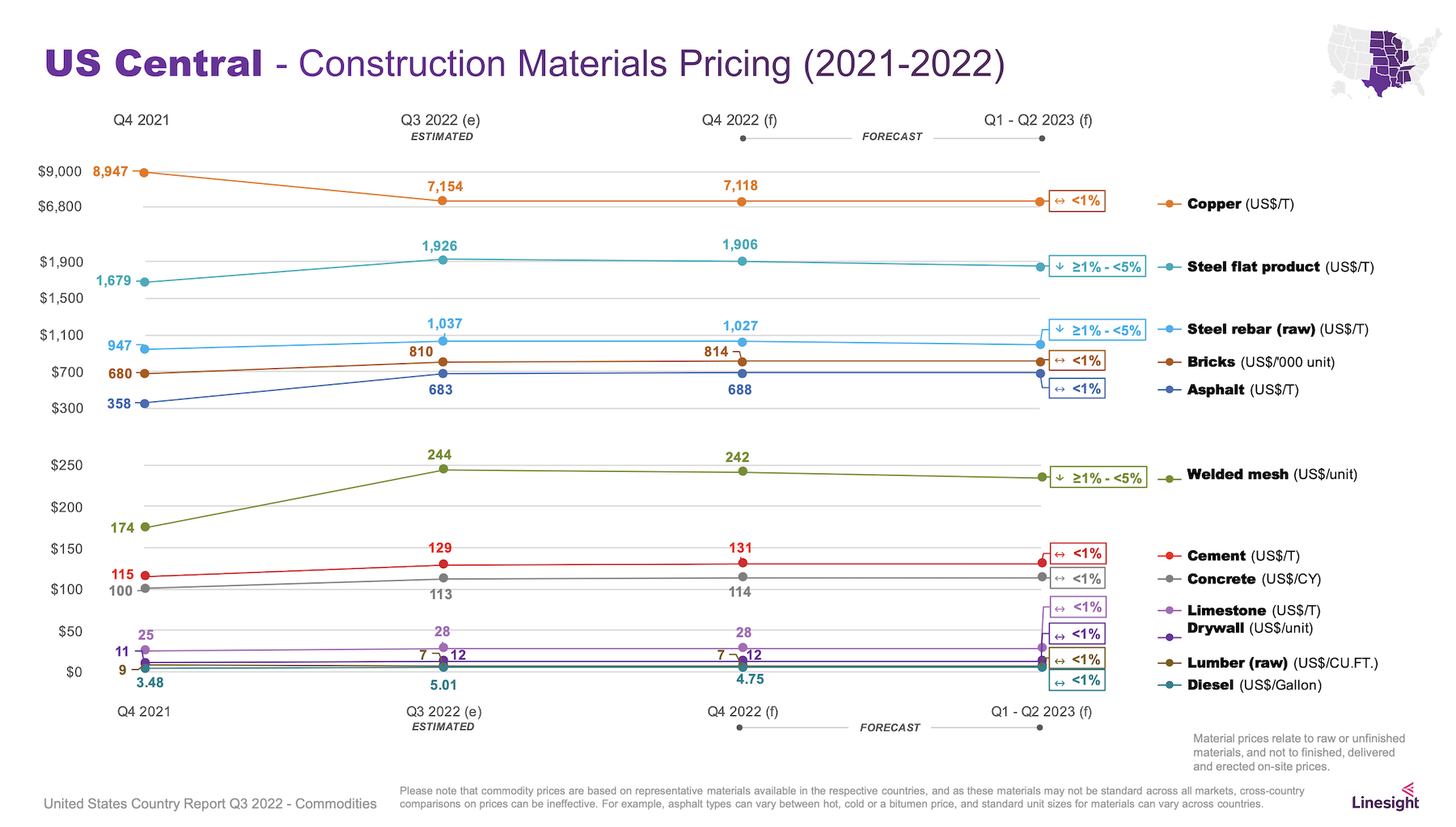

This is the perspective of Linesight, a multinational construction consultant, which has released its Third Quarter Commodity Report for the United States. Patrick Ryan, Linesight’s Executive Vice President for the Americas, states that the “medium to long-term outlook remains positive, with [economic] growth expected in the coming years as inflation comes under control.”

The Report focuses on five key commodities:

•Lumber, whose prices have been on a downward trend since the first quarter. Supply-side fragilities have eased, as post-flood mill inventory in British Columbia is rebuilding.

•Cement and aggregates, whose prices have been affected by oil price turbulence. Linesight sees the slowdown in residential construction as easing pressure on this commodity’s demand, although that could also be negated by commercial demand spurred by the Infrastructure Investment and Jobs Act of 2021.

•Concrete blocks and bricks, whose prices are waning along with residential construction demand that is tamped by rising mortgage interest rates.

•Rebar and structural steel, whose prices had flattened during the previous quarter, and whose weakening future demand, especially from China, anticipates falling prices. However, Linesight also cautions that high energy prices continue to drive up steel’s production costs.

•Copper, whose price declines of late have stabilized. Supply disruptions and the lack of investment in new mining operations continue to contribute to production shortfalls, and demand remains “resilient,” especially as the manufacture of electric vehicle batteries expands.

The Report prognosticates as well about pricing for asphalt, limestone, welded mesh, drywall, and diesel fuel. It also forecasts commodity prices by regions of the country, although the geographic variations are, for the most part, marginal.

Perhaps the most important issue right now affecting commodity prices, says Ryan, is mixed data on the economy. Despite two consecutive quarterly declines, “there are positive indicators being recorded to suggest economic resilience in some key areas,” such as the lowest unemployment rate in five decades, and the Federal Reserve’s aggressive actions to curb inflation.

Another bright spot is labor productivity in the U.S., which still outpaces Germany, the United Kingdom, Hong Kong, Taiwan, South Korea, and Japan.

Related Stories

Market Data | Mar 29, 2017

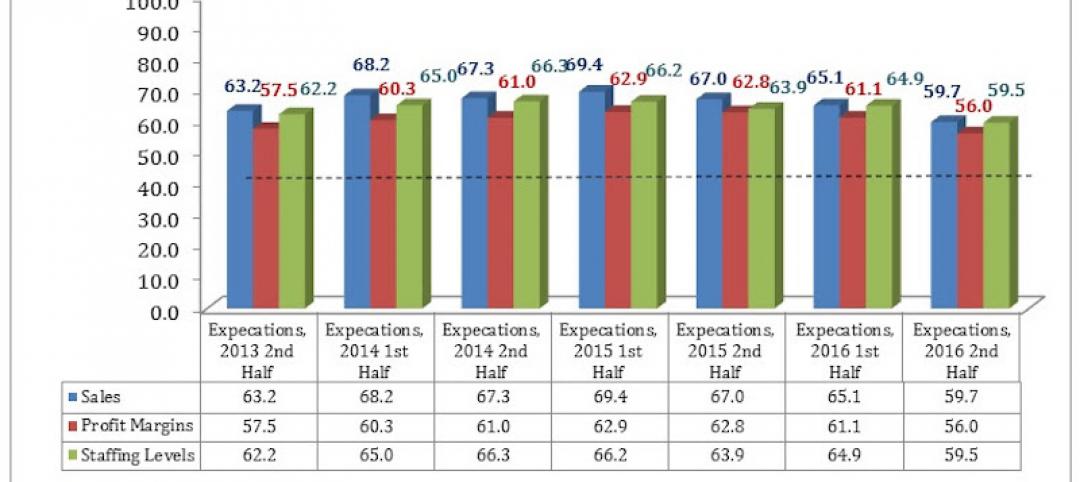

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

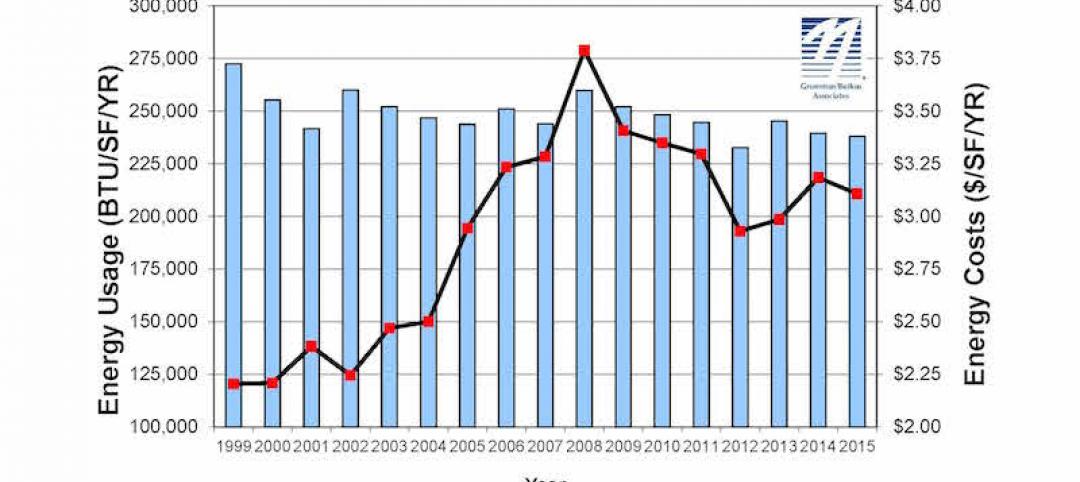

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

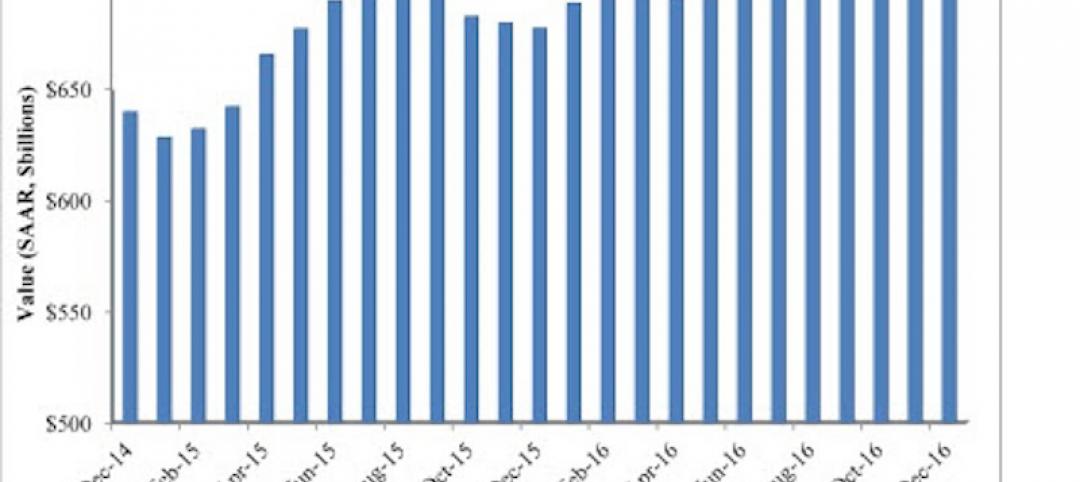

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.