The resolution of global construction disputes remained steady in 2016, and the average time it took to resolve those disputes declined bit, according to the seventh annual Arcadis Global Construction Disputes Report 2017, which is subtitled “Avoiding the Same Pitfalls.”

This report reflects the construction disputes that Arcadis’ team handled around the world. The report infers that the roadblocks to expeditious and less cost dispute resolution often stem from the need for better contract administration, robust documentation, and a proactive approach to risk management.

“Our industry contains the best problem solvers in the world,” the report states. “But there often seems to be a lack of ability or willingness of the project participants to compromise and resolve disputes at the earliest and most inexpensive stage possible.” Roy Cooper, Senior Vice President of Arcadis Contract Solutions, attributes disputes to “human emotions that can impede settlements, as they do with physical factors such as differing site conditions and design errors.”

The world’s economic expansion generally is not seen as an impediment to resolving contract disputes. Global growth is projected at 3.5% in 2017, and 3.6% in 2018, according to the International Monetary Fund.

While the outlook is positive, the report sees risks in labor contraction, increasing commodities prices, and uncertain immigration policies. “A potential widening of global imbalances, coupled with sharp currency exchange rate movements, should those occur in response to major policy shifts, could further intensify protectionist pressures.”

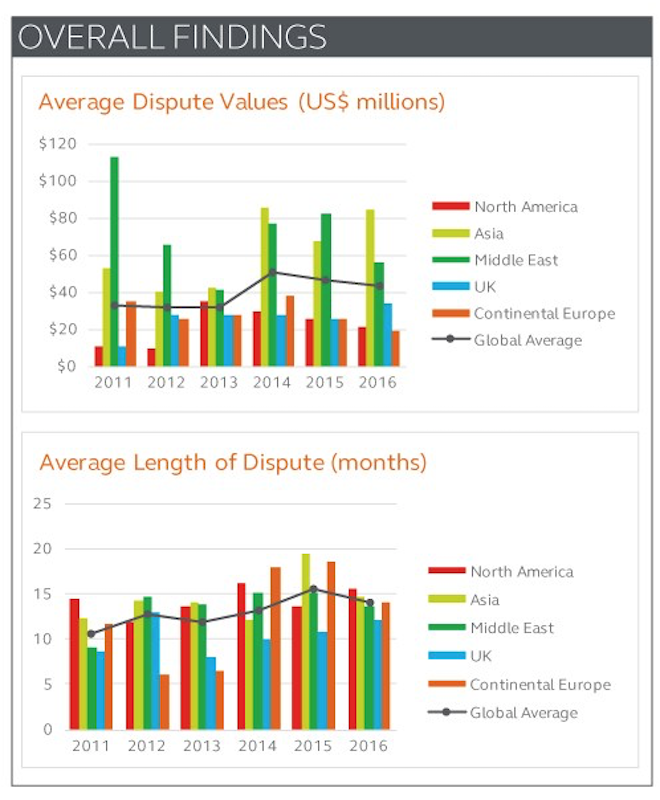

A summary of Arcadis' findings for 2016. Image: Arcadis US

That being said, the global average construction dispute value declined in 2016 by nearly 7% to US$42.8 million (and that includes one US$2 billion dispute Arcadis handled). Asia averaged the highest dispute value, at US$84 million, and the United Kingdom saw a double-digit increase in its average dispute value, to US$34 million.

The global average length of a dispute also fell slightly last year, to 14 months. North America’s dispute duration was the longest of all Arcadis’ regions, an average of 15.6 months. For the third consecutive year, the most common cause for disputes in North America in 2016 was errors and/or omissions in the contract documentation.

Asia had the highest average dispute value last year; North America the longest time it took to resolve a dispute. Image: Arcadis

Globally, Arcadis identifies failure to properly administer a contract among the five most common causes of disputes, along with poorly drafted or incomplete/unsubstantiated claims; the failure of an employer, contractor or subcontractor to understand or comply with its contractual obligations; errors and omissions in the contract; and incomplete design information or employer requires.

The most common methods to resolve construction disputes were, in order of preference, party-to-party negotiation, arbitration, and mediation.

And the most important activities to avoid disputes were led by proper contract administration, accurate documents, and fair and appropriate risk and balances in contracts.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.