Construction employment increased in 248 out of 358 metro areas between January 2017 and January 2018, declined in 68 and stagnated in 42, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that future construction job gains could be undermined, however, as new tariffs force contractors to pay more for steel and aluminum products and dampen demand for new construction.

"The new tariffs are already leading to increases in what many contractors are paying for steel and aluminum products," said Ken Simonson, the association's chief economist. "Most contractors will be unable to pass along these increased costs, leaving less money to invest, ironically, in steel construction equipment as well as personnel."

Riverside-San Bernardino-Ontario, Calif. added the most construction jobs during the past year (10,600 jobs, 12%), followed by Phoenix-Mesa-Scottsdale, Ariz. (9,900 jobs, 9%); Houston-The Woodlands-Sugar Land, Texas (9,200 jobs, 4%); Los Angeles-Long Beach-Glendale, Calif. (9,000 jobs, 7%) and Sacramento--Roseville--Arden-

The largest job losses from January 2017 to January 2018 were in Baton Rouge, La. (-6,600 jobs, -13%), followed by St. Louis, Mo.-Ill. (-3,300 jobs, -5%); Montgomery County-Bucks County-Chester County, Pa. (-2,600 jobs, -5%); Columbia, S.C. (-2,500 jobs, -12%) and Camden, N.J. (-1,700 jobs, -8%). The largest percentage decreases for the year were in Auburn-Opelika, Ala. (-32%, -1,200 jobs) followed by Monroe, Mich. (-16%, -300 jobs); Baton Rouge and Columbia, S.C.

Association officials said that a better way to support the domestic steel and aluminum industrie s is to increase funding for needed infrastructure improvements. They cautioned that the tariffs announcement by the President last week would not only increase the cost of many construction projects, but it could prompt retaliatory measures from other countries that hurt U.S. manufacturers and shippers, impacting demand for new factories and transportation facilities.

"Boosting demand for their products is a much better way to strengthen the domestic steel and aluminum industries," said Stephen E. Sandherr, the association's chief executive officer. "And the best way to boost demand is to finally begin making the investments needed to improve the nation's aging and over-burdened infrastructure."

View the metro employment data by rank and state. View metro employment map.

Related Stories

Market Data | Sep 3, 2019

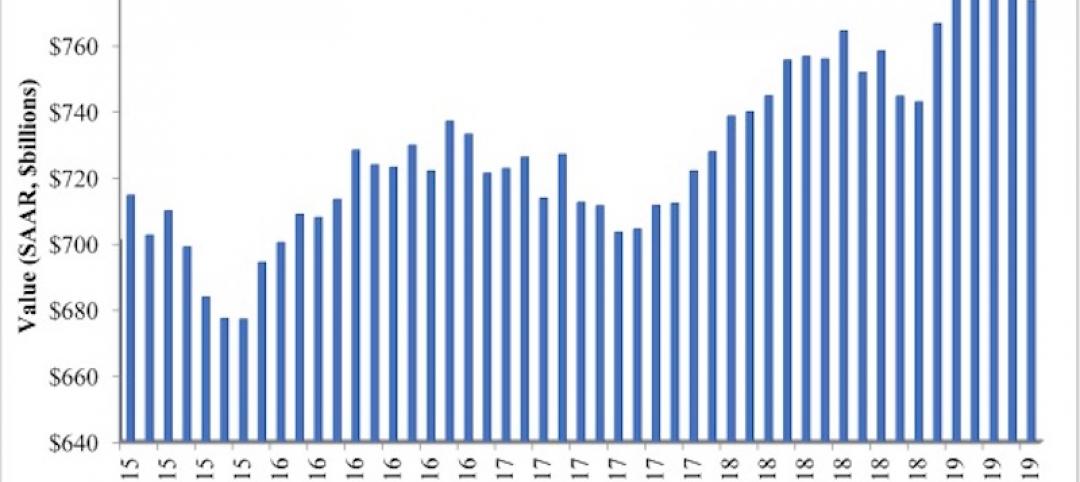

Nonresidential construction spending slips in July 2019, but still surpasses $776 billion

Construction spending declined 0.3% in July, totaling $776 billion on a seasonally adjusted annualized basis.

Industry Research | Aug 29, 2019

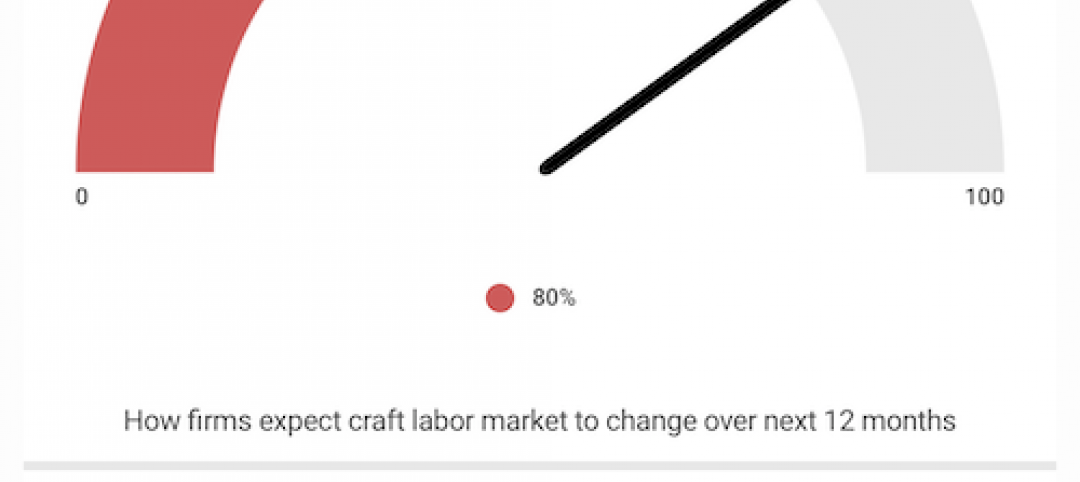

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.

Market Data | Aug 21, 2019

Architecture Billings Index continues its streak of soft readings

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Aug 19, 2019

Multifamily market sustains positive cycle

Year-over-year growth tops 3% for 13th month. Will the economy stifle momentum?

Market Data | Aug 16, 2019

Students say unclean restrooms impact their perception of the school

The findings are part of Bradley Corporation’s Healthy Hand Washing Survey.

Market Data | Aug 12, 2019

Mid-year economic outlook for nonresidential construction: Expansion continues, but vulnerabilities pile up

Emerging weakness in business investment has been hinting at softening outlays.

Market Data | Aug 7, 2019

National office vacancy holds steady at 9.7% in slowing but disciplined market

Average asking rental rate posts 4.2% annual growth.

Market Data | Aug 1, 2019

Nonresidential construction spending slows in June, remains elevated

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, seven experienced increases in monthly spending.

Market Data | Jul 31, 2019

For the second quarter of 2019, the U.S. hotel construction pipeline continued its year-over-year growth spurt

The growth spurt continued even as business investment declined for the first time since 2016.

Market Data | Jul 23, 2019

Despite signals of impending declines, continued growth in nonresidential construction is expected through 2020

AIA’s latest Consensus Construction Forecast predicts growth.