Construction employment increased in 248 out of 358 metro areas between January 2017 and January 2018, declined in 68 and stagnated in 42, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that future construction job gains could be undermined, however, as new tariffs force contractors to pay more for steel and aluminum products and dampen demand for new construction.

"The new tariffs are already leading to increases in what many contractors are paying for steel and aluminum products," said Ken Simonson, the association's chief economist. "Most contractors will be unable to pass along these increased costs, leaving less money to invest, ironically, in steel construction equipment as well as personnel."

Riverside-San Bernardino-Ontario, Calif. added the most construction jobs during the past year (10,600 jobs, 12%), followed by Phoenix-Mesa-Scottsdale, Ariz. (9,900 jobs, 9%); Houston-The Woodlands-Sugar Land, Texas (9,200 jobs, 4%); Los Angeles-Long Beach-Glendale, Calif. (9,000 jobs, 7%) and Sacramento--Roseville--Arden-

The largest job losses from January 2017 to January 2018 were in Baton Rouge, La. (-6,600 jobs, -13%), followed by St. Louis, Mo.-Ill. (-3,300 jobs, -5%); Montgomery County-Bucks County-Chester County, Pa. (-2,600 jobs, -5%); Columbia, S.C. (-2,500 jobs, -12%) and Camden, N.J. (-1,700 jobs, -8%). The largest percentage decreases for the year were in Auburn-Opelika, Ala. (-32%, -1,200 jobs) followed by Monroe, Mich. (-16%, -300 jobs); Baton Rouge and Columbia, S.C.

Association officials said that a better way to support the domestic steel and aluminum industrie s is to increase funding for needed infrastructure improvements. They cautioned that the tariffs announcement by the President last week would not only increase the cost of many construction projects, but it could prompt retaliatory measures from other countries that hurt U.S. manufacturers and shippers, impacting demand for new factories and transportation facilities.

"Boosting demand for their products is a much better way to strengthen the domestic steel and aluminum industries," said Stephen E. Sandherr, the association's chief executive officer. "And the best way to boost demand is to finally begin making the investments needed to improve the nation's aging and over-burdened infrastructure."

View the metro employment data by rank and state. View metro employment map.

Related Stories

Market Data | Feb 28, 2019

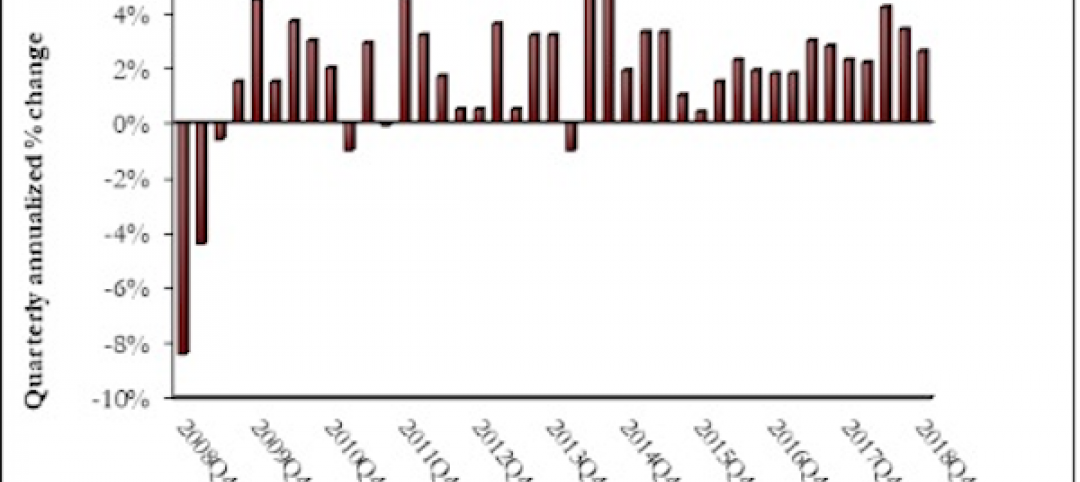

U.S. economic growth softens in final quarter of 2018

Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.

Market Data | Feb 20, 2019

Strong start to 2019 for architecture billings

“The government shutdown affected architecture firms, but doesn’t appear to have created a slowdown in the profession,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD, in the latest ABI report.

Market Data | Feb 19, 2019

ABC Construction Backlog Indicator steady in Q4 2018

CBI reached a record high of 9.9 months in the second quarter of 2018 and averaged about 9.1 months throughout all four quarters of last year.

Market Data | Feb 14, 2019

U.S. Green Building Council announces top 10 countries and regions for LEED green building

The list ranks countries and regions in terms of cumulative LEED-certified gross square meters as of December 31, 2018.

Market Data | Feb 13, 2019

Increasingly tech-enabled construction industry powers forward despite volatility

Construction industry momentum to carry through first half of 2019.

Market Data | Feb 4, 2019

U.S. Green Building Council announces annual Top 10 States for LEED Green Building in 2018

Illinois takes the top spot as USGBC defines the next generation of green building with LEED v4.1.

Market Data | Feb 4, 2019

Nonresidential construction spending dips in November

Total nonresidential spending stood at $751.5 billion on a seasonally adjusted annualized rate.

Market Data | Feb 1, 2019

The year-end U.S. hotel construction pipeline continues steady growth trend

Project counts in the early planning stage continue to rise reaching an all-time high of 1,723 projects/199,326 rooms.

Market Data | Feb 1, 2019

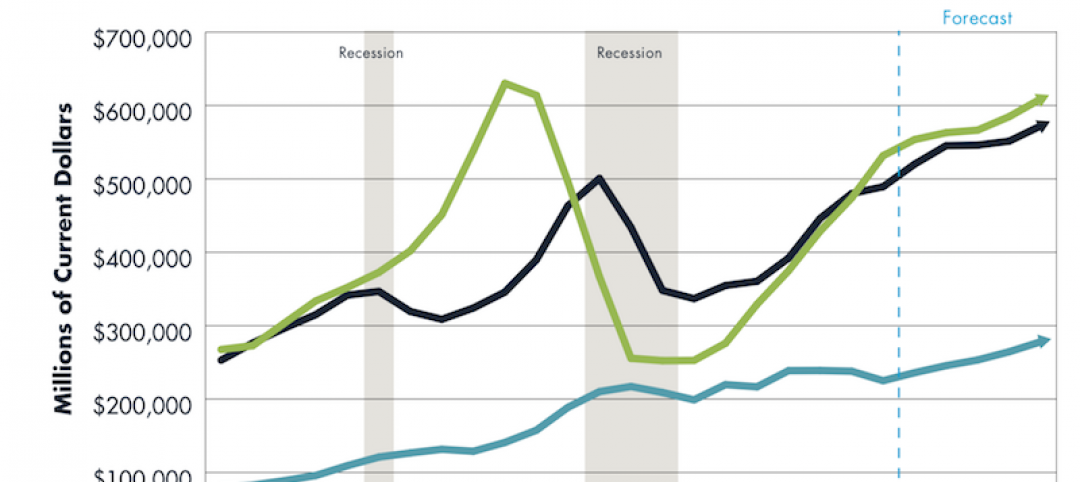

Construction spending is projected to increase by more than 11% through 2022

FMI’s annual outlook also expects the industry’s frantic M&A activity to be leavened by caution going forward.

Market Data | Jan 23, 2019

Architecture billings slow, but close 2018 with growing demand

AIA’s Architecture Billings Index (ABI) score for December was 50.4 compared to 54.7 in November.