Construction employment declined in 91 metro areas and was stagnant in another 24 between February 2020, the last month before the pandemic, and May 2021, according to an analysis by the Associated General Contractors of America of government employment data released today. They said the high number of metro areas losing construction jobs during that time frame reflected the impacts of early pandemic shutdowns and more recent challenges procuring construction materials and finding qualified workers to hire.

“The devastating job losses of early 2020 and more recent materials and labor challenges since then have kept industry employment stagnant or lower this May than in February 2020 in nearly one-third of metros,” said Ken Simonson, the association’s chief economist. “Extreme lead times for producing and delivering materials, along with record prices for many items, has led to project delays and cancellations that have chilled hiring.”

Of the 91 metro areas with lower construction employment in May 2021 than in February 2020, Houston-The Woodlands-Sugar Land, Texas lost the most jobs: 30,500 or 13%. Major losses also occurred in New York City (-21,200 jobs, -13%); Midland, Texas (-9,600 jobs, -25%) and Odessa, Texas (-8,300 jobs, -40%). Odessa had the largest percentage decline, followed by Lake Charles, La. (-36%, -7,200 jobs); Midland; Laredo, Texas (-23%, -900 jobs) and Longview, Texas (-22%, -3,300 jobs).

Construction employment increased in 243 metro areas compared to the February 2020 level—far fewer than the 320 metros that typically add construction jobs between February and May, Simonson noted. Minneapolis-St. Paul-Bloomington, Minn.-Wis. added the most construction jobs over 15 months (11,100 jobs, 14%), followed by Indianapolis-Carmel-Anderson, Ind. (10,900 jobs, 21%); Chicago-Naperville-Arlington Heights, Ill. (10,300 jobs, 9%); Seattle-Bellevue-Everett, Wash. (6,900 jobs, 7%); and Pittsburgh, Pa. (6,900 jobs, 12%). Fargo, N.D.-Minn. had the highest percentage increase (45%, 3,300 jobs), followed by Sierra Vista-Douglas, Ariz. (44%, 1,100 jobs); and Bay City, Mich. (36%, 400 jobs).

Association officials said that many construction firms report challenges with rising materials prices, supply chain problems that are leading to delivery delays for key components and challenges finding qualified labor to hire. They urged the Biden administration and Congress to work together to remove tariffs on key construction materials, ease supply chain shortages and boost investments in career and technical education. They added that the association posted an updated Construction Inflation Alert to inform owners and officials about the worsening problems with rising materials costs, shipping delays and labor shortages.

“It is hard for the construction industry to grow while firms struggle to pay for and source key materials and have a hard time finding qualified workers to hire,” said Stephen E. Sandherr, the association’s chief executive officer. “Federal officials can help the industry and boost the economy by removing tariffs, easing supply chain backups and investing in workforce development.”

View the metro employment data, rankings, top 10, multi-division metros, and map. View the Alert.

Related Stories

Market Data | Nov 2, 2018

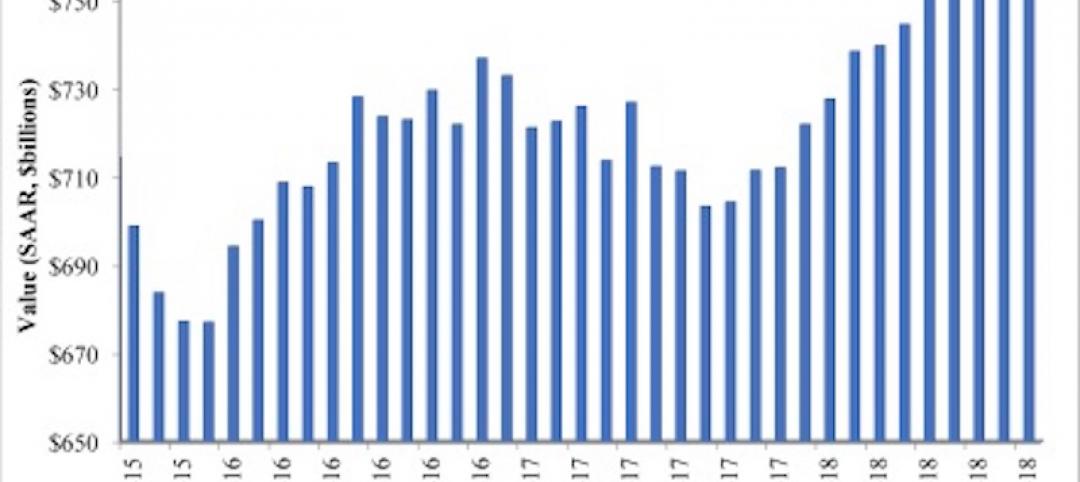

Nonresidential spending retains momentum in September, up 8.9% year over year

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

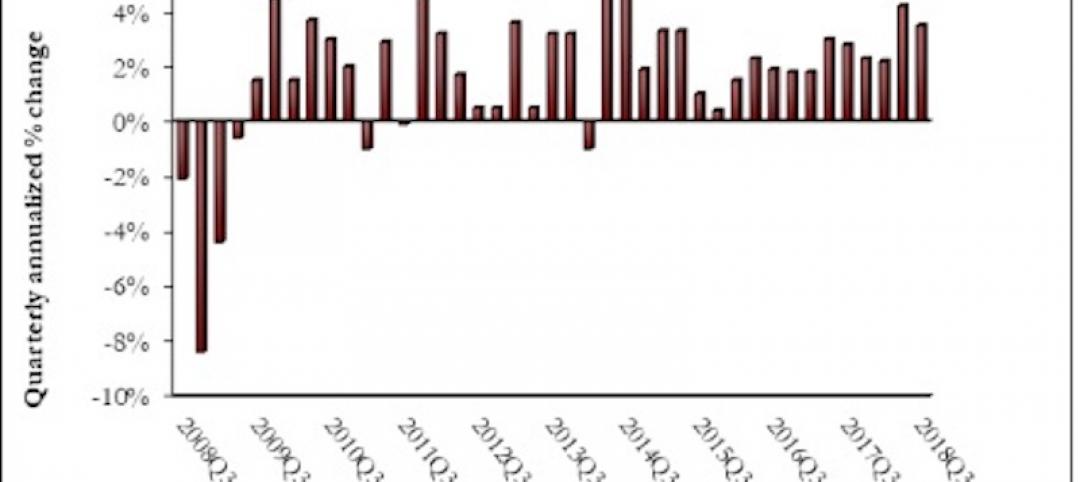

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

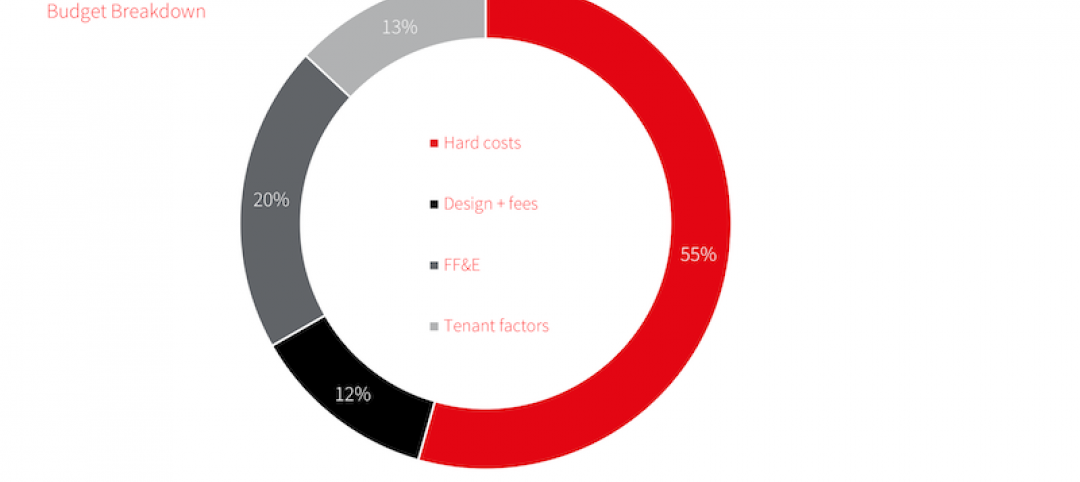

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.