Construction employment declined in 91 metro areas and was stagnant in another 24 between February 2020, the last month before the pandemic, and May 2021, according to an analysis by the Associated General Contractors of America of government employment data released today. They said the high number of metro areas losing construction jobs during that time frame reflected the impacts of early pandemic shutdowns and more recent challenges procuring construction materials and finding qualified workers to hire.

“The devastating job losses of early 2020 and more recent materials and labor challenges since then have kept industry employment stagnant or lower this May than in February 2020 in nearly one-third of metros,” said Ken Simonson, the association’s chief economist. “Extreme lead times for producing and delivering materials, along with record prices for many items, has led to project delays and cancellations that have chilled hiring.”

Of the 91 metro areas with lower construction employment in May 2021 than in February 2020, Houston-The Woodlands-Sugar Land, Texas lost the most jobs: 30,500 or 13%. Major losses also occurred in New York City (-21,200 jobs, -13%); Midland, Texas (-9,600 jobs, -25%) and Odessa, Texas (-8,300 jobs, -40%). Odessa had the largest percentage decline, followed by Lake Charles, La. (-36%, -7,200 jobs); Midland; Laredo, Texas (-23%, -900 jobs) and Longview, Texas (-22%, -3,300 jobs).

Construction employment increased in 243 metro areas compared to the February 2020 level—far fewer than the 320 metros that typically add construction jobs between February and May, Simonson noted. Minneapolis-St. Paul-Bloomington, Minn.-Wis. added the most construction jobs over 15 months (11,100 jobs, 14%), followed by Indianapolis-Carmel-Anderson, Ind. (10,900 jobs, 21%); Chicago-Naperville-Arlington Heights, Ill. (10,300 jobs, 9%); Seattle-Bellevue-Everett, Wash. (6,900 jobs, 7%); and Pittsburgh, Pa. (6,900 jobs, 12%). Fargo, N.D.-Minn. had the highest percentage increase (45%, 3,300 jobs), followed by Sierra Vista-Douglas, Ariz. (44%, 1,100 jobs); and Bay City, Mich. (36%, 400 jobs).

Association officials said that many construction firms report challenges with rising materials prices, supply chain problems that are leading to delivery delays for key components and challenges finding qualified labor to hire. They urged the Biden administration and Congress to work together to remove tariffs on key construction materials, ease supply chain shortages and boost investments in career and technical education. They added that the association posted an updated Construction Inflation Alert to inform owners and officials about the worsening problems with rising materials costs, shipping delays and labor shortages.

“It is hard for the construction industry to grow while firms struggle to pay for and source key materials and have a hard time finding qualified workers to hire,” said Stephen E. Sandherr, the association’s chief executive officer. “Federal officials can help the industry and boost the economy by removing tariffs, easing supply chain backups and investing in workforce development.”

View the metro employment data, rankings, top 10, multi-division metros, and map. View the Alert.

Related Stories

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

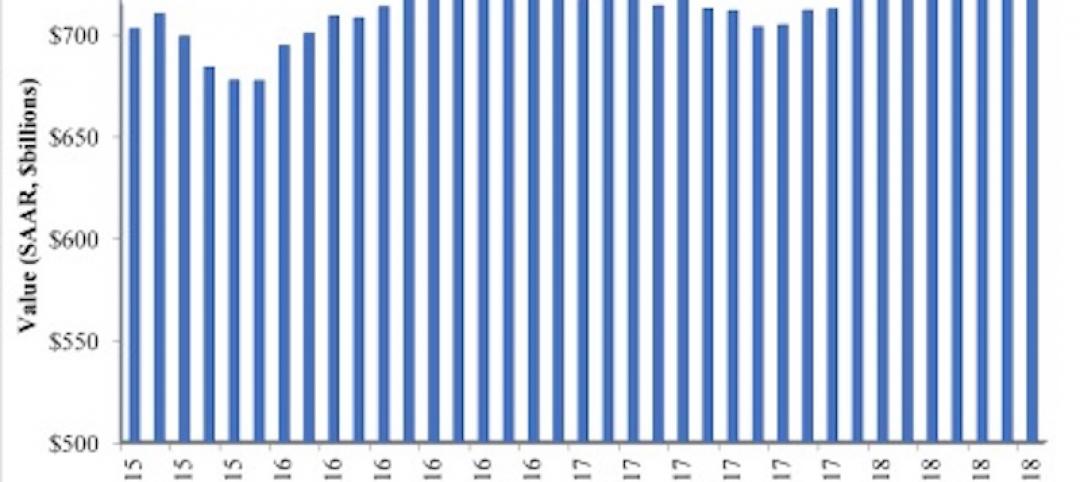

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.