Construction employment stagnated in January, ending eight months of recovery from the pandemic-related losses of early 2020, according to an analysis by the Associated General Contractors of America of government data released today. Association officials added that new measures being considered in Congress, including the PRO Act and the National Apprenticeship Act, threaten to undermine the sector’s recovery by disrupting ongoing projects and hampering employers’ ability to train workers.

“The stagnation in construction employment in January may foreshadow further deterioration in the industry as projects that had started before the pandemic finish up and owners hold off on awarding new work,” said Ken Simonson, the association’s chief economist. “With so much of the economy still shut down or operating at reduced levels, it will likely be a long time before many nonresidential contractors are ready to hire again.”

Construction employment dipped by 3,000 to 7,392,000 in January from a downwardly revised December total. Employment in the sector remains 256,000 or 3.3% lower than in February 2020, the most recent peak.

Nonresidential construction has had a much weaker recovery than homebuilding and home improvement construction, Simonson added. While both parts of the industry had huge job losses in early 2020 from the pre-pandemic peak in February to April, residential building and specialty trade contractors have now recouped all of the employment losses they incurred. In contrast, nonresidential construction employment—comprising nonresidential building, specialty trades, and heavy and civil engineering construction—was 259,000 or 5.5% lower in January than in February 2020. Only 60% of the job losses in nonresidential construction had been erased as of last month.

Unemployment in construction soared over the past 12 months. The industry’s unemployment rate in January was 9.4%, compared to 5.4% in January 2020. A total of 938,000 former construction workers were unemployed, up from 515,000 a year earlier. Both figures were the highest for January since 2015.

Association officials warned that the newly-introduced PRO Act would hurt construction workers and demand for future projects by unleashing a new wave of labor unrest that could put a halt to many types of construction projects, even those that are not directly involved in a labor dispute with a union. Meanwhile, the National Apprenticeship Act seeks to deny federal funding to registered apprenticeship programs that are not operated with unions. This would undermine the ability of many firms across the country to train and prepare workers.

“Instead of finding ways to build back better, these new congressional proposals would leave many workers unpaid and untrained while projects languish, unfinished,” said Stephen E. Sandherr, the association’s chief executive officer. “It is hard to see how cutting funding to training programs, undermining workers, and crippling the economy will help put more people back to work in construction or other fields.”

Related Stories

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

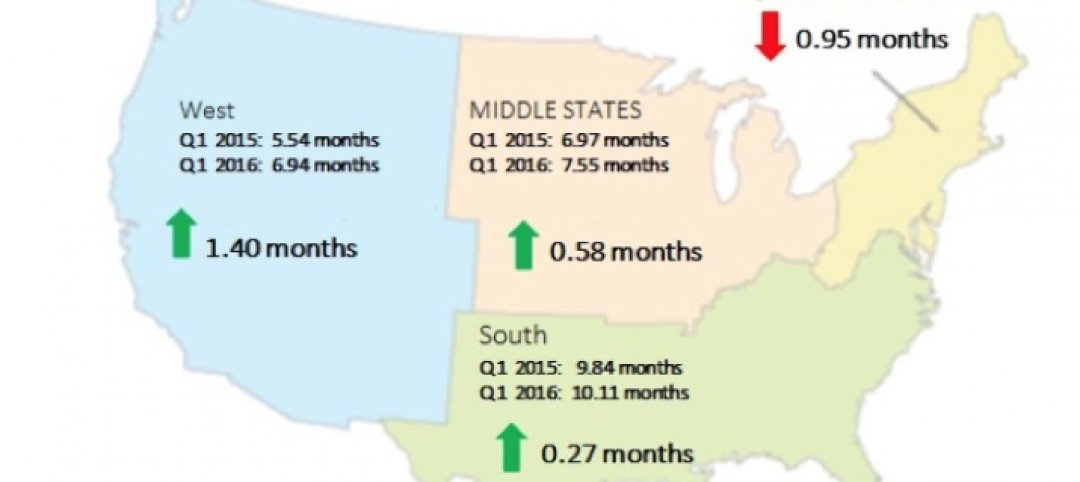

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.