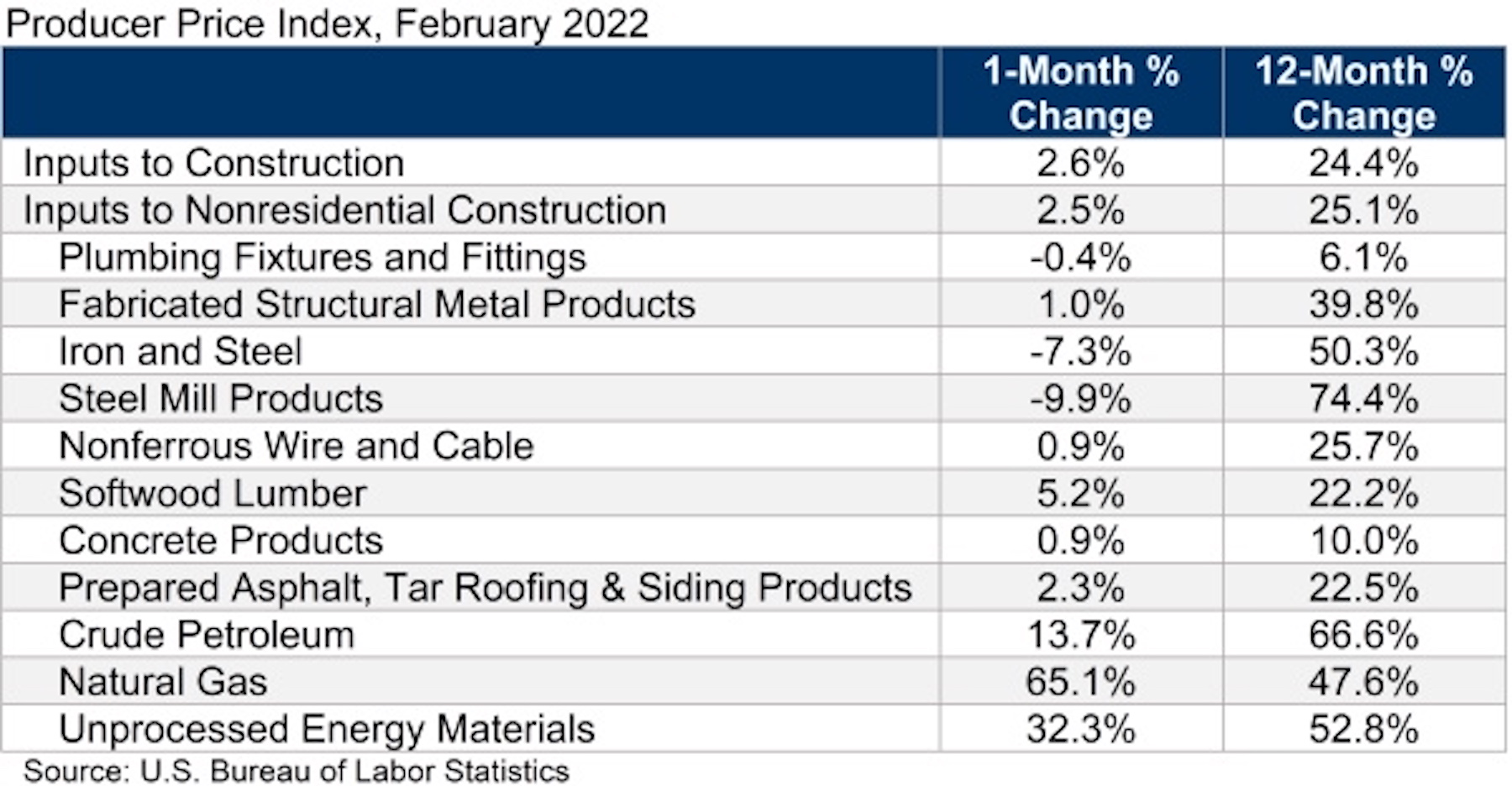

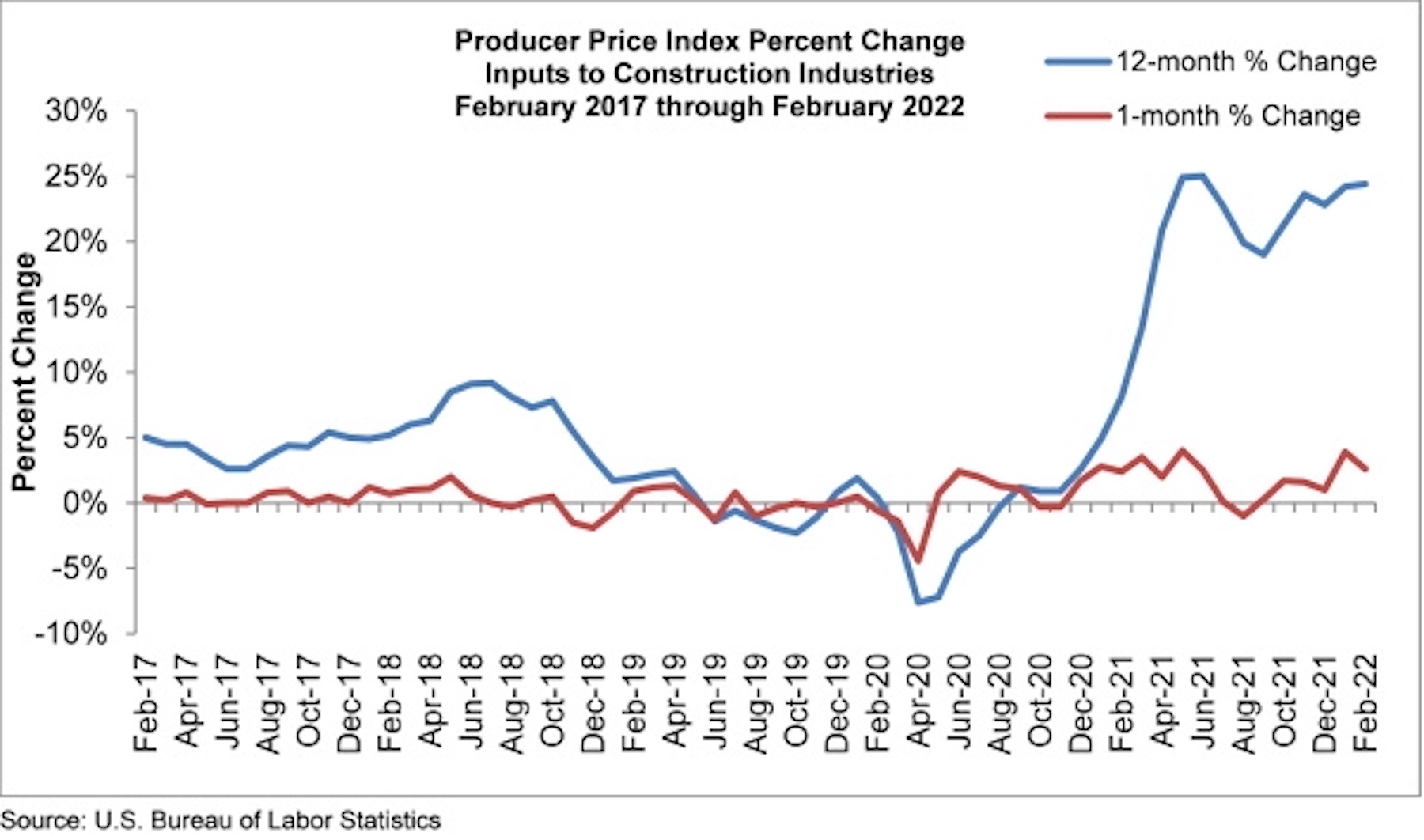

Construction input prices increased 2.6% in February compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices rose 2.5% for the month.

Construction input prices are up 24.4% from a year ago, while nonresidential construction input prices are up 25.1%. Input prices for natural gas and unprocessed energy materials increased for the month, rising 65.1% and 32.3%, respectively. Crude petroleum prices increased 13.7% in February. All three energy subcategories are up significantly on a year-over-year basis.

“It will get worse before it gets better,” said ABC Chief Economist Anirban Basu. “Not only has Russia’s assault on democratic Ukraine created supply challenges in a number of categories, including oil and natural gas, but the reemergence of COVID-19 in parts of Asia and Europe is also poised to produce additional impacts. While many still expect commodity prices to decline later this year, the wait has been meaningfully extended by geopolitical conflicts and ongoing COVID-19 lockdowns.

“For contractors, this has the potential to put even more downward pressure on margins,” said Basu. “It is likely that, as bid prices continue to soar, more project owners will choose to delay project starts. The current state of affairs also creates complications for public agencies considering when to start large-scale infrastructure projects. It is a challenging time to begin such projects, given the workforce shortages that remain and materials price inflation. Undoubtedly, some public administrators will decide to extend planning time, delaying project start dates.

“Remarkably, many projects to date have continued to move forward,” said Basu. “Construction backlog, as measured by ABC’s Construction Backlog Indicator, has remained stable for several months in the wake of rapidly rising materials prices. It remains to be seen whether this stability can prove resilient in the face of additional, severe supply challenges.”

Related Stories

Multifamily Housing | Aug 12, 2019

Multifamily Amenities 2019: Rethinking the $30,000 cup of coffee

What amenities are “must-have” rather than “nice to have” for the local market? Which amenities will attract the renters or buyers you’re targeting? The 2019 Multifamily Amenities Survey measured 113 amenity choices.

Codes and Standards | Jun 27, 2019

Public restrooms being used for changing clothes, phone conversations, and 'getting away'

About 60% of Americans use a public restroom one to five times a week, according to the latest annual hand washing survey conducted by Bradley Corporation.

Industry Research | Jun 11, 2019

New research suggests individual work spaces increase productivity

The research was conducted by Perkins Eastman and Three H.

Industry Research | Apr 8, 2019

New research finds benefits to hiring architectural services based on qualifications

Government agencies gain by evaluating beyond price, according to a new Dodge survey of government officials.

Office Buildings | Jul 17, 2018

Transwestern report: Office buildings near transit earn 65% higher lease rates

Analysis of 15 major metros shows the average rent in central business districts was $43.48/sf for transit-accessible buildings versus $26.01/sf for car-dependent buildings.

Market Data | May 29, 2018

America’s fastest-growing cities: San Antonio, Phoenix lead population growth

San Antonio added 24,208 people between July 2016 and July 2017, according to U.S. Census Bureau data.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Market Data | Jan 29, 2018

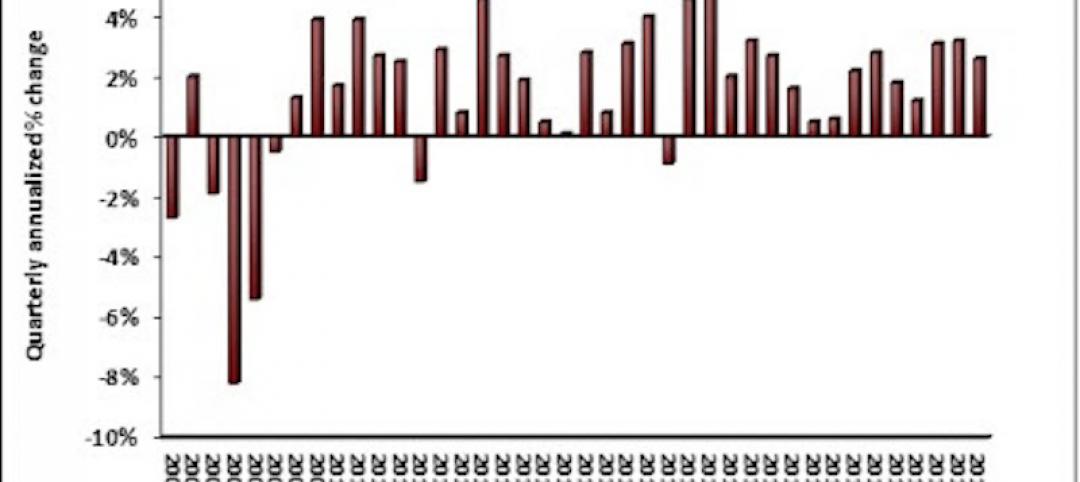

Year-end data show economy expanded in 2017; Fixed investment surged in fourth quarter

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017.

Market Data | Jan 25, 2018

Renters are the majority in 42 U.S. cities

Over the past 10 years, the number of renters has increased by 23 million.