Construction employment rebounded by 464,000 jobs in May, but the total remained 596,000 below the latest peak in February and the industry’s 12.7 percent unemployment rate was the highest for May since 2012, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned that the future job losses are likely as temporary federal support programs end, state and local officials deal with tighter budgets and private sector demand declines later this year.

“The huge pickup in construction employment in May is good news and probably reflects the industry’s widespread receipt of Paycheck Protection Program loans and the loosening of restrictions on business activity in some states,” said Ken Simonson, the association’s chief economist. “Nevertheless, the industry remains far short of full employment, and more layoffs may be imminent.

Simonson noted that the association’s latest survey found that nearly one-fourth of contractors reported a project that was scheduled to start in June or later had been canceled. He added that with most states and localities starting a new fiscal year on July 1, even more public construction is likely to be canceled unless the federal government makes up for some of their lost revenue and unbudgeted expenses.

The gain of 464,000 jobs in May followed losses of 995,000 in April and 65,000 in March, for a cumulative loss over three months of 596,000. Construction employment totaled 7,043,000 in May, about where it stood in late 2017, the economist noted.

The industry’s unemployment rate in May was 12.7 percent, with 1,187,000 former construction workers idled. These figures were roughly four times as high as in May 2019 and were the highest May levels since 2012 and 2011, respectively.

Association officials said the best way to avoid the expected future construction job losses is for federal officials to boost funding for infrastructure, including highway, bridges, waterways and airports. They noted that the additional funding would help cover expected state and local budget shortfalls and would help replace expected declines in private-sector demand.

“Government officials have done a good job providing temporary relief for firms struggling to cope with the economic impacts of the pandemic,” said Stephen E. Sandherr, the association’s chief executive officer. “As those temporary supports end, the broader economic realities of the lock-downs will cost countless construction jobs unless Congress and the Administration can work together to enact measures to revive the economy.”

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

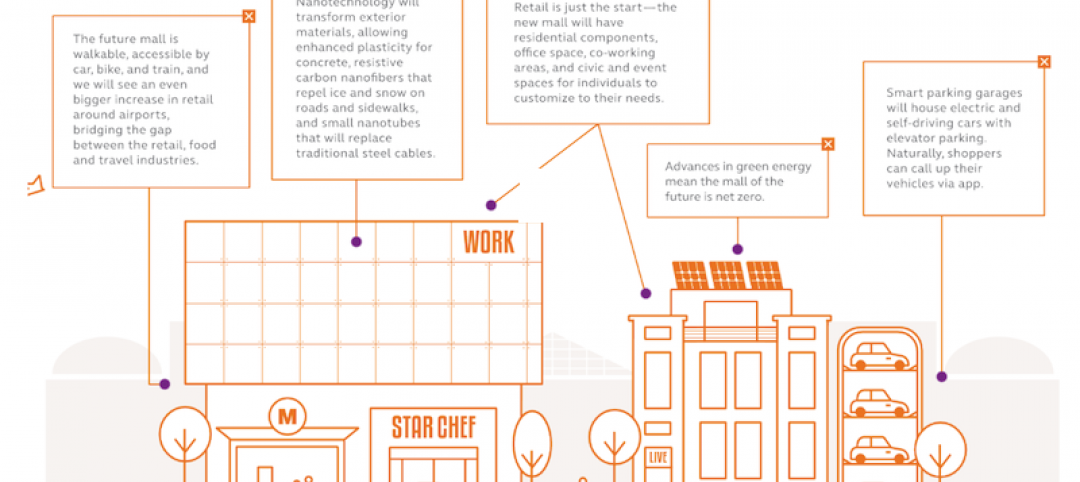

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.