A total of 6,645 planned and ongoing construction projects by the world’s megacities, valued at US$4.2trn and fueled by the increase in population, are sparking interest in residential and infrastructural developments, according to GlobalData.

The United Nations predicts that, between 2016 and 2030, the percentage of the world's population living in cities with at least a million inhabitants is likely to grow from 23% to 27%, and the number of megacities is projected to increase from 31 to 41.

Following a recent assessment of project pipelines in major cities worldwide by GlobalData, a listing of 50 ‘Construction Mega Cities’, discovers they each have a pipeline of projects with an investment value above US$30bn.

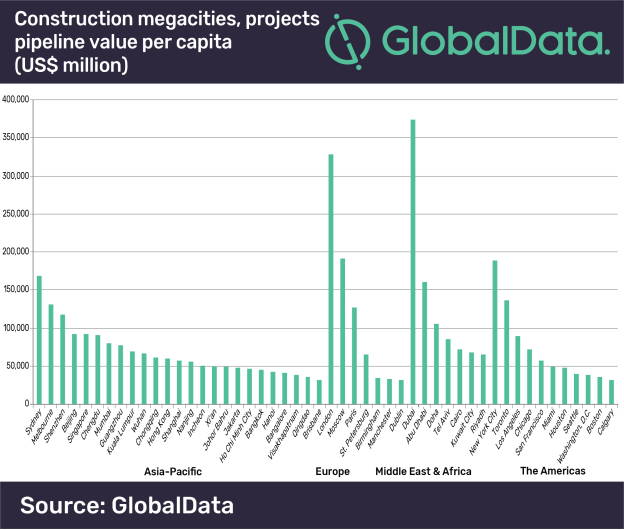

The report states that Dubai tops the list with total project values amounting to US$374.2bn, just ahead of London in second place with US$328.7bn and Moscow in third with US$191.5bn. However, the Asia-Pacific region dominates the list, accounting for 25 of the 50 cities, and having a combined projects pipeline valued at US$1.7trn.

Yasmine Ghozzi, Economist at GlobalData, comments, “The ranking of Construction Mega Cities in the Gulf states shows they are spending the most on major development projects relative to the size of their populations. Dubai, for example, has a population of 3.2m, but it holds the top position in terms of the value of the construction mega-projects pipeline per capita.

“In addition, the number of people living in Doha has increased to 1.1m as the Gulf state recruits tens of thousands of workers to work on major infrastructure projects linked to the 2022 FIFA World Cup; their project pipeline valued at US$105.6bn.”

There are major differences among the 50 Construction Mega Cities in terms of the value of the project pipelines compared to the size of the economies. Visakhapatnam, one of India's largest ports and an important industrial town and seaside resort, tops the ranking primarily owing to the government’s push on infrastructure and affordable housing.

Ghozzi continues, “The two main cities in Vietnam, Hanoi and Ho Chi Minh City, also feature in the top 10 ranking of cities in terms of the value of the project pipeline in relation to the city’s economy. Ho Chi Minh City’s economy recorded high economic growth in the first six months of 2018, with the construction industry recording growth of 7.7%. The city is expected to grow by around 8.8% a year, ahead of Hanoi (8%) and many other major cities in the region – outside of China and India – between 2018 and 2022.”

Related Stories

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Market Data | May 18, 2021

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.