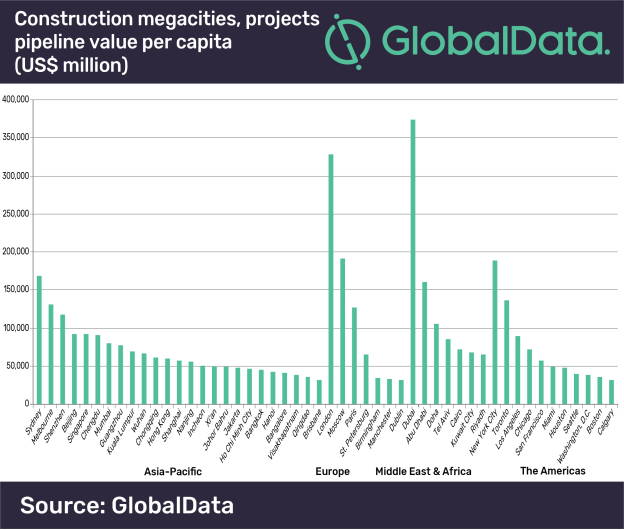

A total of 6,645 planned and ongoing construction projects by the world’s megacities, valued at US$4.2trn and fueled by the increase in population, are sparking interest in residential and infrastructural developments, according to GlobalData.

The United Nations predicts that, between 2016 and 2030, the percentage of the world's population living in cities with at least a million inhabitants is likely to grow from 23% to 27%, and the number of megacities is projected to increase from 31 to 41.

Following a recent assessment of project pipelines in major cities worldwide by GlobalData, a listing of 50 ‘Construction Mega Cities’, discovers they each have a pipeline of projects with an investment value above US$30bn.

The report states that Dubai tops the list with total project values amounting to US$374.2bn, just ahead of London in second place with US$328.7bn and Moscow in third with US$191.5bn. However, the Asia-Pacific region dominates the list, accounting for 25 of the 50 cities, and having a combined projects pipeline valued at US$1.7trn.

Yasmine Ghozzi, Economist at GlobalData, comments, “The ranking of Construction Mega Cities in the Gulf states shows they are spending the most on major development projects relative to the size of their populations. Dubai, for example, has a population of 3.2m, but it holds the top position in terms of the value of the construction mega-projects pipeline per capita.

“In addition, the number of people living in Doha has increased to 1.1m as the Gulf state recruits tens of thousands of workers to work on major infrastructure projects linked to the 2022 FIFA World Cup; their project pipeline valued at US$105.6bn.”

There are major differences among the 50 Construction Mega Cities in terms of the value of the project pipelines compared to the size of the economies. Visakhapatnam, one of India's largest ports and an important industrial town and seaside resort, tops the ranking primarily owing to the government’s push on infrastructure and affordable housing.

Ghozzi continues, “The two main cities in Vietnam, Hanoi and Ho Chi Minh City, also feature in the top 10 ranking of cities in terms of the value of the project pipeline in relation to the city’s economy. Ho Chi Minh City’s economy recorded high economic growth in the first six months of 2018, with the construction industry recording growth of 7.7%. The city is expected to grow by around 8.8% a year, ahead of Hanoi (8%) and many other major cities in the region – outside of China and India – between 2018 and 2022.”

Related Stories

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.

Market Data | Apr 9, 2021

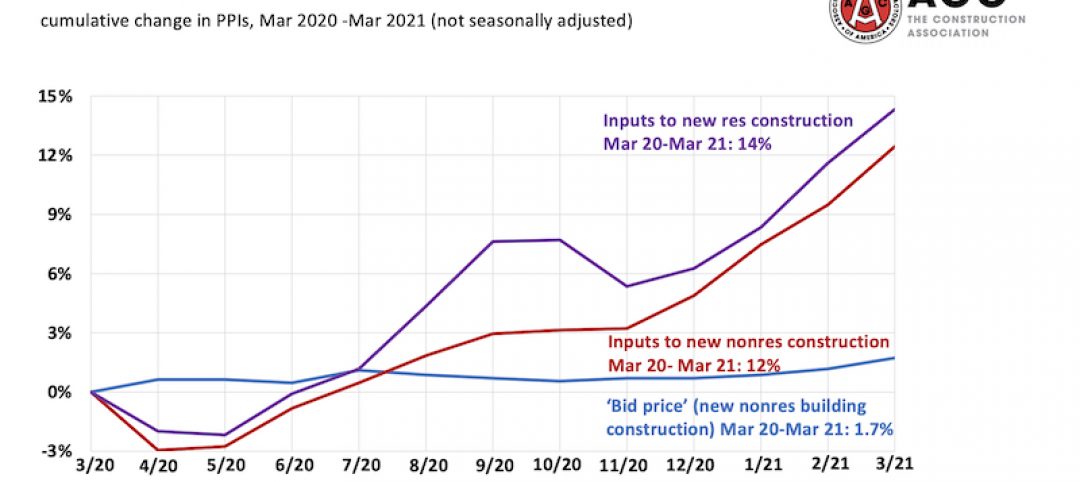

Record jump in materials prices and supply chain distributions threaten construction firms' ability to complete vital nonresidential projects

A government index that measures the selling price for goods used construction jumped 3.5% from February to March.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Apr 7, 2021

Construction employment drops in 236 metro areas between February 2020 and February 2021

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 12-month employment losses.

Market Data | Apr 2, 2021

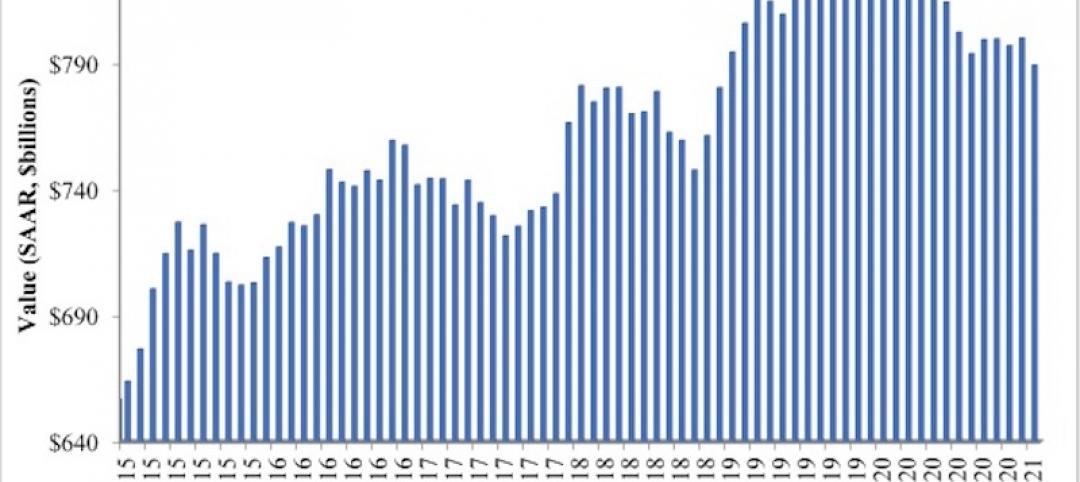

Nonresidential construction spending down 1.3% in February, says ABC

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories.

Market Data | Apr 1, 2021

Construction spending slips in February

Shrinking demand, soaring costs, and supply delays threaten project completion dates and finances.

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.