Construction spending declined for the third month in a row in May as a sharp slowdown in private projects more than offset a rise in public work, according to an analysis by the Associated General Contractors of America of government data released today. Association officials warned that the pickup in public projects is likely to reverse soon unless the federal government acts quickly to invest in needed infrastructure and shore up crumbling state and local budgets.

“Three short-lived factors may have boosted construction spending in May: emergency healthcare projects, acceleration of highway work to make use of the drop in road traffic, and the end to some state government shutdown orders,” said Ken Simonson, the association’s chief economist. “Unfortunately, these stimuli have now worn off, and there is a high risk that construction spending will soon shrink as state and local governments start a new fiscal year today with large budget gaps that they must close. Too often, they turn to postponing and canceling construction.”

Construction spending in May totaled $1.36 trillion at a seasonally adjusted annual rate, a decline of 2.1% from April and the lowest total since June 2019. Since February, total spending has slumped by 5.9%, the steepest three-month contraction since 2009, the economist noted.

The decrease in May was widespread across private construction categories, which recorded a spending decline of 3.3% from April, following a 3.8% slide from March to April. Public construction spending rose by 1.2% in May, an increase that only partially reversed a drop of 2.7% the month before.

“It is likely that the pickup in highway construction and other public spending that occurred in May will fade as soon as current projects are completed,” Simonson said. “Our latest survey of contractors, conducted June 9-17, found only about one-fifth of respondents had won new or expanded work—unchanged from early May. In addition, nearly one-third of respondents reported that an owner had canceled an upcoming project.”

Association officials said that private-sector funding is likely to continue to remain below pre-coronavirus levels for some time as many owners opt to delay investments amid pandemic-induced uncertainty. Meanwhile, many state and local investments in infrastructure and construction are likely to decline amid falling tax revenues. What is needed is a federal infrastructure measure that can attract broad, bipartisan support in the House and Senate, the association officials noted.

“The best way to get people back to work and to make our economy more efficient and effective for the long run is by improving the nation’s vital infrastructure,” said Stephen E. Sandherr, the association’s chief executive officer. “Leaders in both parties need to understand that messaging measures may excite the base, but they do nothing to improve roads, fix bridges or modernize water systems.”

Related Stories

Market Data | Mar 29, 2017

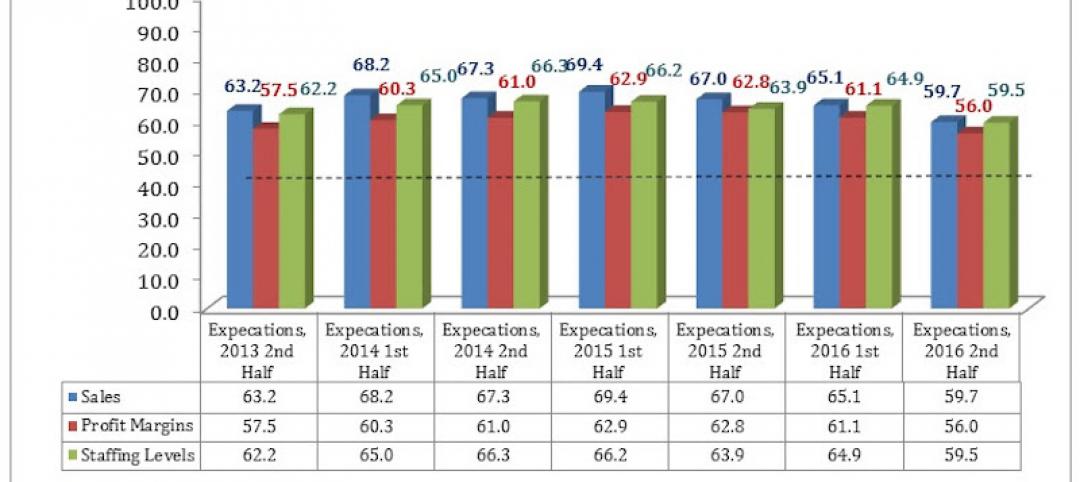

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

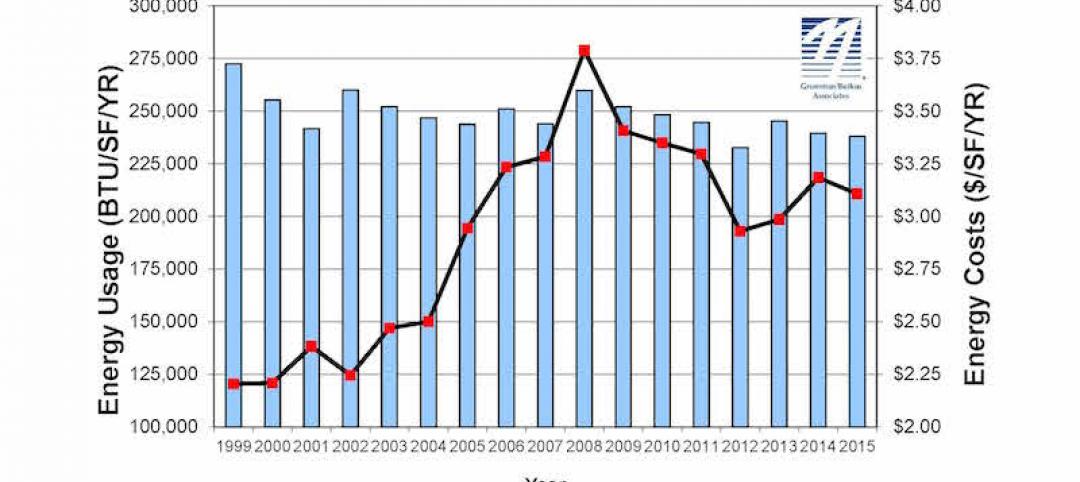

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

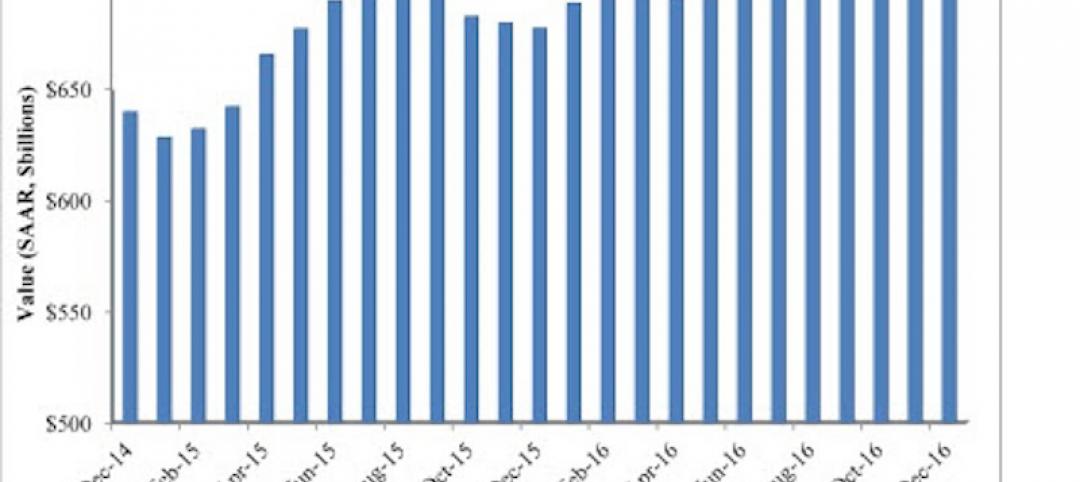

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.